Sendai Ikuei Gakuen Okinawa High School was established in April last year, and the "investment club" was launched at the same time.

The members gather once a week to discuss the global economy ― and the ups and downs of their real-life stock portfolio. They have a kitty of 1 million yen, currently about US 6,380 dollars, and the funds are provided by the school.

Students who join the club must first attend a series of lectures held by a brokerage firm. Stocks can only be bought with a majority approval. The students then inform the teacher, who tells the brokerage to make the purchase.

Any profits will be donated to charity.

Fostering financial independence

School officials believe the club will help the students become financially independent. After all, the income level in Okinawa is considered to be one of the lowest in the country.

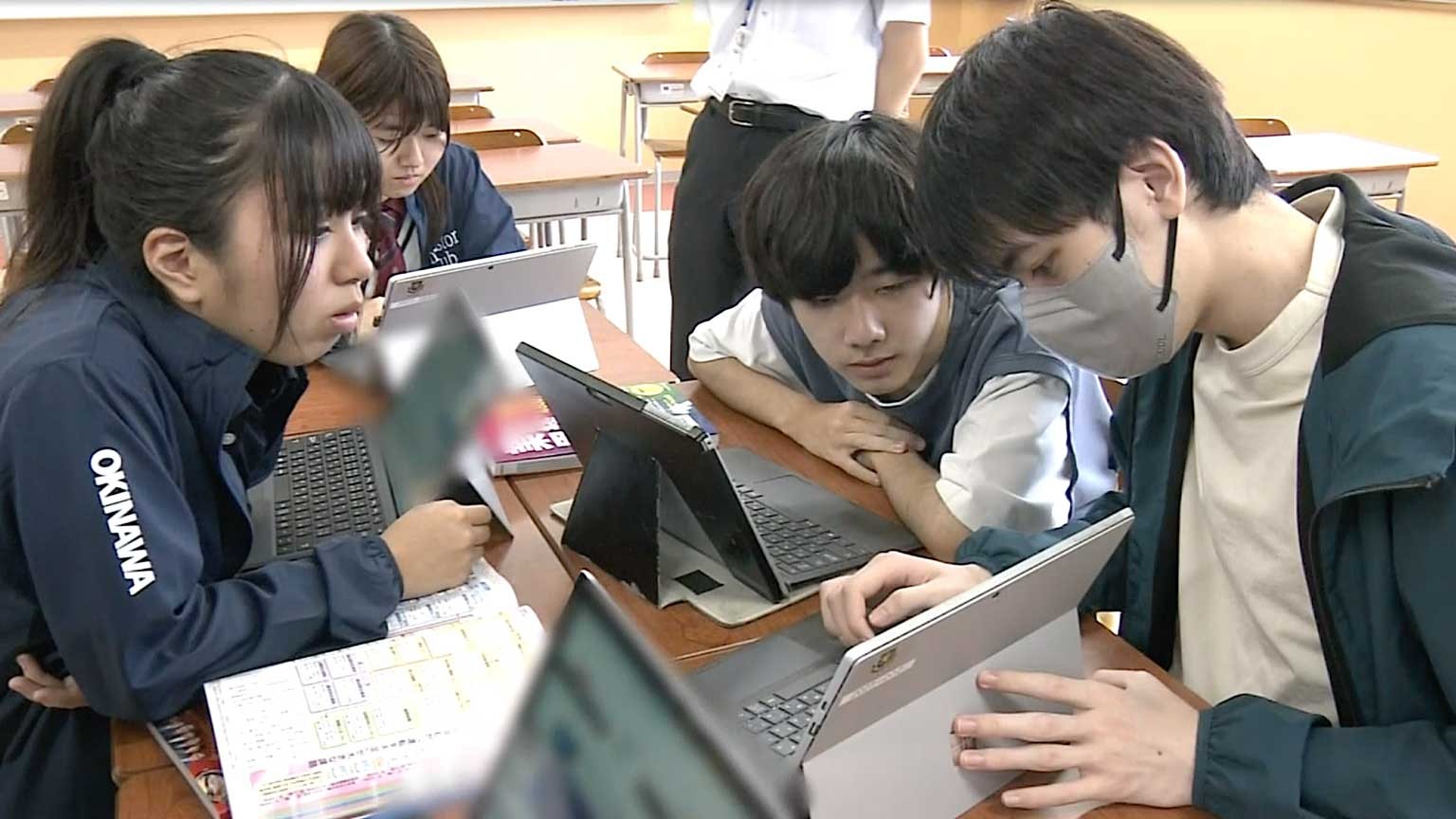

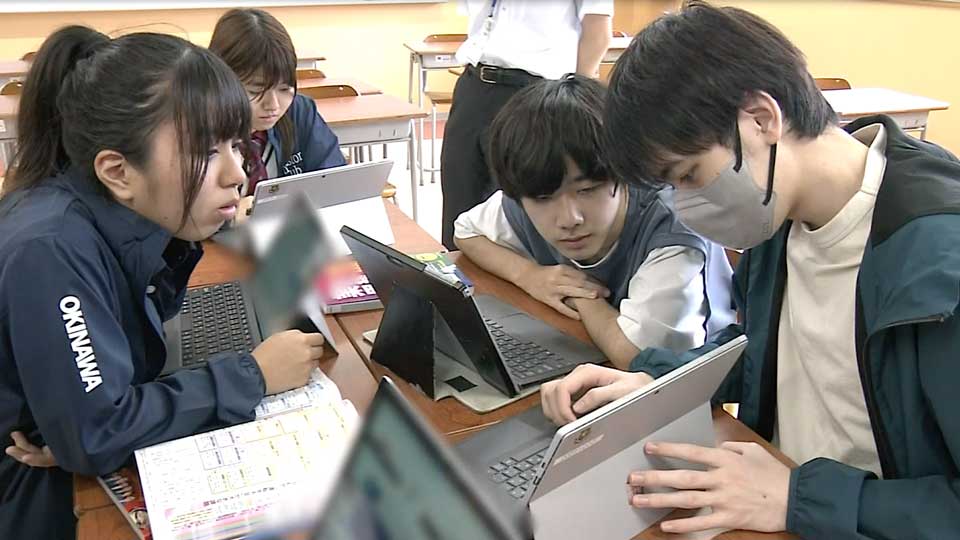

There are 19 students when we visit the club, including some from the first year who are considering whether to join.

And they have a guest lecturer from a Tokyo-based securities firm. The students are asked to research how much it would cost to visit the Japanese capital in search of a job, or to study abroad.

Later, the second-year students move to another classroom to discuss which stocks they'd like to buy for the year ahead. They are armed with all sorts of materials, including booklets about the various sectors.

"I heard some news about a likely shortage of bus drivers in 2024. Companies with AI and automated driving technologies will probably attract attention," said one member.

Another said, "The US presidential election takes place in November. How about looking at Japanese firms related to the policies of the candidates?"

Making informed decisions

Investing allows them to take a look at the wider world and make their own judgments, especially when it comes to risk.

The second-year students were asked to reflect on the performance of their portfolio, traded from July last year to February this year.

The stock price of one company rose after they predicted an increase in demand spurred by Japan's booming inbound tourist industry. But the stock price of another firm dipped on the back of a well-documented problem.

The students learned the importance of making informed decisions by always checking the news.

A survey conducted in 2022 by the central committee of Japan's Financial Services Agency asked 30,000 people aged 18 to 79 if they have received financial education. Just seven percent said yes.

But in a similar survey conducted in the United States, the figure was 20 percent.

Sobering statistics like that are spurring the Japanese government into action.

Improving financial education

Two years ago, financial education became a compulsory part of the high school curriculum. And in April this year, officials established the public-private Japan Financial Literacy and Education Corporation, or J-FLEC.

President Ando Satoshi says he did not directly know about the investment club in Okinawa. At the same time, he says he will support schools by providing teaching materials and dispatching instructors, as well as cooperating with any club activities that meet J-FLEC's objectives.

"Financial education is a prerequisite," he says. "It is extremely important to give people the opportunity to put their knowledge into practice, after they have grasped the basics."

And the young investors at Sendai Ikuei Gakuen High School are doing exactly that. More than half of the stocks they bought in fiscal 2023 are up. But overall, their portfolio is about 10,000 yen in the red.

"I need to look closely at social conditions, and I've become more conscious about what's going on in the news," says one student.

"I realize that industries are changing because of the events happening around me," says another. "I now feel more of a connection to events in faraway places around the world."