Visit-Japan frenzy

Kamakura, on the coast south of Tokyo, is a favorite of foreign tourists. Its main street, Komachi-dori, is often packed with people from around the world.

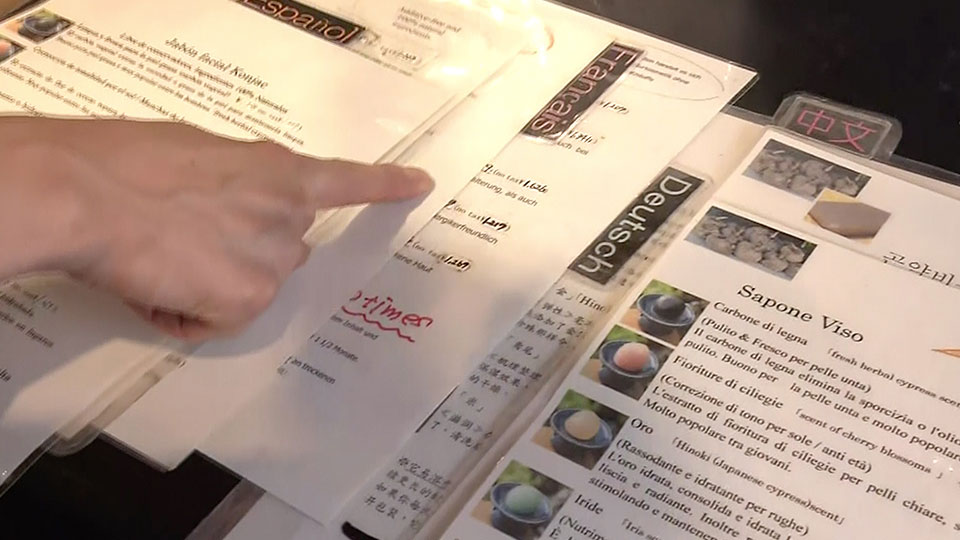

Businesses here are adapting to meet the needs of overseas travelers. One shop put up signs, such as "NO FOOD OR DRINK ALLOWED," in multiple languages.

Foreign visitors from January to March spent a record 1.75 trillion yen, or 11.3 billion dollars, in Japan.

Komachi Shop Association chief Kon Masafumi says that many business signs are now in Chinese and Korean, in addition to English, as many tourists started coming from Asian countries. He stresses that shops in the area welcome foreign visitors.

The flip side of booming tourism

An estimated 3,081,600 foreigners visited Japan in March. The Tourism Agency says the weak yen and demand for cherry blossom viewing drove the increase to a record.

The benefits to businesses are clear, but so are the problems of over-tourism.

A typical example can be seen at this railroad crossing in a quiet residential area in Kamakura. It's sought out by throngs of foreign tourists. That's because it's depicted in the popular basketball manga, "Slam Dunk."

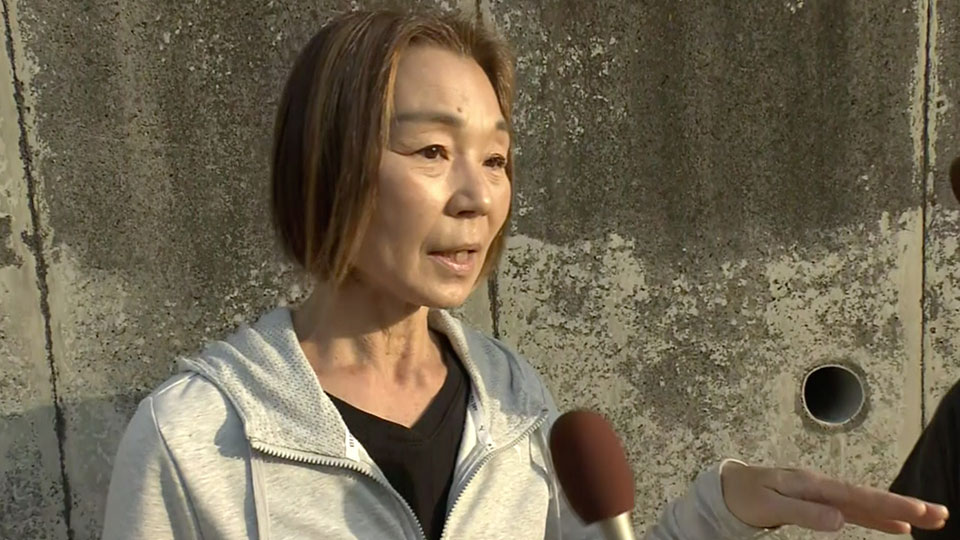

Visitors take photos of the crossing and sometimes crowds spill over the sidewalk. Residents are concerned about possible disruptions and accidents.

This shop on Komachi-dori sells fish-shaped pancakes stuffed with bean jam. The shopkeeper says residents used to be his main customers. But he says some are complaining of huge crowds, and that they would rather stay away from the main street.

Rattling a pillar of Japan's economy

But a broader look at Japan's economy reveals the negative impacts of a weaker yen. A depreciating currency raises import costs, which then drives up domestic prices. This imposes a heavy burden on businesses and consumers.

Small and medium firms like this metalworking company in Tokyo's Ohta Ward have been hit especially hard.

Monthly spending for buying materials such as iron and aluminum is up about 40 percent from 2 years ago.

The management says it is not easy to pass on costs to customers. The firm says it can take months to complete procedures for raising prices, making it even more challenging to deal with the increases.

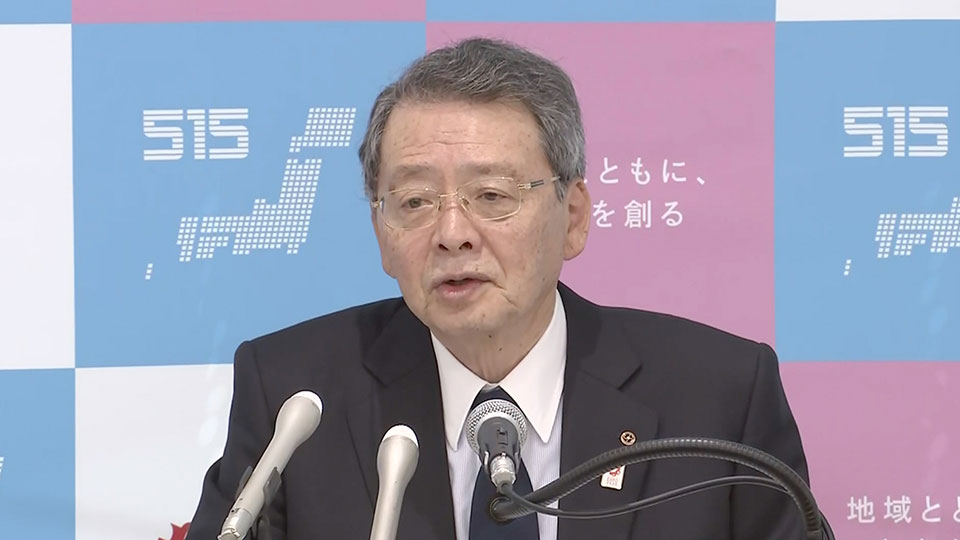

Many small businesses belong to the Japan Chamber of Commerce and Industry. Chamber chief Kobayashi Ken says they face greater difficulty day-by-day with the yen losing ground. It is becoming a grave problem.

Experts say one of the major market forces weakening the yen is a robust US economy with relatively high interest rates. Federal Reserve Board Chair Jerome Powell on Tuesday suggested it may be some time before the Fed cuts interest rates, given the outlook for strong growth.

Market participants say that the gap between interest rates in Japan and the United States is driving the yen down. As the currency continues to decline versus the dollar, traders are closely watching for possible intervention by the Japanese government and the Bank of Japan.