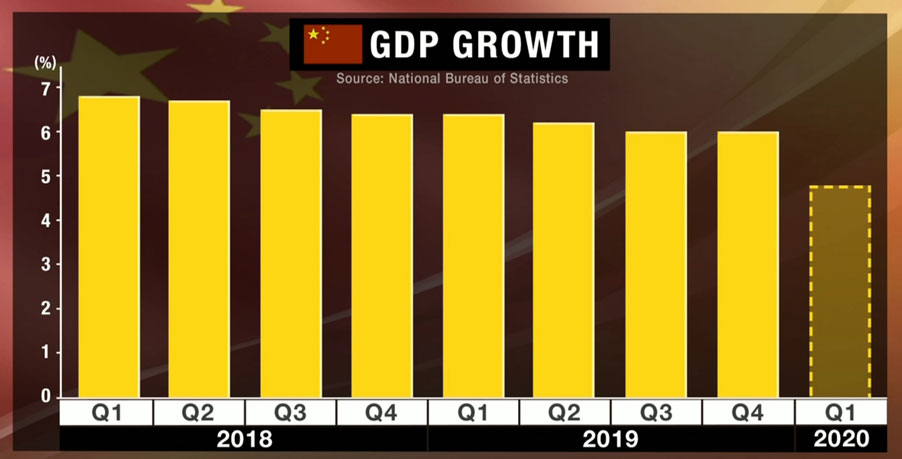

Naoto Saito, Chief Researcher at the Daiwa Institute of Research, expects the epidemic will deliver a heavy blow to the Chinese economy, particularly the transportation and tourism sectors. He predicts GDP is likely to fall to below 5 percent in the January-to-March quarter, well down from his previous forecast of around 6 percent.

This will inevitably have flow-on effects around the world, warns Saito, who notes that China's SARS epidemic had a sizeable impact on global growth in 2003, when its economy was just a quarter of its current size.

Analysts in Japan say the health emergency could have drawn-out consequences for the local tourism industry as well as businesses that rely heavily on the Chinese market.

They say even in the best-case scenario, where China and other countries bring the outbreak under control within a few months, Japan's GDP will likely slow by 0.09 percent to 0.2 percent in inflation-adjusted terms. If the epidemic continues for a year, the consensus is that it could weaken GDP by up to 0.9 percent.

Takahide Kiuchi, Executive Economist at Nomura Research Institute, says the medium-to-long-term prognosis for Japan's economy isn't good. The tourism sector is already contending with the fallout from a political dispute with Seoul that has precipitated a steep drop-off in visitors from South Korea. The impact of the coronavirus epidemic will compound this situation, he says, by discouraging people from traveling to the region. And that could lead to a reduction of investment in the industry.

Kiuchi, a former policy board member of the Bank of Japan, says he wouldn't be surprised if some countries employ a range of measures to cushion the blow to their markets, one being a loosening of monetary policy. China's central bank has already pumped more than $170 billion into financial markets. Kiuchi thinks smaller countries could cut interest rates.

But using easy money to stimulate economic activity could have a limited impact, he says, due to the sharp decline in the movement of people and goods. For this reason, he believes the Bank of Japan, the US Federal Reserve, and the European Central Bank are highly unlikely to go down this road.

Saito and Kiuchi agree the Chinese and global economies are likely to suffer for at least the next few months. What happens beyond that will depend largely on how the virus outbreak plays out.