Fed tightens monetary policy

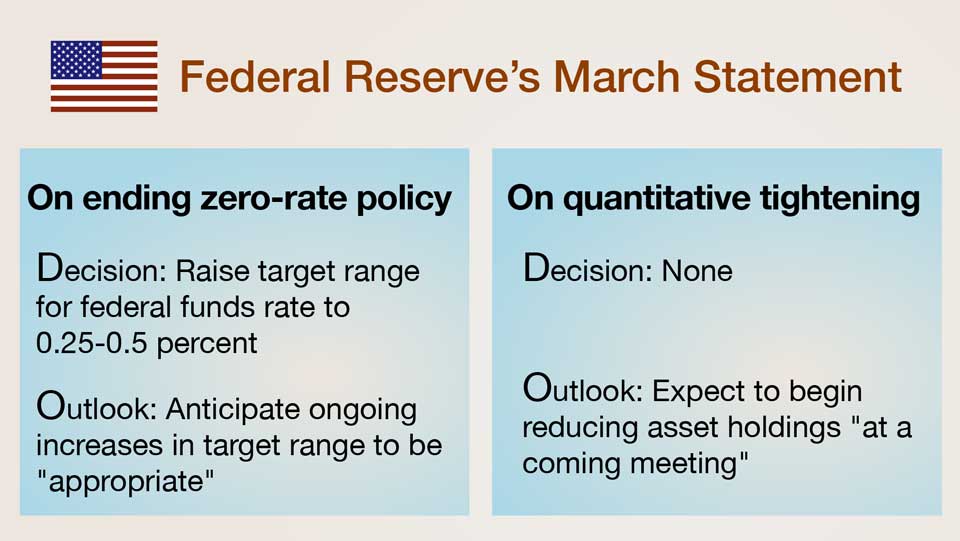

The Fed has two ways to tighten policy: raising interest rates and quantitative tightening (QT). At its March meeting, the central bank started with the first, and signaled the second would soon follow. This comes after a period of easy policy aimed at supporting the US economy through the coronavirus pandemic.

At its most recent policy meeting, the Fed raised rates by 0.25 percentage points. This put an end to its zero-rate policy, which had been in place for two years since the US economy started slowing due to the COVID-19 pandemic. Policymakers have indicated they are ready to be aggressive in raising rates going forward. They see rates going up six more times this year, given that each increase is by 0.25 percentage points.

The Fed also announced plans for quantitative tightening. The central bank plans to start reducing the assets on its balance sheet, which ballooned to $9 trillion due to purchases made during the pandemic. It said in a statement it expects to reduce its asset holdings "at a coming meeting."

Fed aims to cool inflation

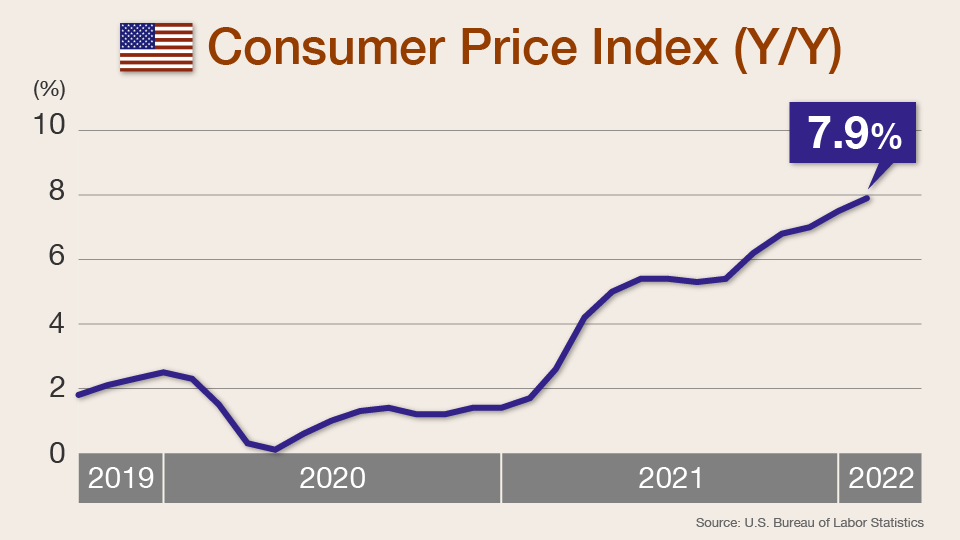

The goal of the tightening is to cool inflation. The consumer price index (CPI) has been soaring in the US. The year-on-year figure for February jumped to 7.9%, the highest in 40 years.

Inflation has been climbing due to an imbalance between supply and demand since the economy started reopening. Americans have been releasing pent-up demand, spending more than they did before the pandemic. Supply, though, remains tight. Pandemic-induced shipping delays and port bottlenecks have left businesses with insufficient supply. Workers choosing not to return to their jobs have also contributed to the supply shortage.

Russia-Ukraine conflict puts upward pressure on prices

Russia's invasion of Ukraine, which began on February 24, is adding to supply concerns, as well as inflation. Commodity prices have been driven even higher because of the conflict.

Russia is the world's second-largest oil producer. The recent sanctions on the country have helped push up the WTI crude oil benchmark to a 13-year high. It topped $130 a barrel in early March, and has mostly hovered over $100 a barrel since.

Russia also ranks second as a supplier of natural gas, which too has become more expensive. The country has several pipelines feeding gas to Europe.

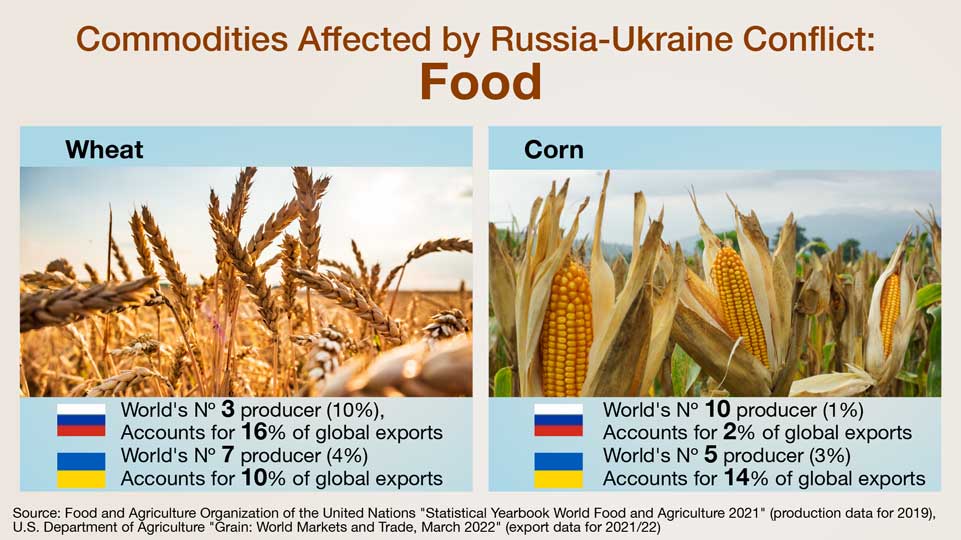

Russia and Ukraine are both major wheat producers. The region is known as "Europe's breadbasket." Not surprisingly, wheat prices have surged.

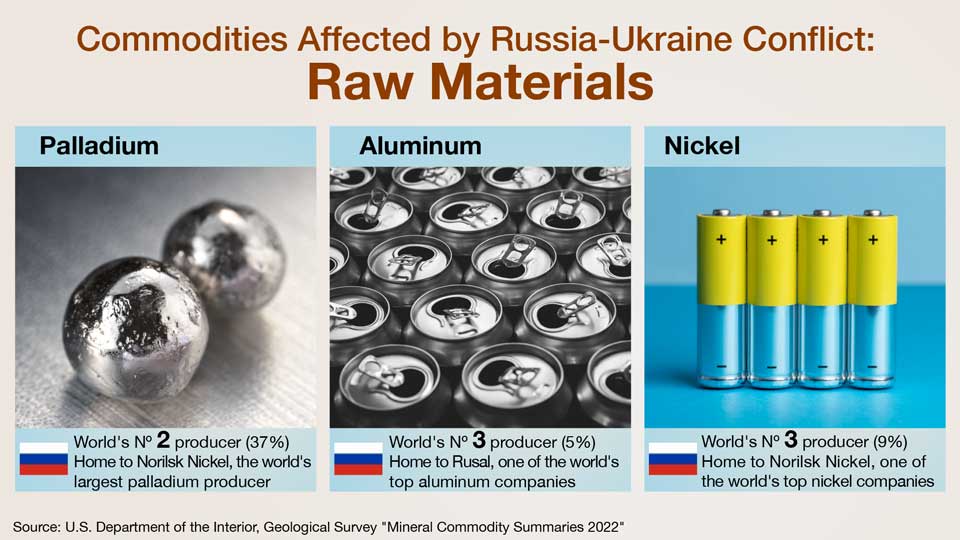

Many other commodities are seeing similar price rises, from food, such as corn, to raw materials, like palladium and aluminum. Corn is used for livestock feed, while metals are turned into industrial products, such as cars and batteries. Energy is needed for all economic activity. Therefore, the gains in commodity prices impact the costs of a wide range of goods.

Inflation outlook: A bigger jump on the horizon

Chief Investment Strategist Fujito Norihiro at Mitsubishi UFJ Morgan Stanley Securities notes that Russia is a country overwhelmingly rich in resources. He says that as countries around the world sanction Moscow, its exports will be excluded from international markets, worsening the supply shortage. "The effects of sanctions against Russia will be felt everywhere in the world."

Fujito says the CPI in the US will likely rise even beyond its recent 40-year high. He notes that Russia's invasion of Ukraine started on February 24, so the rise in commodity prices caused by the war were not fully incorporated into the February CPI figures. He expects the data for March due out April 12 will show an even greater jump. "If the Russia-Ukraine conflict drags on and the supply chain issues are not resolved, there's even the risk of double-digit inflation."

Inflation outlook: Moderation coming soon

Chief Economist Kanno Masaaki at Sony Financial Group has a more conservative view on the inflation outlook, believing it hit a peak in February. He sees it falling moderately after the first quarter of 2022 under the premise that oil prices stay around current levels.

Kanno explains that because the CPI is measured on a year-on-year basis, it is unlikely the figures for the second quarter of this year will exceed those for the first quarter. "Inflation began to climb from April last year, as consumers released demand that was pent-up from the pandemic. Technically, it will be hard for this year's figures going forward to surge compared to last year."

Kanno also points out that rising prices will weigh heavily on demand. He says higher energy prices are reducing disposable incomes, so consumers will likely cut back on spending. He thinks this may help even out the imbalance between demand and supply.

Fed faces a dilemma

Whatever the outlook for inflation, the current surge, led first by pent-up demand and supply shortages, and compounded by the war in Ukraine, is far from what policymakers desire — inflation that is stable and modest, led by healthy demand.

Kanno points out that the type of inflation now occurring as a result of supply constraints may be difficult for the Fed to control. "Addressing supply-driven price gains with monetary policy is difficult." He maintains that no matter how much a central bank raises rates, it can't increase supply.

Still, Kanno says the Fed may have no choice but to raise rates. He warns that price gains lead to an "inflationary mindset," which in turn brings about higher wages. He notes that when consumers earn more, they tend to spend more, so what had been supply-led inflation can soon turn into demand-led inflation. "In order to prevent that, the Fed has no choice but to hike rates, which dampens demand, in an attempt to keep the inflationary mindset in check."

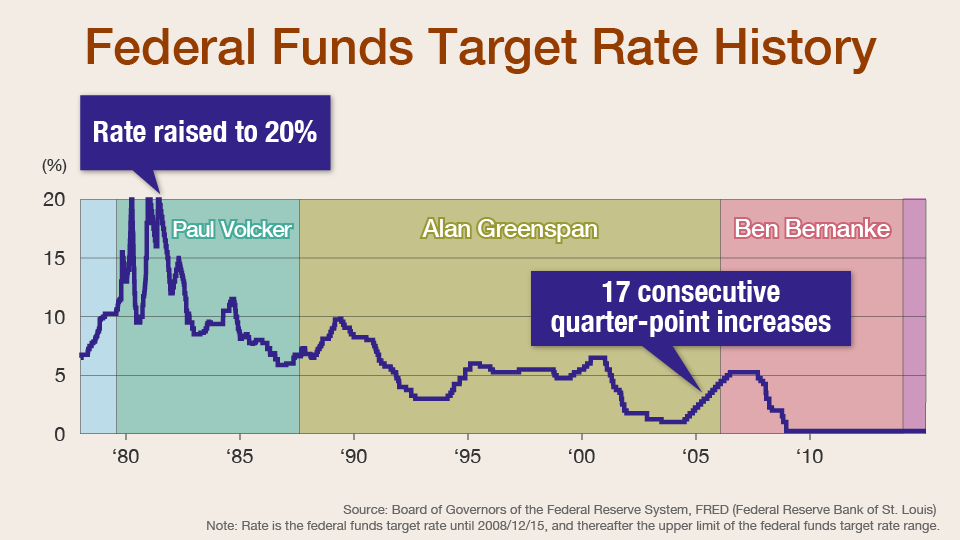

Fujito believes that rate increases alone will not be sufficient. He thinks the degree of each rate increase is of critical importance. He cites a cycle of rate rises that started during the tenure of former Fed Chair Alan Greenspan. The Fed hiked rates by a quarter percentage point at 17 policy meetings in a row. However, this modest pace of rate increases could not tame robust demand for housing in the US. A real-estate bubble ensued, creating the conditions for the global financial crisis.

Fujito also cited the experience of rate increases by former Fed Chair Paul Volcker, who raised rates to over 20%. "There was a shock, and inflation pulled back. This hiking cycle caused a recession, but it did get prices under control." The episode earned Volcker the nickname "inflation fighter."

Fujito thinks the Volcker approach is the one needed now, but it is not without danger. "The best prescription to tame inflation is a big rate hike. However, strong tightening measures of course lead to recession risks." Scaling back monetary easing too much could leave consumers without enough money to spend. The resulting decrease in demand could cause deflation.

Fujito warns that the Fed faces "a balancing act" between taming inflation and keeping recession risks in check. If the Fed does not tighten appropriately, there is a risk of hyperinflation. On the other hand, if the Fed tightens too much, there is a risk of an economic downturn.

While Fujito seems to view Volcker's experience as instructive, Kanno sees it more as a cautionary tale. "Volcker drastically raised rates and controlled inflation in the end, but that led to a recession." He calls it a typical example of stagflation, in which prices rise while the economy lags. He says raising rates in drastic steps increases the risk of stagflation.

Both economists agree that the Fed must walk a tightrope going forward. Kanno warns that if the pace of rate hikes is too slow, there is a risk of inflation heating up. That would most likely require drastic tightening in the future. Therefore, Kanno points out any near-term pain to the economy from raising rates would be a small price to pay compared to the consequences of delaying policy tightening. "Avoiding short-term pain could have a major impact on the economy down the road. That is the uncomfortable decision that the Fed is facing."

Predicting the Fed's moves

People around the world are watching how Fed Chair Jerome Powell walks the tightrope of raising rates in an environment of soaring inflation. The two economists have different predictions on how things will go.

Fujito says the March rate increase was mild because the Russia-Ukraine war had just begun. He believes the Fed was being "cautious" because the invasion had made market sentiment unstable. There was no way of knowing how big the impact of the conflict will be on US businesses. He thinks the central bank will have more policy leeway once it has a clearer picture how exposed US firms are.

Fujito, who predicts a further rise in inflation, says, "Following the Fed's modest rate increase in March, I do not think it can afford to do nothing for two months until its next policy meeting scheduled for May 3-4." He expects the central bank to hold an emergency meeting in April after the next CPI figures come out on April 12, possibly raising rates by half a percentage point. If the inflation figure is over 8%, "there is a high possibility of such a rate increase."

Fujito also believes the Fed could take even more aggressive steps. He says that if inflation cannot be brought under control by consecutive rate rises of half a percentage point, in addition to QT measures involving decreasing asset holdings at their redemption, the Fed might take the extreme step of selling the bonds it owns directly to the markets.

Kanno, on the other hand, thinks rates will rise at a more modest pace. He believes the Fed will increase rates by a quarter of a percentage point at each of its meetings scheduled for May and June. But he does not think the Fed has a clear plan thereafter, as the Ukraine situation is difficult to predict. He expects it to raise rates about twice more in the four remaining meetings in the second half of 2022, for a total of five increases this year. However, if inflation cannot be brought under control by the middle of the year, he thinks the Fed may increase rates at every meeting in the latter half of 2022, for a total of seven this year. On the other hand, if the economy starts losing steam and unemployment surges, Kanno expects the Fed to forgo rate rises altogether in the latter half of the year. He says the central bank is probably preparing for both scenarios.

Considering the possibility of rises of half a percentage point, Kanno says that with the global situation obscure, the Fed won't do anything to shock the markets, adding, "I don't think it will suddenly go there." However, he has the same expectations as Fujito for when the Fed might see the need for drastic action to curb inflation. He says that if inflation stays in the range of 7-8%, the Fed could raise rates more than he otherwise predicts.

Lasting impact of the Russia-Ukraine war

The crisis in Ukraine has not only made monetary policy more difficult, it has changed the world in far-reaching ways.

Fujito says globalization was accomplished on the premise that countries do not invade each other, but that myth has now collapsed. He expects many nations to increase their defense spending going forward, leaving less for infrastructure as well as research and development. As a result, he expects the Russia-Ukraine war to have a lasting negative impact on the global economy.

Kanno predicts the world could be divided into two camps: authoritarian nations and democratic ones. This could strain global supply chains, and consequently, economic activity.

The future has become more difficult to foresee. Whatever the world looks like in the coming years, Fed policy will be a major force in shaping the global economy. Its success depends to a large degree on how well it walks the tightrope it is now on.