Many in Japan are familiar with the term “zombie firms.” They refer to "living dead" companies that are unable to cover debt servicing costs from current profits over an extended period. Unprofitable and unproductive firms that stay in business with help from creditors or the government have been blamed as one of the causes of Japan’s economic stagnation or the so-called “lost decades” which started in the 1990s.

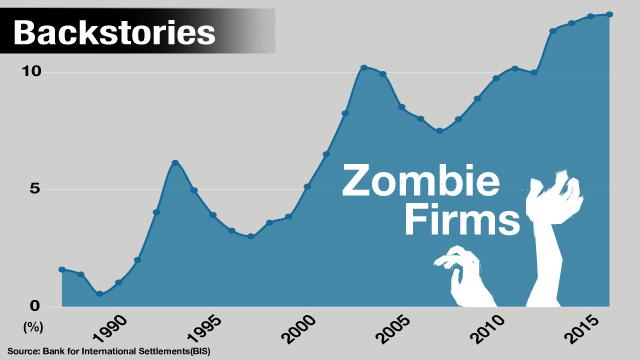

Now, the problem is spreading worldwide. The BIS says that in 14 advanced economies including Japan, the US, Germany, France and the UK, the share of zombie firms has risen from around 2% in the late 1980s to some 12%.

Analysts say the number of zombie firms may grow even further on the back of prolonged monetary easing.

The Bank of Japan recently announced that it is set to continue its massive easing program at least until the spring of 2020. The US Federal Reserve has given up monetary tightening on the back of trade tensions and geopolitical risks. The European Central Bank, which has a negative interest rate policy, has promised that it will not raise rates at least through the end of this year.

And China, which has been trying to get rid of its zombie companies, has changed course. Now, its leaders are trying to boost the economy amid trade talks with the US, meaning that structural reforms may suffer a temporary halt.

Zombie companies that should exit the marketplace manage to survive longer thanks to the ultra-low interest rates. They can borrow cheaply and thus stay afloat. And lenders keep feeding those firms in hopes of higher returns rather than investing in institutions that give back safer but much lower returns.

However, the consequences of keeping zombie firms alive could be big. A recent working paper from the European Central Bank found evidence that zombies crowd out credit to healthier and more productive firms. Capital misallocation disrupts chances for more promising startups that seek bigger lending. And when the economy slows and interest rates go up, zombie firms fail quickly, which will amplify any economic downturn.

The US Federal Reserve issued a warning about high levels of risky corporate debt in a report published on May 6th. Loans to companies with large amounts of outstanding debt grew by 20 percent last year and are still growing in the first three months of 2019. The report reads, “Any weakening of economic activity could boost default rates and lead to credit-related contractions to employment and investment among these businesses.”

Ultra-low interest rates enable people and businesses to borrow easily, creating new opportunities. But policymakers, lenders and investors need to be alert of the side effects, which are creating a potential risk for the global economy.