Are CBDCs the future of money?

Economists have been talking about central banks issuing digital currencies for decades. The concept of money has evolved throughout human history. In ancient times, people used seashells until authorities started making coins. Centuries later, paper bills emerged. Money is now issued by central banks, which might soon start creating electronic currencies for the digital age, when many economic transactions are already made electronically.

How are CBDCs different from electronic payments?

Electronic payments are already in wide use – from grocery shopping to sending friends money. In China, services using smartphones like Alipay and WeChat Pay are so ubiquitous that many people do not feel a need to carry around cash anymore. In the United States, credit cards such as Visa, Mastercard and American Express are widely used, as well as internet payment systems like PayPal or Venmo. All of these are run by private companies, which guarantee that their form of payment has the same value and validity as cash issued by central banks. The money in accounts operated by commercial firms will always be vulnerable to those companies’ solvency and liquidity risks. Therefore, in theory, if the firms providing the service were to go bankrupt, users might not be able to access their money, and might even lose it. CBDCs, on the other hand, are considered risk-free in this aspect because they are issued by central banks.

Another key difference is who would be able to see the transaction data. Electronic payments are operated by private companies, so governments and central banks do not have access to this data. CBDCs, on the other hand, would give authorities a direct route to users’ data.

Which countries plan to issue CBDCs?

Taiwan will reportedly complete trials of its prototype CBDC this fall. India says it will issue a digital rupee in fiscal 2023. The Euro-zone, Japan, Russia and New Zealand are also contemplating introducing CBDCs.

The United States, until recently, was seen as one of the countries proceeding more cautiously. However, President Biden issued an executive order in March to look into creating a digital dollar. Experts say the move is likely in reaction to China’s issuance.

China is ahead of other countries with its electronic yuan. The e-CNY is being tested in various regions of the country, and was even rolled out for foreign visitors at the Beijing Olympics. The nationwide launch date has yet to be announced, but the digital yuan is on track to become the first electronic currency released by a major central bank.

Why is China issuing the digital yuan?

China moved swiftly to issue its e-CNY. Experts point out that Beijing has several motives for wanting its own CBDC.

To challenge US financial control

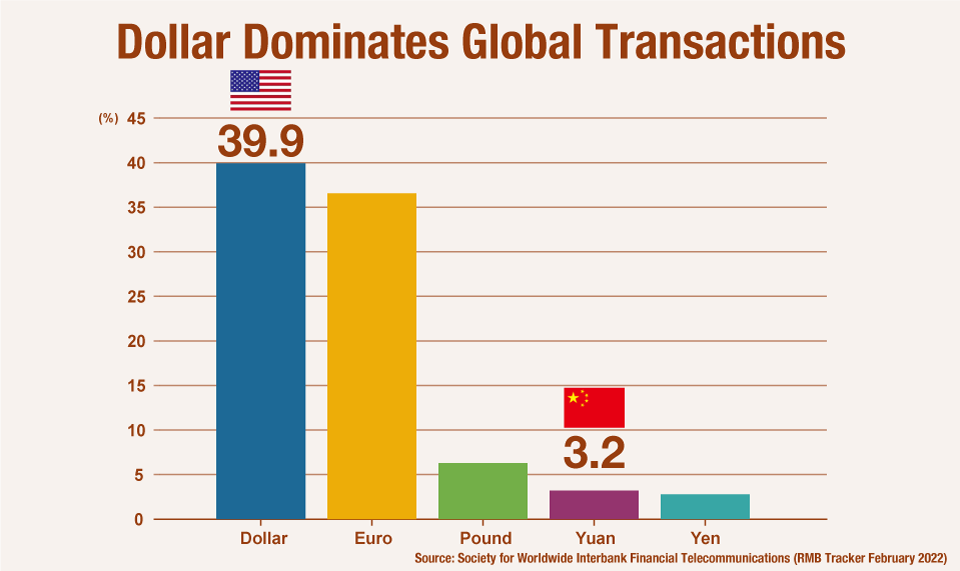

One key objective of the digital yuan may be to challenge the US dollar’s dominance. According to Kiuchi Takahide, a former Bank of Japan policymaker and Executive Economist at Nomura Research Institute, “China and the US are competing for economic hegemony as the world’s two superpowers. However, China is weak in terms of currency and money flow.” He says international finance is US-centric for two reasons.

First, the dollar dominates international payments. The greenback accounts for about 40% of global payments by value, while the Chinese yuan’s share is a mere 3%.

Kiuchi points out that countries would rather trade in their own currency. “Deals made in another country’s currency make your own economy vulnerable to foreign exchange levels. Forex levels would make the price of goods fluctuate with it, and that would negatively impact the domestic economy,” he said.

Kiuchi says the second reason why the US controls money flow is that international transactions, especially those in dollars, are made through banks using a system called SWIFT. That’s an acronym for “Society for Worldwide Interbank Financial Telecommunication,” which is a messaging system that allows the transfer of money across borders.

Here’s how it works: if a Brazilian farm sells coffee beans to a café chain in Italy in exchange for dollars, the buyer’s bank in Italy pays the seller’s account in Brazil through a bank in the US using the SWIFT system.

“A country cannot make international transactions if its banks are disconnected from SWIFT. This has been used by the US as a means of economic sanctions,” Kiuchi noted. In fact, Russia now faces this predicament: some of its banks have been removed from SWIFT due to the Ukraine conflict. SWIFT is overseen by major central banks around the world, including the US Federal Reserve. Although it maintains neutrality, the Belgium-based network complies with EU regulations, including sanctions.

In essence, the United States has the upper hand financially over China because the dollar is the preferred currency for international trade, and these transactions are made by banks using SWIFT.

“I believe China wants to escape US financial control by increasing yuan-based transactions that can be made not through banks, but digitally,” Kiuchi said, adding that the e-CNY might be the perfect way to do that. “Money in digital form doesn’t require costly transportation. The fact that the electronic yuan would make transactions easier will encourage other countries to use it.” He predicts that nations wary of the US, or those trading heavily with China, will start using its CBDC.

To gain competitive edge from data

Beijing might have another motive in mind for its digital yuan: gathering transaction data. The e-CNY is a “data issue,” said Yaya Fanusie, Adjunct Senior Fellow at the Center for a New American Security. “The digital currency is really just one part of a data collection effort. Chinese policy is trying to make data more controllable and more accessible.”

Although the Chinese government has said it would value users’ privacy, some experts are worried about how it might use the data it collects. If entities decide to use the digital yuan, Fanusie is concerned that their transaction data could be used against them.

Fanusie warns that any non-Chinese company using the e-CNY risks giving up its competitive advantage. “The Chinese authorities are going to know about how much the company is making, and they’re going to know about the pattern of behavior of that firm’s users. So with artificial intelligence and big data analysis, it seems quite possible that China would learn from that data and develop insights that it could use for the companies within its sector.”

To enforce stricter control

Both experts think that part of Beijing’s motivation in developing the e-CNY is rooted in power. They envision scenarios in which authorities use the electronic currency to enforce stricter control.

Kiuchi states that taking back power from the private sector is a key objective. Chinese citizens have adopted electronic payment services such as Alipay and WeChat Pay. He says, “I believe authorities are concerned about private companies collecting data on its citizens. Beijing wants in, too.” He believes the government will slowly try to take over electronic payments by making the digital yuan more convenient than its private competitors.

Fanusie is worried about authoritarian retaliation. He points out that Beijing already does that to an extent, alluding to an incident in which retailer H&M’s internet presence in China was scrubbed after the company criticized Beijing’s alleged human rights abuses of Uyghur minorities.

“If a company’s transactions are part of a digital ecosystem that China controls, I would imagine that China would simply cut off financial access to any company or individual that the government is not happy about,” Fanusie said. The digital yuan would make it easy for Beijing to stop payments or freeze holdings, taking authoritarian retaliation to a whole new level.

To lead internationally in new field

Fanusie says another aim of the e-CNY may be to lead in a new field of technology. “Beijing’s main objective is to be a leader in the digital economy. China wants to get a foothold in technologies that are still up for grabs.”

Traditionally, being an early adopter has its advantages. Countries with more experience and deeper insight into new technologies generally tend to influence international rule-making. In the case of CBDCs, the conversation would likely center on making a system for international transactions.

Fanusie emphasizes the perils of letting an authoritarian country lead the way to build infrastructure. “The standards China is going to push for are not going to be ones that respect democracy or freedom. If other countries want access to a system China has great influence over, then they may be forced to follow certain guidelines or to support certain policy moves.”

Kiuchi agrees that China aims to become a leader in the CBDC sector, and warns that the country could take it further. “Beijing’s vision may be to create an economic zone that uses the yuan as its reserve currency, and adheres to its own trade rules that benefit itself and emerging economies,” he said, adding that such a state could ultimately lead to an international divide. “The world could be divided into two economic zones... one for developed nations and the other for emerging ones. That would shrink global trade and hit the world economy.”

Will the digital yuan win gold?

If the electronic yuan turns out to be everything experts fear, its influence could spread far beyond financial transactions. Whether China’s new legal tender will win gold may depend on if it becomes widely accepted... and trusted.