Japan's unique pathway

The BOJ is the only major central bank with an easing policy, meaning rates are below zero while it pumps money into the economy in a bid to achieve a steady 2 percent inflation rate. Other countries are raising rates to combat inflation.

Japan also differs on how it conducts its monetary policy.

Most central banks rely solely on overnight rates to influence economies. The overnight rate is the interest rate that commercial banks use for single-day borrowing and lending between themselves. Central banks alter the rate to impact people's access to money, such as how much they pay for a housing loan, or whether a company can get bank credit to grow its business.

The United States Federal Reserve just raised its overnight rate to 5.25-5.5%.

Japan's is minus 0.1%.

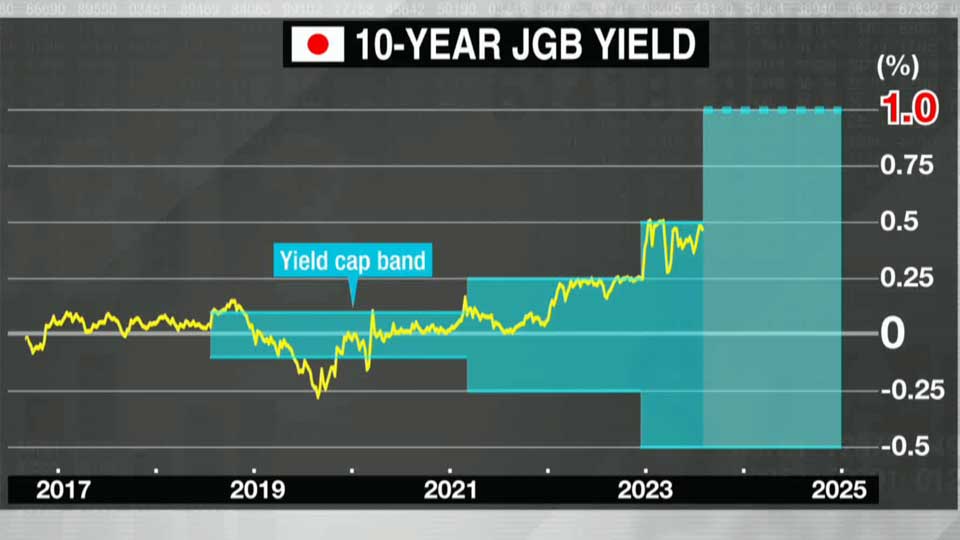

In addition, The BOJ has its long-term rate, namely the 10-year rate, at close to zero ... something no other major central banks are doing. The rate is allowed to fluctuate between plus and minus 0.5 percent, a yield curve control adopted in 2016 that is the cornerstone of Japan's ultra-loose monetary policy.

Details from the BOJ's July meeting

At the conclusion of its July meeting, the BOJ announced that it remains committed to an ultra-easing monetary policy, and keeping the overnight rate at minus 0.1 percent, but allowing more flexibility in its yield curve control policy.

For the 10-year yield, the BOJ will continue to target the 10-year government bond to trade around plus or minus 0.5 percent. But the bank also states it "will offer to purchase 10-year Japanese Government Bonds at 1.0 percent." That means that the BOJ will effectively allow the 10-year bond to trade up to 1 percent.

The BOJ said it will maintain its asset purchase program, implying it will keep pumping money into the market by buying bonds and other form of assets.

Bank officials believe their target of a sustainable 2 percent inflation is still some way off. Their quarterly inflation outlook suggests it will not be achieved in the fiscal years 2024 or 2025.

Governor explains the 10-year rate shift

Ueda Kazuo took over as BOJ governor in April. The shift on the long-term rate is the first change in monetary policy under his leadership. At his press conference he explained what the BOJ statement meant. Many traders wondered why the BOJ did not just do away with the 0.5 percent band on the 10-year bond and simply trade it at 1 percent.

Governor Ueda says the 1 percent cap in 10-year bond trading aims to create room for the long-term rate to rise above 0.5 percent if inflation exceeds the current outlook some time in the future. The bank is setting the measure now because if it changes at the same time inflation jumps, there is a risk of detrimental side effects.

The dollar/yen market, the Japanese stock market, and the bond market went wild after the July 28 announcement. The fluctuations reflected market confusion over whether the BOJ was continuing its easing stance, or had adopted a disguised tightening measure.

UBS Securities Japan chief economist Adachi Masamichi says the BOJ's message is that it is sticking to the monetary easing policy.

Adachi says the bank kept the plus/minus 0.5 percent band for the 10-year yield because it wants to keep the rate near zero. If the BOJ changes the measure to a "1 percent cap of the 10-year yield," traders may think it wants the 10-year rate to be close to 1 percent, not zero.

He says the 1 percent cap was set just for emergency purposes. Adachi notes that the BOJ does not think this will happen.

What lies ahead

Adachi expects it will not be until October next year, at the earliest, when the BOJ steps away from controlling the 10-year yield and returns to the so-called normal monetary policy of controlling only the short-term overnight rate.

That is because the BOJ is unsure whether a global recession is on the cards. The world's two largest economies are under a cloud, with the US raising rates to cool inflation, and China seeming to struggle to bounce back from the pandemic.

Adachi explains that the BOJ is cautious about changing its approach because the last two times it moved to tighten monetary policy, there were global downturns and Japan's economy was dragged down. The measures were regarded as mistakes, says the economist, so that's why the bank is taking more time than some expect to do away with the ultra-easing policy.