The delisting was decided at a shareholders meeting on November 22. Voters approved the purchase of all Toshiba shares by Japan Industrial Partners, an investment fund made up of Japanese firms.

Toshiba has been listed on the Tokyo Stock Exchange for 74 years, and it was once a Nikkei index heavyweight.

A history of innovation

The firm's origins go back even further, to 1875. Toshiba made its name as an electronics giant with numerous innovations.

It developed Japan's first color TV, washing machine and refrigerator. It was also the first manufacturer to sell rice cookers.

Toshiba became a global brand known for its TVs and laptops. It grew into a conglomerate that made it a significant player in the semiconductor and nuclear power industries.

Fall follows fraud

The company's fortunes began to falter in the last decade. Accounting fraud was revealed in 2015, with an admission from Toshiba that it had overstated operating profits for seven years.

In 2017, its United States nuclear plant subsidiary went bankrupt, which led to debt exceeding assets that year.

To address that imbalance between debt and assets — which would have forced a delisting from the stock exchange — management opted to accept funds from overseas activist investors.

But that led to new problems, including disagreements over business decisions.

Toshiba sold its TV and PC units, and spun off what was seen as its crown jewel, the semiconductor division.

Following a series of management changes, Japan Industrial Partners bought all the shares and took the firm off the stock exchange.

"Made-in-Japan" loses appeal

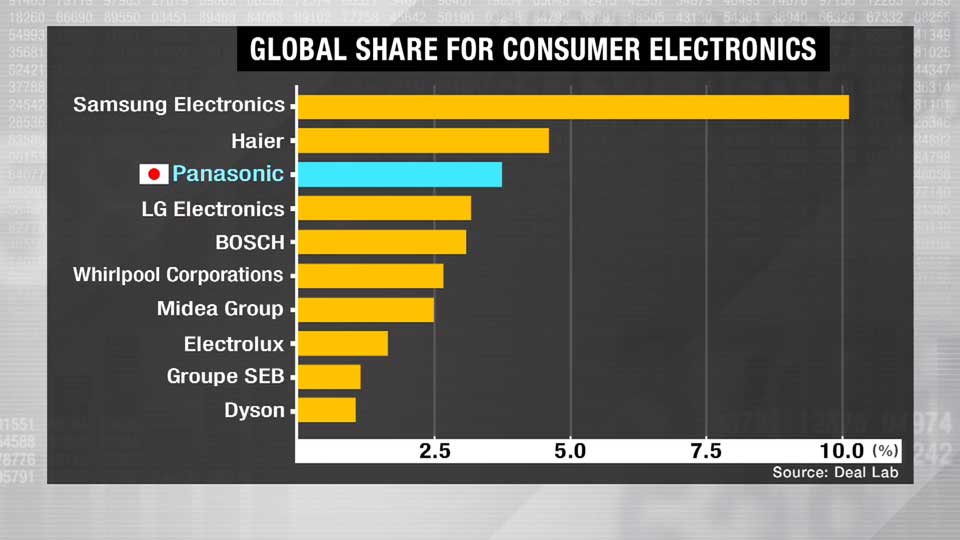

In tandem with Toshiba, other "made-in-Japan" electronics firms like Sony and Panasonic are no longer among the world's powerhouses.

According to market researcher Deal Lab, South Korea's Samsung and China's Haier now hold the biggest shares in the global consumer electronics market.

What lies ahead

Waseda Business School Professor Osanai Atsushi says Toshiba had no choice but to delist from the Tokyo Stock Exchange.

"Stockholders tend to seek short-term gains. But there are times when managers need to devise long-term strategies for the company that are different from what stockholders want."

Osanai maintains that if Toshiba's management can devise a successful strategy, the firm can be revived as it still has competitive technologies in both software and hardware.

He uses an example of Toshiba's high-speed elevators, which were installed in what was once the world's tallest building in Taiwan and earned a place in the Guinness Book of Records.

Osanai says that kind of hardware innovation, combined with the firm's advanced artificial intelligence and information technologies, can add value.

He goes on to say that the golden age of "made-in-Japan" electronics came about when people used video recorders, fax machines and analog TVs — items that are barely used anymore.

As consumers adapt to changing times, electronics manufacturers like Toshiba are doing the same by seeking out new ways to do business.