BOJ surprises the markets

For the past two monetary policy meetings in a row, the Bank of Japan has taken the bond market by storm.

In December, Governor Kuroda Haruhiko unexpectedly announced a tweak to its ultra-loose policy. Specifically, the adjustment was aimed at a measure known as yield curve control, which no other central bank in the world is currently implementing. It essentially means the BOJ controls long-term rates. The Bank of Japan has long tried to keep the 10-year yield at around 0% through unlimited bond-buying from the market. At its December meeting, the BOJ expanded its target range on long-term yields from between around plus and minus 0.25 percentage points to between around plus and minus 0.5 percentage points.

The move essentially raised the cap on long-term yields. As a consequence, despite Kuroda's assertion that it was not a rate hike, it led to the view that the central bank was starting on a path to normalize policy. Many investors were betting that the BOJ would further raise the limit at its January meeting. However, that did not happen. Though not as significant, the BOJ did expand its loan program to financial institutions aimed at prompting them to buy bonds.

BOJ objectives

Why did the Bank of Japan tweak its control on long-term rates?

Encouraging a smoother yield curve

One reason given by the BOJ in its December statement on monetary policy was to "encourage a smoother formation of the entire yield curve."

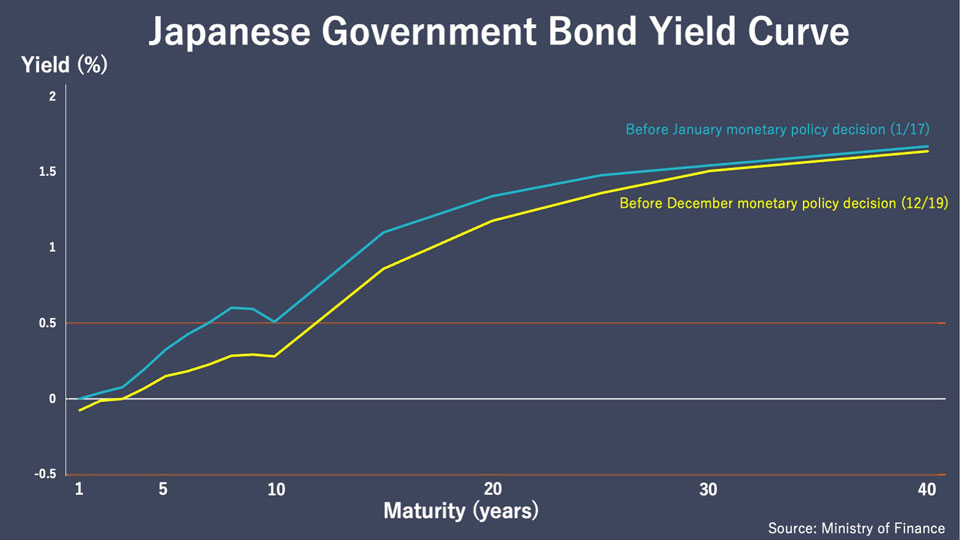

A "yield curve" shows bond yields across various maturities. As the BOJ points out, it should form a smooth line, with the curve slanting upwards as maturities get longer. That's because the longer investors wait to get their money back, the better the returns they expect. The aim of YCC is to control the whole curve by buying 10-year bonds. Ideally for the bank, a lower 10-year yield would pull down the whole curve while keeping it smooth.

However, Japan's yield curve has been painting a different picture. As rates encountered upward pressure from the rest of the world in 2022, the whole curve faced upward pressure... but the BOJ kept the 10-year yield low. As a result, the yield became unnaturally low compared to those of other maturities. As the yellow line below shows, the yield curve was distorted, with a bump around the 10-year mark, ahead of the December monetary policy meeting.

Though the BOJ sought to remedy this bump with its December tweak, it was not successful. As the blue line shows, the distortion intensified ahead of the January monetary policy meeting, with the 10-year yield surpassing the BOJ's new 0.5% target. Bond market expert Morita Chotaro explains what happened. "The market priced in future moves... ultimately, an end to yield curved control. So, even though the December decision raised the 10-year yield, the yields of bonds with other maturities climbed as well." As a result, he says, "The unnatural bump around the 10-year persisted. The distortion in the yield curve was not remedied as hoped."

Given that the BOJ set out to accomplish a smoother yield curve, many market participants speculated that the central bank might further raise its cap on long-term rates at its January meeting. However, the BOJ persisted with its policy this time. Kuroda noted at a press conference following the January meeting, "Not much time has passed since our modification (in December). It will take time to evaluate its effects." The BOJ holding firm brought down the 10-year yield below its cap, but the bump in the yield curve remains.

Improving market functioning

Another motive given in the BOJ statement for the December policy tweak was to "improve market functioning."

There may be several "market functions" the BOJ wants to improve. Financial expert Fukumoto Yuuki describes how the BOJ's intervention to control yields that should be decided by the market is causing problems. "By buying an extreme amount of bonds, the BOJ is distorting bond prices... especially that of 10-year bonds." The prices and yields of bonds have an inverse relationship. This is because bonds can be cashed in for a set price upon maturity. If you can acquire a bond at a cheaper price, the yield, or financial benefit you receive from that purchase, becomes higher and vice versa. By keeping the 10-year yield unnaturally low compared to other maturities, the BOJ has been effectively pushing up their prices. Fukumoto notes, "The BOJ's bond-buying is destroying the market function of price discovery. Because investors cannot trust bond prices, they're starting to see the whole bond market as unreliable."

The fact that the prices of 10-year JGBs are unnaturally high is also having an impact on other markets. Fukumoto notes, "Local governments look at JGB yields when issuing their own bonds. So do companies upon issuing corporate bonds." Morita is also concerned about corporate bonds. "If the distortion in yields of different maturities hits corporate bonds, it could hamper companies from raising funds. That could have a negative effect on business operations."

Top JGB owner

Not only has the BOJ's moves failed to achieve its objectives so far, they may have caused further problems. As already stated, the December tweak left many investors thinking that policy normalization might be on its way and put upward pressure on yields across the curve. The 10-year yield climbed above the new 0.5% limit numerous times until the January decision calmed the markets down. The jump in yield meant the BOJ had to ramp up its bond-buying to record levels in order to pull it down. The Bank of Japan set new monthly records for bond purchases in both December and January.

Fukumoto believes the central bank won't be able to keep up the feverish pace much longer. "If the BOJ tries to maintain its ultra-loose policy with upward pressure on yields, it will have to buy a vast amount of bonds. Operations will be difficult going forward, given the limited amount of JGBs left in the market." The Bank of Japan now owns more than half of all JGBs in circulation.

BOJ's next moves

With the JGB yield curve still distorted, and experts questioning the sustainability of bond-buying, will the BOJ soon have to change course? How might it alter policy?

How: Lift YCC completely

In terms of the how, both experts believe the BOJ should lift the cap on the 10-year yield completely, rather than raise it just a little as the central bank did in December. Morita says, "Lifting the cap on long-term yields little by little will not fix the distortion in the bond market. Getting rid of the cap altogether at some stage would lead to fewer problems." He explains, "If the cap is raised a little, the markets will speculate when the next move will be, as they did after the December meeting. Expecting the cap to rise further, investors will sell bonds. It will turn into a cat-and-mouse game."

It is for this reason that Fukumoto told NHK before the December policy meeting that the BOJ would only change YCC without prior announcement... exactly what came to happen with the tweak. He still asserts the central bank will only be able to lift the cap on YCC at a time when the markets don't expect a change. "The BOJ will have to lift the cap without announcing it previously. Otherwise, the market will be bombarded with sell-orders, and the BOJ will have no choice but to buy a large amount of bonds until the change in cap is enforced."

Fukumoto calculates, "The fair value of the 10-year yield, as in, how much it would rise if the BOJ were not controlling it, should be at around 1%." If the BOJ expanded the target range by 0.25 percentage points as it did in December, it would make the cap 0.75%... still too low.

When: Under new Governor

In terms of the when, both experts say the main scenario is to lift the cap after a new Governor takes over when Kuroda's term ends in April. Morita points out, "The Bank of Japan will likely change policy only after revising the accord set with the government." The accord, or joint statement, was issued in January 2013 by BOJ Governor Kuroda and then-Prime Minister Abe Shinzo. It set the groundwork for "Abenomics," under which Kuroda started the BOJ's unprecedented easing. The decade-old accord ties the central bank to a 2% inflation goal, which Kuroda adamantly says has not been truly accomplished in a sustainable way. Morita notes, "Prime Minister Kishida has mentioned possibly revising the accord with Kuroda's successor. It stands to reason that the next step, a change in policy by the BOJ, will be after the new Governor is in office." Kishida has said he plans to nominate the new BOJ Governor in February.

As for when exactly the change under Kuroda's successor might take place, Morita says it will depend on the state of the global economy. "The biggest factor for monetary policy this year will be whether the US and the world enter recession. The BOJ will, realistically speaking, not normalize policy with the world economy in a downturn. Discerning whether the world is entering a recession in April will be premature, so I believe the BOJ will take at least until early summer to make a decision."

Questions remain

The Bank of Japan is implementing one of the world's most complex monetary policies. Unwinding it will likely be a strenuous task, with no perfect timing. With the architect of the BOJ's decade-long ultra-easy policy preparing to step down, several questions remain: Will Kuroda leave his successor a blueprint on how to end his policy? If not, will Japan's bond market survive the impact of continuing YCC? Will Kuroda drop any hints at his last monetary policy meeting as Governor on March 21-22?