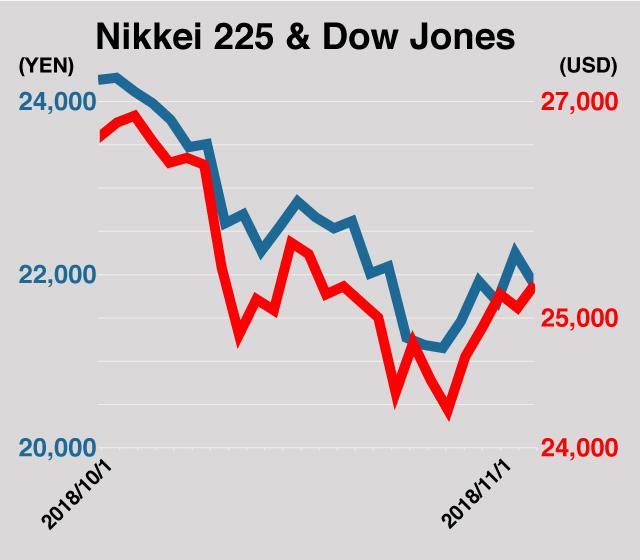

The Dow Jones Industrial Average and the Nikkei 225 both dropped 9 percent in the month of October. On October 31st, the Chinese yuan fell to its weakest since the 2008 global financial crisis.

Japan and the US have both been enjoying the fruits of the era of easy money. The 2 countries are on their way to marking their longest economic recovery period in a matter of months. So why the fear and frustration?

The minutes from the latest Federal Reserve policy meeting show that Chairman Jerome Powell and his colleagues will continue to raise interest rates no matter what President Donald Trump says. The European Central Bank plans to follow suit by ending its asset buying program by the year-end.

And even the most cautious Bank of Japan may finally join the group. Experts point out that the BOJ is “stealth tapering.” The central bank is actually purchasing less than half of the JGBs it said it intends to. Now, some analysts think that the more hawkish members of the BOJ board are attempting a “stealth exit.” The BOJ decided to allow long-term interest rates to move more flexibly around its zero percent target in July. And some see this as laying the groundwork for stealth rate hikes. They say there is still a small chance that the BOJ will move toward one rate hike in early 2019, just months before a new consumption tax hike takes place in October.

BOJ Governor Kuroda stressed in a speech Monday that the central bank needs to continue its monetary easing, but not necessarily in the same way it has in the past five years. “Japan’s economic activity and prices are no longer in a situation where decisively implementing a large-scale policy to overcome deflation was judged as the most appropriate policy conduct”, he said.

With more monetary tightening in the US, Europe, and possibly Japan ahead, investors may see capital outflows from emerging economies, reduced spending and investment due to higher loans. Few may expect the global economy to immediately enter a severe winter, but they’re already feeling the rather sudden chilly autumn headwinds as they wind up their long festive summer season.

Geopolitical tensions are not helping. In fact, Trump’s trade war is not only beginning to hurt the Chinese economy. It's having a boomerang effect on the US.

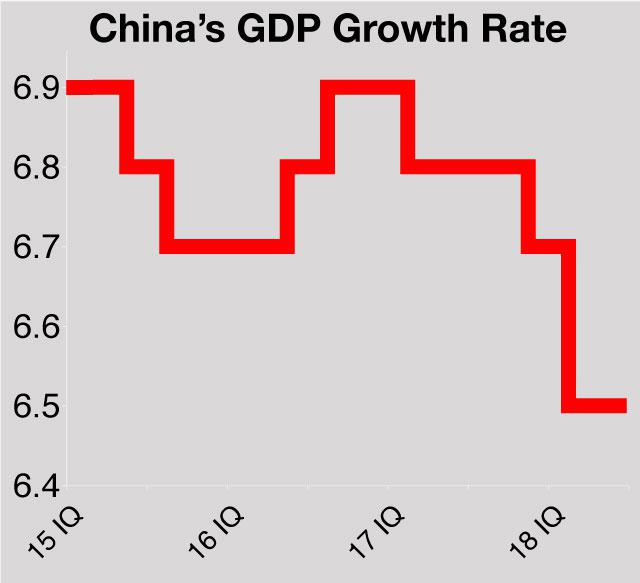

First, a quick look at China. The country’s GDP growth in the July to September quarter was the lowest in 9-and-a-half years, due to subdued infrastructure investment and weak consumer spending. Sales of automobiles, smartphones, and real estate have become sluggish. Financial authorities are becoming increasingly sensitive to outflows from China. Sources say they are closely monitoring overseas remittances from foreign financial institutions in Beijing.

That doesn’t mean that the US is winning. American farmers are already suffering from fewer soybean exports to China. Their Brazilian rivals are getting extra orders from China instead. Companies including Caterpillar and Texas Instruments are starting to become cautious about their business outlook in China. A recent IMF report warns that it will be the US that will suffer the most from a trade war in the long run.

Japan will certainly not be immune from the slowdown of the 2 biggest economic engines. Machinery orders from China in September were 20 percent less than a year before. Companies are starting to feel the pinch -- they’re downgrading their outlook for fiscal 2018. With the BOJ’s interest rate still in the negative range, and a ballooning national debt, the country has few additional policy options if the economy deteriorates.

The Buenos Aires G20 summit later this month and possible US-China bilateral talks will be the next points of focus. Some market participants became more optimistic after Trump recently tweeted, “I think we'll make a deal with China” on trade. He claimed that Chinese President Xi Jinping is eager to make a deal at their expected meeting on the sidelines of the G20 summit. But there are mixed signals, with US administration officials trying to downplay expectations before the Argentina meeting.

And trade friction is not the only issue worrying investors. There are many more, including higher crude oil prices due to turbulence in the Middle East, mounting concerns the European economy will be hurt by issues such as the Italian budget, Brexit negotiations, and German Chancellor Angela Merkel’s recent announcement that she will step down in 2021.

It’s the bad times, not the good, that show how big a role global leadership can play in saving the world, and populism is certainly not the way to go at a time when the G20 countries need to stay united to maintain global economic momentum.