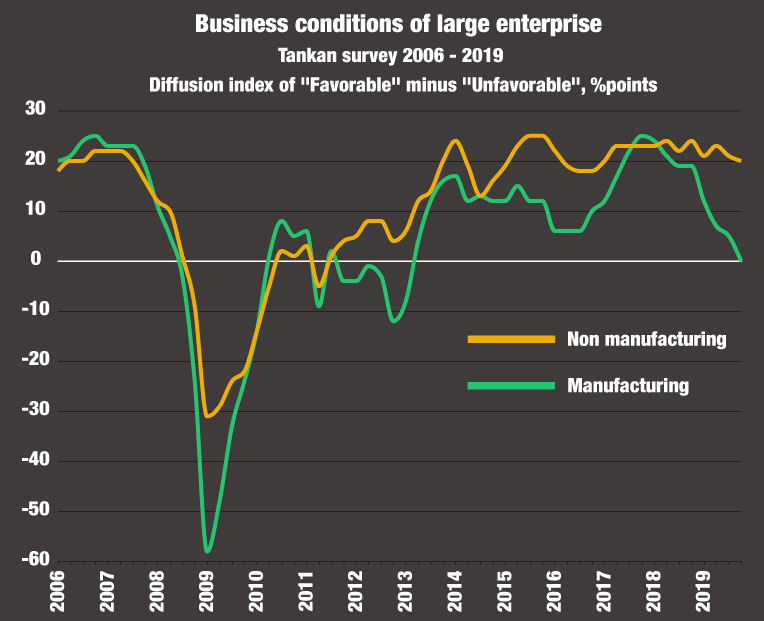

The headline index for big manufacturers dipped to zero, marking a decline from plus five in September. Recording a fourth consecutive quarter of decline, the number was worse than market expectations.

Three factors were behind the fall -- typhoons in October, the consumption tax hike from 8 to 10 percent, and negative spillover from the trade dispute between the US and China. Autos and machinery were sectors especially hit by those three factors.

Encouraging sign

The number from the non-manufacturing sector provided some relief to policymakers and analysts trying to estimate the impact of the recent tax increase. It dipped only one point from the previous survey, which was far better than the market forecast. Retailers reported only a seven-point decline in the previous three months. They reported a 23-point drop right after the consumption tax hike in 2014.

Government officials have been hopeful that this time around, measures such as giving refunds to people who use cashless payments and adopting reduced tax rates on food and beverages will help beat the slump. The recent numbers suggest that those measures are working, at least to some extent.

But experts warn that it’s too early to be optimistic about the country’s outlook. The industrial production index forecast shows that it will drop further in November, continuing a decline in October. And the list of vacancies in the manufacturing sector is beginning to shrink, which could be an alarming sign that job markets are starting to worsen. Analysts predict smaller bonuses for workers this winter, which will be a negative change from the most recent three to four years.

Slower growth expected in 2020

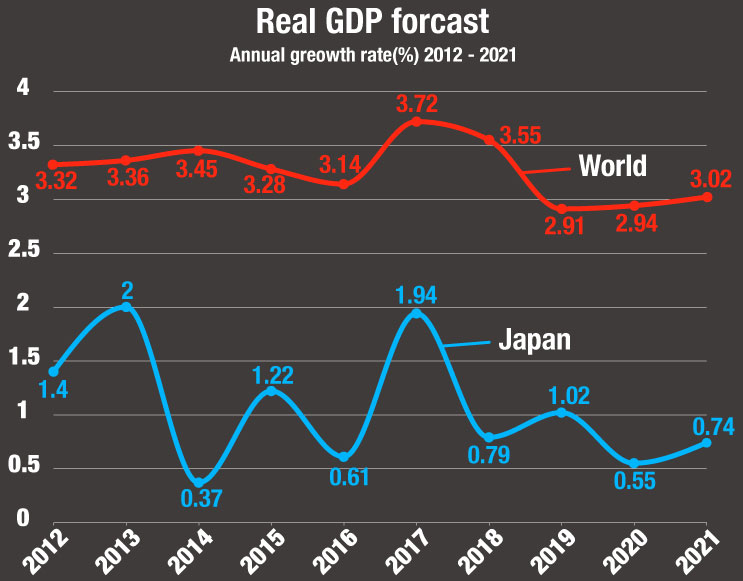

As for 2020, the OECD downgraded the 2020 global economic outlook to 2.9 percent. That's some of the lowest growth since the global financial crisis of 2008. Japan is expected to grow 0.55 percent next year, which is below the potential growth rate of around 1 percent.

The Abe administration is trying to keep the country’s economy going by adopting an economic stimulus package worth 26 billion yen. More than half of the money will be spent for purposes other than disaster restoration. The laundry list shows that it will be used to fund support for exporting farm products, helping out small businesses, and giving job opportunities to people who are in their late 30s and 40s who have missed out on those chances in the face of a severe economic downturn. This spending will be funded by deficit-covering bonds, meaning that these economic stimulus measures should be targeted ones that really work.

Supporting households

So, now, we come to think about what would really work to achieve sustainable economic growth in Japan. And the answer might be that we should adopt more support for households, rather than businesses. Capital spending has grown by more than 20 percent in the last five years, which has been above the country’s GDP growth rate. Analysts say that while the robust capital expenditure has helped the country maintain its economic strength, there might be not much room for further growth.

On the other hand, personal consumption has been sluggish, well below the GDP growth rate. The new tax hike has further weighed on household spending. If government leaders want Japan to continue its economic growth, it needs an engine that realizes a “self-sustained” growth through stronger personal consumption.

The Abe government has been trying to boost personal spending by pressuring company managers to increase wages. But so far, it has only succeeded to a limited extent. With a fresh tax increase of 2 percent, a wage hike of 3 to 4 percent including regular pay raises is needed to offset the negative impact. The problem is that it’s unlikely Japanese companies will be willing to give out such increases in a time of global uncertainty.

So, the final solution (not necessarily the best) will be government measures to help boost personal consumption and strengthen purchasing power. Giving more support to education, nursing care and childcare -- areas that have more potential needs than is now provided -- is a viable option.

Another might be to give more opportunities to those who need job training, higher education and new career options. Japan desperately needs means to activate potential workers and invigorate younger generations in their 20s and 30s. And now is the time to do so, before the country’s economy begins to deteriorate severely.