Fed rapidly changes course from crisis-era policies

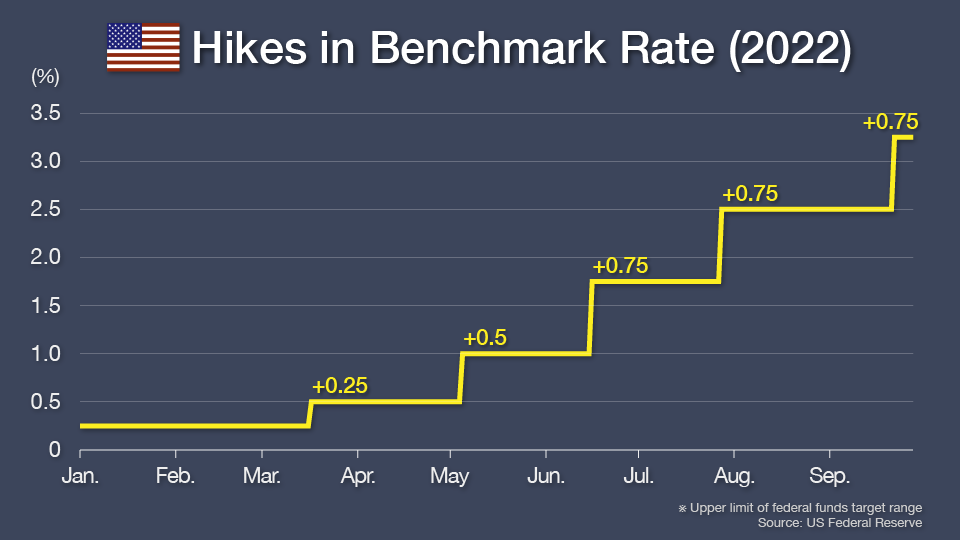

The US Federal Reserve raised its key interest rate by 0.75 percentage points at its September 20-21 monetary policy meeting, raising borrowing costs for Americans. The Fed has now hiked at five consecutive meetings: 0.25 pp in March, 0.5 pp in May, and 0.75 pp in the three meetings from June. The benchmark rate's target range is now 3-3.25%.

Fed Chair Jerome Powell reiterated the central bank's commitment to monetary tightening. "We will keep at it until the job is done," he told reporters shortly after the meeting ended.

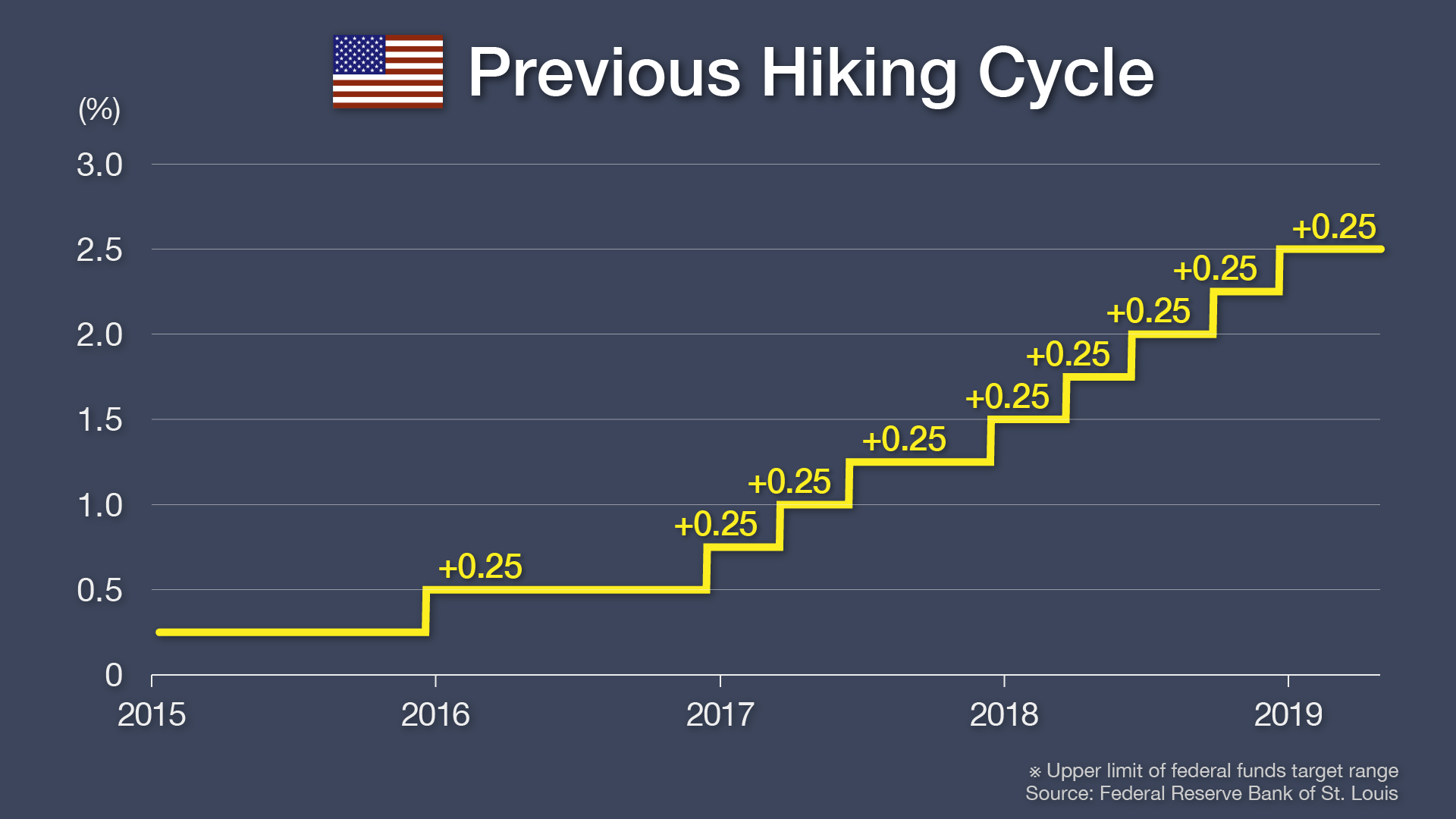

Fed-watcher Suzuki Toshiyuki calls the pace of tightening extraordinary. "During the Yellen era (Janet Yellen was Powell's predecessor) and the first half of the Powell era, rate increases were by 0.25 percentage points at about every other meeting. Most recently, it's by 0.75 pp every meeting, so the pace has really picked up."

The other aspect of the Fed's tightening policy is a reduction in the amount of its holdings of securities. Suzuki describes the current speed of this move, which reduces liquidity in the financial markets, as "unprecedented." The Fed's balance sheet had ballooned to $9 trillion as the central bank purchased bonds, mainly Treasuries, as part of its easing policy to stimulate the economy during the pandemic; now, policymakers are winding that down.

The Fed trimmed its holdings by $47.5 billion per month from June to August, and $95 billion per month from September. This is primarily done by allowing the securities "roll off" its balance sheet, in other words allowing them to mature rather than selling them.

Aggressive hiking plan

With Fed Chair Powell vowing to choke off inflation, investors around the world are wondering how aggressive he will become.

The central bank's outlook on rate rises can be surmised from its "dot plot," which is data on where policymakers project rate levels will be in the near future. At the September meeting, the Fed updated its forecast to indicate a more aggressive stance in its fight against inflation. The median of how high policymakers see the key rate climbing was 4.6% in 2023 – a jump from a peak of 3.8% in the previous dot plot three months ago.

Currently, the Fed's target range is 3-3.25%. So, if policymakers move in line with their latest projections, a considerable number of rate increases would be in store.

Red-hot inflation

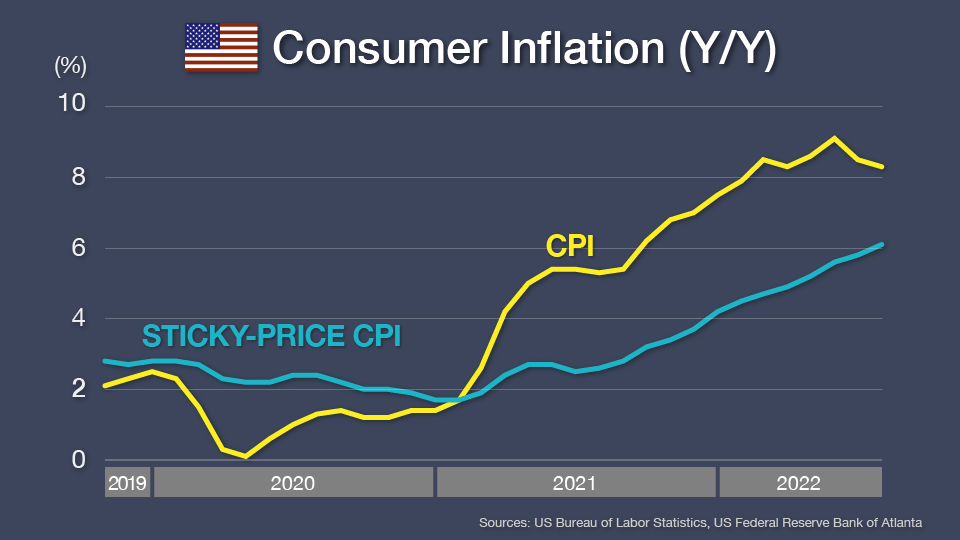

The Fed thinks it will tighten policy aggressively for another year because inflation remains high despite the previous hikes. Although the consumer price index (CPI) has come off its peak, it's still rising at a pace far above the central bank's 2% target. The figure for August increased by 8.3% compared to a year earlier.

In addition, Suzuki points out that another gauge indicates continuing price pressures. "An index called the 'sticky-price CPI' looks at items for which, once their prices start moving, that trend persists. It's currently on an uptrend, meaning inflation is here to stay." Sticky-price items include things like rent and medical fees. Once their prices rise, they tend to stay high.

The current inflation in the US can be attributed to several factors, many of which are on the supply side. The coronavirus pandemic has seriously disrupted the global supply chain. The Russia-Ukraine war is causing scarcity in many commodities. Americans are slow to come back to the labor market after the pandemic, causing a worker shortage.

Although it remains to be seen whether a central bank can rein in supply-led inflation, the Fed is trying to make full use of its policy tools. Powell has warned that such action could incur a harsh cost. "We have got to get inflation behind us. I wish there were a painless way to do that. There isn't," he told reporters.

Why does the Federal Reserve so desperately want to pull back inflationary pressures? Suzuki cites three reasons why high inflation is problematic.

Problem 1) Consumers suffer

When rising prices of products and services outpace wages, consumers' lifestyles suddenly become unaffordable. Currently, salary hikes in the US are not covering increased household costs. Suzuki notes, "Tightness in the labor market is leading to higher wages. Companies are passing on the additional labor costs onto consumers."

Problem 2) Corporate profits go lower

Not every company, however, will be able to transfer the added costs onto their customers. "Even if wage growth and price gains were perfectly in tandem, too much inflation still hurts the economy," Suzuki says.

Problem 3) Economy becomes less efficient

The most fundamental problem with excessive inflation may be that it causes inefficiencies to creep into the economy. Suzuki explains, "If you know prices are going to rise, you're going to hoard products. That means you're buying things you don't really need. This leads to problems with resource allocation." This view holds that rising prices will lead to unnecessary purchases, which in turn generates more inflation.

Price to pay

Another cost to not winning the inflation battle in a timely manner may be an "exacerbation of inequality," according to Suzuki.

"Monetary easing during the pandemic supported the economy by causing the value of assets to soar. This means that the rich who owned assets benefited," he explains. Now that policy has turned toward tightening amid inflation, Suzuki cautions that the hardest hit will be low-income earners.

The example he gives paints a gloomy image. "Currently, people's wages aren't going up as much as prices in the supermarket. As the Fed tightens policy, the labor market will likely lose steam. The people who lose their jobs in such circumstances tend not to be the affluent. So, the people who had already been suffering from higher prices may take another hit from losing their income," he explains. "If the Fed cannot get inflation under control and has to tighten policy over an extended period of time, the allocation of assets within society may become a problem."

The US has a lot to lose if the Fed cannot fulfill its mandate of price stability – and the world would also feel harsh effects should the US economy go into recession. The Fed has warned of "pain." Policymakers should keep in mind that the burden should not weigh too heavily on the poor and worsen inequality.

Era of drastic change

People around the world may want to brace for an "era of drastic change" in terms of inflation, Suzuki notes. He points out that developed countries have gotten used to low inflation and interest rates over the last couple of decades. But that may no longer be the norm going forward. He gives several reasons.

The first is that "globalization is backtracking," putting a stop to cheap manufacturing. Globalization basically allowed nations to make products in other countries at lower costs. However, Suzuki says developments including rising US-China tensions and Russia's invasion of Ukraine have stopped that flow.

Another reason he gives is that aging societies have fewer workers. A tight labor market tends to lead to inflationary pressures.

If the era of low inflation is really over, so may be the era of low interest rates. Suzuki warns, "Presuming we see drastic changes in inflation trends, we will likely see frequent aggressive tightening and recessions." Policymakers, along with consumers and businesses, will be forced to face new realities.