Make it a double

A number of canned cocktails with a high alcohol content have gone on the market in recent years. Many are chuhai cocktails that involve a vodka-like base with soda and fruit juice or flavoring. Some pack a punch, with an alcohol content as high as nine percent. Amid rising concerns about health, two major beverage makers have announced they will not release new products in this category.

These so-called strong-type drinks have gained much popularity over the past 15 years. According to private research firm Intage, such beverages accounted for more than 40 percent of sales of canned chuhai drinks at one point.

Although their market share has since declined, it is still estimated to be as high as 25 percent.

Drinking sensibly

One reason for the new focus on strong-type products is a set of guidelines on alcohol consumption published by the health ministry in February.

Government recommendations aim to reduce the percentage of people who consume more than 40 grams of net alcohol intake per day for men and 20 grams for women. The guidelines state that consumption above these levels increases the risk of lifestyle-related diseases.

Net alcohol intake is calculated by multiplying alcohol content by the amount of alcohol consumed. For example, a 20-grams net intake is equivalent to one medium-sized bottle or large can of five-percent alcohol beer or two small glasses of 12-percent wine.

In the case of a beverage coming in at nine percent, a small can contains more than 20 grams.

Mixing things up

Despite those concerns, there is still strong demand for high-alcohol chuhai beverages among tipplers looking for easy drinking that comes with a splash of good cost performance.

"These drinks go down easily and the cans often feature colorful, eye-catching designs. For those who want a shortcut to that tipsy feeling, they offer a cost-effective way of getting there," says Associate Professor Yoshimoto Hisashi at the University of Tsukuba.

He is the director of the Research and Development Center for Lifestyle Innovation and an expert on alcohol and health. He cautions that these inexpensive, potent chuhai drinks "can pose a risk of alcohol dependence."

Beverage makers have been designing cans and other containers to display the amount of net alcohol more prominently in recent years, in the runup to the release of the health ministry guidelines. Under these circumstances, the industry has made a series of moves to rethink the alcohol levels in some of the drinks on offer.

Asahi Breweries is one of two major beverage makers that has no plans to release any new strong chuhai canned drinks. The firm says, "We have reviewed our product mix with a view to reducing inappropriate drinking and ensure that customers can continue to enjoy a healthy relationship with alcohol."

The other company announcing no new strong drink rollouts was Sapporo Breweries. They explained that the decision was made in light of consumer trends, including growing health consciousness.

Beverage heavyweights Kirin Brewery and Suntory are leaving their options open but, according to the latter, "Continuing to educate people about sensible drinking."

None for me, thanks

Meanwhile, those opting for non-alcoholic beverages mimicking the real thing are an increasingly important consumer group.

The first fully non-alcoholic beer in Japan was put on the market by a major beer company 15 years ago, in part to combat drunk driving. Other companies followed suit.

Demand has since increased, including a particular boost during the coronavirus pandemic. Many prefer such beverages when drinking at home and restaurants find that it is appealing during hours when alcohol cannot be served.

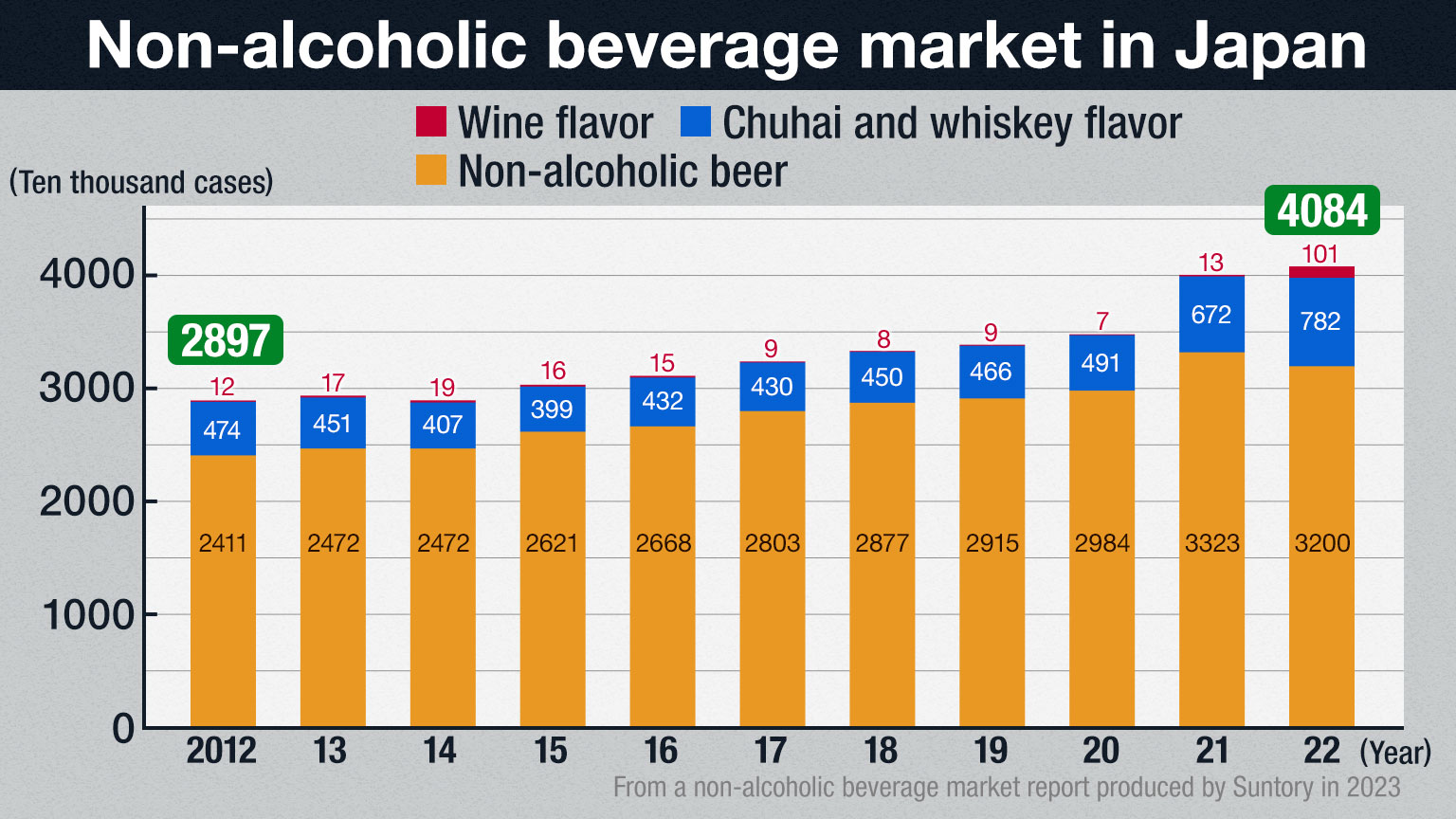

Companies are introducing new non-alcoholic products and diversifying their lineups to include chuhai-like drinks and wine-flavored beverages.

The Japanese market for non-alcoholic beverages is on the rise, with some major beverage makers estimating a 1.4-fold increase over the past ten years, with more where that came from in future.

Would you like a mocktail with that?

Restaurants have taken note and more are offering non-alcoholic options. One eatery in Tokyo began offering a course pairing dishes with either alcoholic or non-alcoholic beverages in April of last year. At the outset, about 20 percent of diners chose to go the non-alcohol route, a number that is now up to 40 percent.

Restaurant manager Yoshihashi Mako of Happo-En says, "Even diners who normally drink alcohol are increasingly choosing non-alcoholic pairings with a view to improving their health or because of plans for the following day. We want to provide an environment where those who do not drink alcohol can enjoy the same tasty food as those who do."

One chain of izakaya taverns, AP Holdings, is working to create dishes that pair well with its non-alcoholic beverages. The aim is to have lighter flavored food on the menu beginning this summer.

Turning off the taps

From the perspective of alcohol and health, people might be concerned about 'all-you-can-drink' offers, traditionally popular at such venues.

Some tavern operators are determined to continue offering bottomless drinks, while stressing the importance of avoiding excessive consumption. Many are also including more non-alcoholic options on the menu, reflecting an increasingly common trend among diners.

The new guidelines are likely to generate even more interest in how much is too much and how beverage makers and dining establishments should tailor their offerings to provide fun, and encourage healthy lifestyles.