Facebook's White Paper says the aim is to create a simple global currency and financial infrastructure that empowers billions of people. It promises to slash the fees involved in remitting, withdrawing and running into overdraft.

The firm says it wants to do to banking what the Internet did to telecommunications: make it easier, cheaper and more inclusive. All you will need is a smartphone.

The plan has spurred some excitement in the financial sector. One executive of a Japanese cryptocurrency exchange hailed it as a big step towards the era of digital token economy. “We know that Facebook's challenge will not be easy, but we certainly want them to succeed," he said.

But not everyone is thrilled. US President Trump argued via tweet that Libra would have little standing or dependability. He also said Facebook would need to be authorized as a bank.

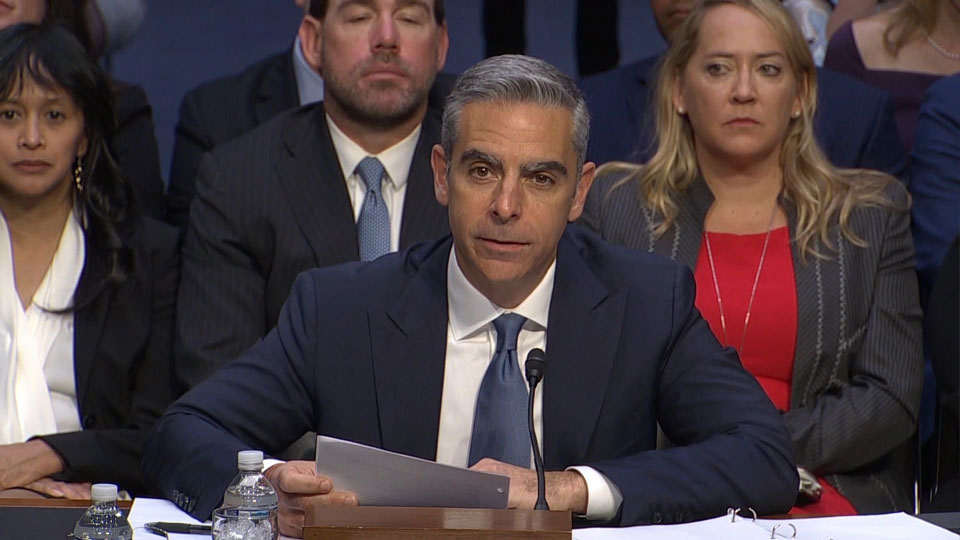

One of the architects of the currency, former PayPal president David Marcus, spent two-and-a-half hours answering questions in a Senate hearing Monday. One recurring theme was the lack of trust in the company behind the currency, and how Facebook might use the transaction data it obtains from Libra users. Marcus said the currency was being created by Calibra, a regulated subsidiary of Facebook, and argued that this ensures a separation between social and financial data. He said the social media giant would not be able to use Libra information without permission.

Critics have also suggested Facebook might be about to make it easier to launder money, finance terrorism or violate international sanctions. Some experts say the Libra white paper seems to allow space for creating pseudonymous accounts.

Marcus told the Senate that Libra will comply with all US regulations and won't launch until US lawmakers' concerns have been answered.

The biggest concern is the impact Libra could have on the global economy. Facebook has created a Libra Association with members including VISA, Mastercard, Uber and Booking.com. You could earn cryptocurrency by driving an Uber, then spend it via Visa or Mastercard, or pay a hotel fee via Booking.com.

This raises the prospect of a "Libra economic sphere” in which people can make a living only by Libra, without hard currencies. Traditionally, only central banks have been allowed to issue currencies. They've never faced a challenge like this before, and they believe it could threaten financial stability.

G7 Finance Ministers and central bank governors discussed the pros and cons at a meeting in Chantilly. Japanese finance minister Taro Aso said there were many skeptical opinions voiced, and warned that focusing only on convenience means we could face problems later.

The G7 plans to work with other international bodies to analyze possible issues stemming from Libra. They are expected to release their findings by October.

They're then expected to shift toward coming up with specific regulations for a Facebook currency.