Sudden notice

In 2022, Florida resident Robert Norberg received a letter notifying him that his home insurance company was terminating his coverage. He had just 45 days to find a new policy.

The letter arrived not long before the start of the annual hurricane season, a perennial threat for homeowners in the southern state.

"I only had 45 days to find [alternative] insurance," says Norberg, who notes that US insurers typically give 120 days' warning of cancellation. "It made me feel terrible."

The move was an ironic twist for the Florida man, who has more than two decades of experience as an insurance broker himself. "I started in the business about 24 years ago, and this is now the worst marketplace here in Florida for property insurance.

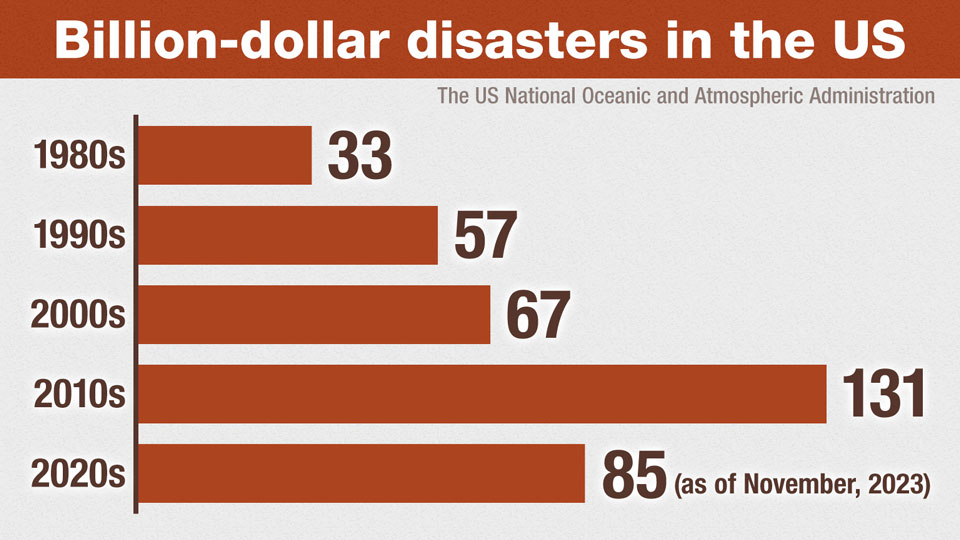

Billion-dollar disasters

US authorities say in the 1980s, the country had 33 "billion-dollar disasters" — natural catastrophes such as hurricanes and floods that have clean-up bills topping 1 billion dollars. The first four years of the 2020s have already brought 85 such events.

The surge, fueled by climate change, has drastically increased insurance payouts and prompted a major re-think by the big firms.

Florida is particularly vulnerable, because it gets more hurricanes and other disasters than any other US state. One consequence is the spiraling cost of insuring a property there. The Insurance Information Institute, an industry association, says that in 2022, Florida residents paid an average of 4,231 dollars in annual premiums, nearly three times the national average.

Another result, Norberg says, is that people in his state are finding it increasingly hard to get coverage at all. More insurers are going under, and those that remain are pulling coverage for coastal homes and businesses.

His claim is supported by numbers from the institute, which show that just one in five Florida homeowners has property insurance.

"That is a very risky proposition because if you have no insurance, it makes it extremely difficult to recover from a natural disaster," says institute spokesman Mark Friedlander.

The industry group says that insurance firms lost 900 million dollars in Florida in 2022. In the same time frame, 10 firms went bankrupt or withdrew from the market.

Lawsuits

Legal issues are adding to the pressure on Florida insurers, who face more than 100,000 lawsuits a year over insurance payments and other claims — many of which, Friedlander asserts, are fraudulent.

"One of the issues we've been facing here in Florida is roof replacement fraud schemes where unscrupulous contractors go door to door soliciting business from homeowners to replace roofs that are not damaged by storms," says Friedlander. "As a result, this leads to litigation because insurance companies will typically decline these claims, and then lawsuits ensue."

The Florida legislature has passed a series of regulations to prevent lawsuits from becoming more frequent. These include laws that limit high attorney fees and make it harder to bring cases to court. There are also laws that fund reinsurance programs that can be purchased by insurance companies.

Friedlander says these are important steps in the right direction. But he believes it will take some years for the laws to stabilize the Florida insurance market, such is the current state of turmoil.

Japanese insurers also under pressure

The implications of Florida's situation are serious for Japan, where damage from catastrophic storms and other events has noticeably increased in recent years.

The General Insurance Association of Japan has given no intimation that insurers may scale back their fire insurance policies — which also cover damage from wind, flood, and other disasters. But it acknowledges that businesses are coming under intense financial pressure.

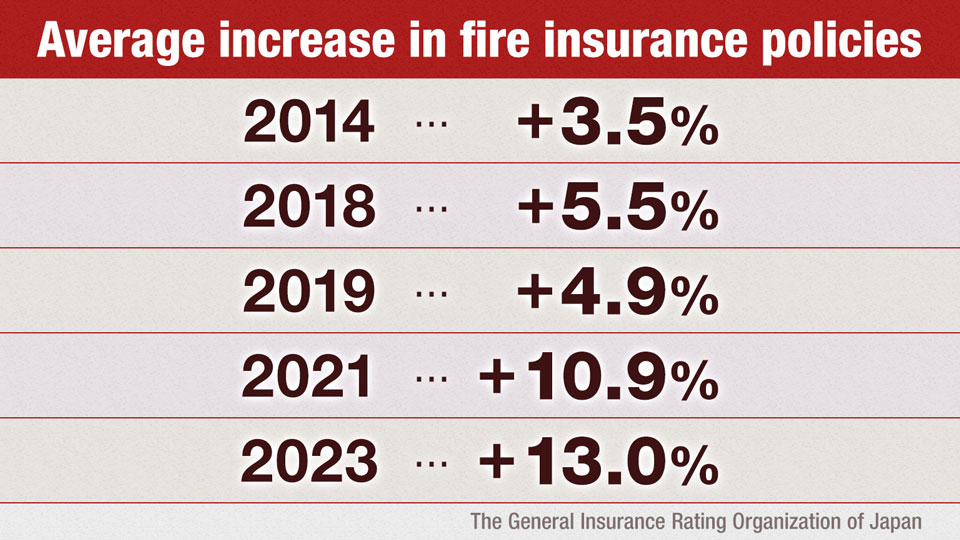

Last May, the General Insurance Rating Organization of Japan announced a 13 percent increase in the national average for fire insurance policies.

The increase, expected to kick in from April 2024, is the biggest to date.

The rating organization blames the increasing frequency of major natural disasters, which have triggered hefty payouts by insurers. It says aging housing stock is another consideration, as creaking homes are more susceptible to damage from storms. A third factor is the rising costs of materials for repairs and rebuilding.

The rating organization has also changed the way it assesses disaster risks to give greater weight to data on typhoons, which have struck more often in recent years.

The cost of home coverage is still relatively low in Japan compared with the US, but climate change does not discriminate by country. Though the non-life insurance systems are different, the threats faced by the two countries are very similar.