Coronavirus pandemic shapes Fed policy

In the spring of 2020, with the COVID-19 pandemic bringing US economic activity to a standstill, the Federal Reserve stepped in to try and prop up the economy. The central bank eased monetary policy by slashing rates and ramping up asset purchases.

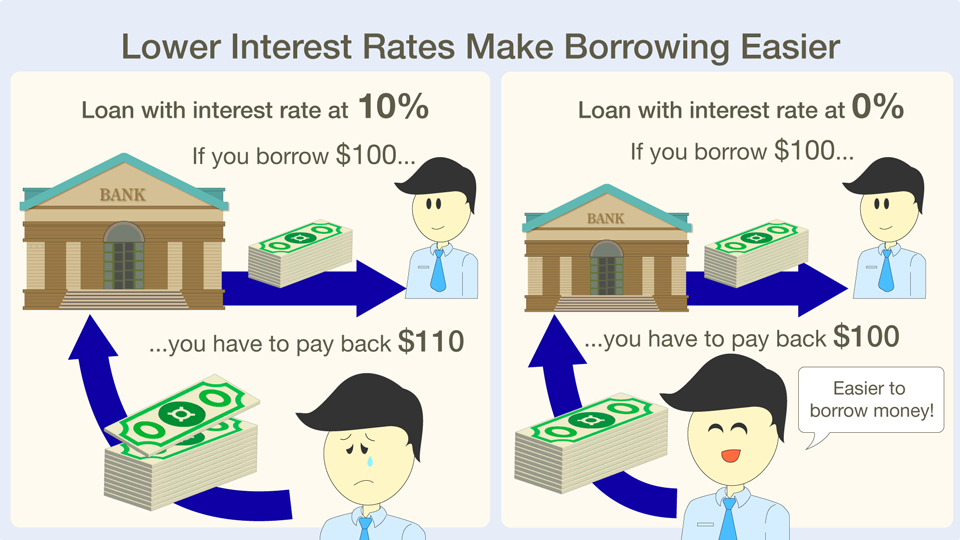

How do interest rates impact the economy?

The Federal Reserve influences the economy by hiking or cutting the Federal Funds Rate. This typically influences other interest rates throughout the economy, especially for shorter-term borrowing. Higher rates raise the cost of borrowing and limit cash in the economy, so both companies and consumers tend to tighten their purse strings. This leads to lower prices, which reins in inflation. Lower rates, on the other hand, make it cheaper to borrow money, which stimulates the economy by encouraging spending and investment.

How do asset purchases help the economy?

Another way the Fed influences the economy is through asset purchases. This unconventional monetary policy was first taken in the aftermath of the Global Financial Crisis, when the Fed's target rate hit zero but the economy was still struggling. By buying US Treasury bonds and mortgage-backed securities, the central bank reduces the supply of these assets in the markets. Less supply lowers their rates, which spills over to other longer-term rates and spurs lending. Less supply also leads to higher asset prices, which incentivizes asset owners to spend. However, if the Fed wants to reduce inflation, it cuts back on these asset purchases. This move is called tapering.

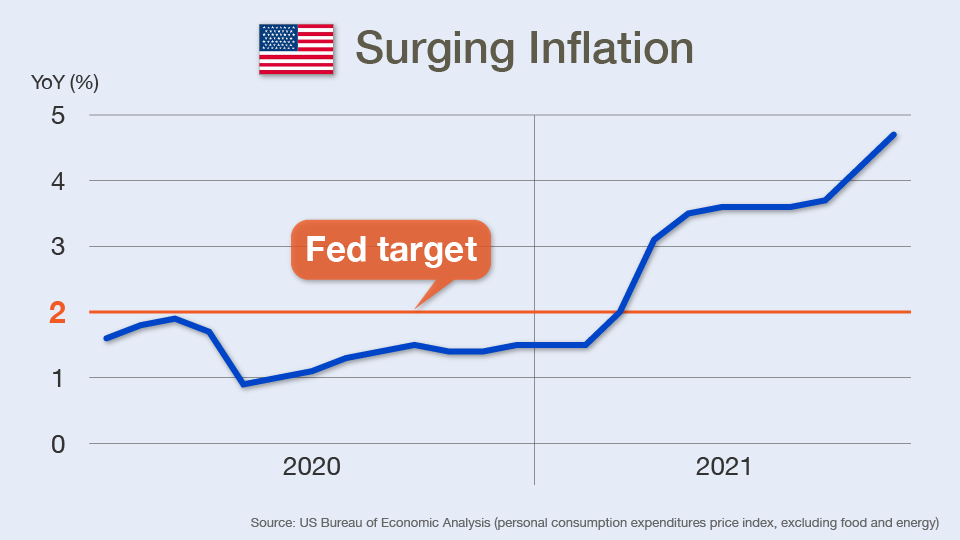

Fed shifts to tightening as inflation surges

In 2021, as the US economy started to recover, inflation soared. The Federal Reserve's preferred measure of inflation is the core PCE, or Personal Consumption Expenditures price index, excluding food and energy. The figure surged to 4.7%, the highest level in nearly four decades and more than double the Fed's target of 2%.

Economists have been growing increasingly concerned that surging inflation will harm the economy. Karakama Daisuke, Chief Market Economist at Mizuho Bank, notes that "If wages cannot keep up with rising prices, people's livelihoods will be put at risk."

As inflation jumped, the Fed decided to tighten monetary policy. The central bank started to taper its asset purchases in November 2021. At the current pace, purchases of new assets will cease by early 2022. Policymakers also signaled that they would start hiking rates during the year.

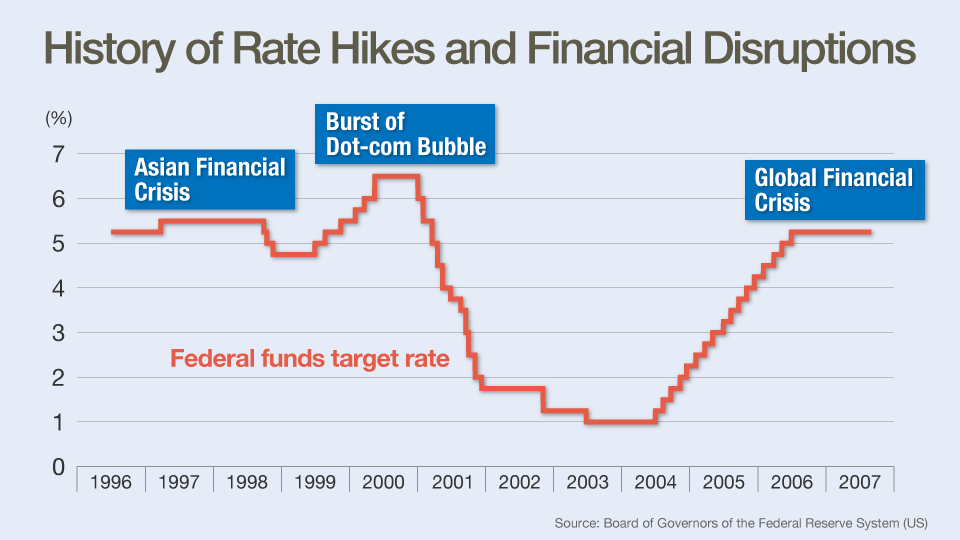

Rate hikes and financial disruptions

As the Federal Reserve gets ready to raise rates, some experts warn that if history is any indication, the markets could be facing severe disruption. Shirai Sayuri, Professor at Keio University and former Bank of Japan policymaker, says, "Historically, there has been quite a strong correlation between normalization of Fed policy and financial crises."

For example, the Fed raised its Federal Funds Rate target in March 1997. A few months later, the Asian Financial Crisis hit. After a while, the central bank loosened monetary policy. When the Fed eventually hiked rates again, the US Dot-com Bubble burst. Easing followed once again. When rates were hiked after that, the Global Financial Crisis struck.

Although it may seem that rate increases have caused mayhem, experts say that the hikes only exacerbated already-existing weaknesses in the markets. Professor at Columbia University and former Senior Advisor at the International Monetary Fund Ito Takatoshi says, "Looking back, all the financial crises have causes that are independent from US monetary policy."

The Asian Financial Crisis

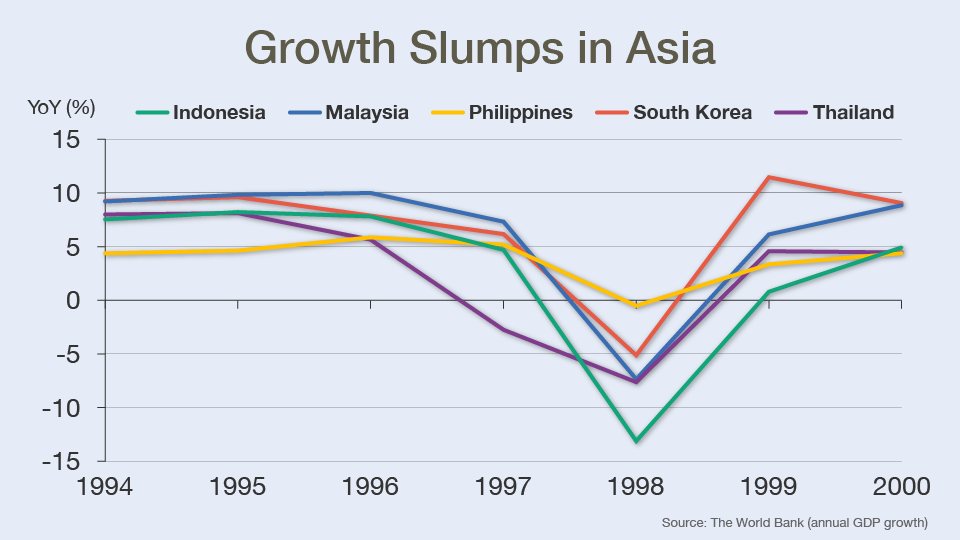

In July 1997, the Asian Financial Crisis began in Thailand, only a couple of months after a Fed hike in March. Indonesia, South Korea and other markets in the region followed a similar fate.

Before the US rate hike, investment into Asia had been booming because the region had been quickly growing. In order to get more international financing, many Asian countries had fixed their currencies to trade in lockstep with the US dollar. This had allowed overseas investors to put money into the countries without the risk of currency fluctuations. Kiuchi Takahide, Executive Economist at Nomura Research Institute and former Bank of Japan policymaker, says the influx of money into the region had also been boosted by US monetary policy. "The Fed's loose stance meant excess money in the markets, which poured into Asia."

Then came the Fed's policy change. The rate increase made the US a more attractive destination for investments and raised the dollar's value. Since some Asian currencies had traded in tandem with the dollar, their value went up with the greenback. However, because some Asian countries had lower interest rates and large current account deficits, global financial institutions pulled their assets out of Asia, and put them into the more appealing US market. Asian governments used their foreign currency reserves to purchase their own currencies in order to maintain their value. Nevertheless, the countries eventually depleted their foreign currency reserves. Thailand, Indonesia and South Korea saw the value of their legal tenders collapse along with their dollar-peg systems. Financial chaos ensued, with spillover effects across the region in the Philippines, Hong Kong and Malaysia.

Karakama says that Asia's inherent weakness lay in two areas, a lack of foreign currency reserves and a current account deficit. He says the region has learned from the experience. "Now, 60% of the world's foreign currency reserves are concentrated in Asia."

The burst of the Dot-com Bubble

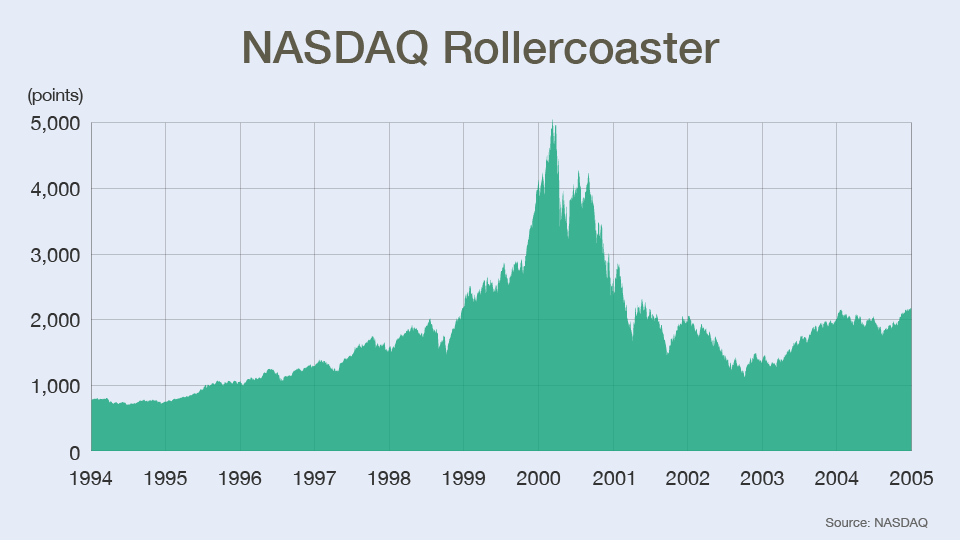

The next major financial disruption was the burst of the US Dot-com Bubble. In the late 90's, technology and internet stocks in the United States had seen enormous gains as computer ownership ushered in a new era. The tech-heavy NASDAQ Composite stock market index gained a whopping 400% between 1995 and its peak in March of 2000. That same year, the US Federal Reserve hiked rates 6 times, and the NASDAQ quickly shed most of its value. Shirai says that many companies had been overvalued due to monetary policy. "The Dot-com Bubble was also triggered by US Federal Reserve rate hikes in a way. There had been so much money injected into US companies before policy tightening and stock prices were way too high."

Easy money leads to financial disruptions

Kiuchi notes that although financial disruptions have tended to come after rate hikes, it's actually the Fed's easing before the hikes that has been the cause. Loose monetary policy means more money in the markets, and that leads to excessive investment in risky assets, which tends to turn into a bubble. "When interest rates are low, it's harder to get higher returns, so investors take risks and put money in assets that have a better payoff. This makes speculative assets overpriced and leads to distortions in the markets."

The Global Financial Crisis

The 2007-8 Global Financial Crisis was another typical example of exaggerated financing in risky assets leading to a correction. With a low-yield environment making higher returns hard to come by, investors poured money into risky financial assets.

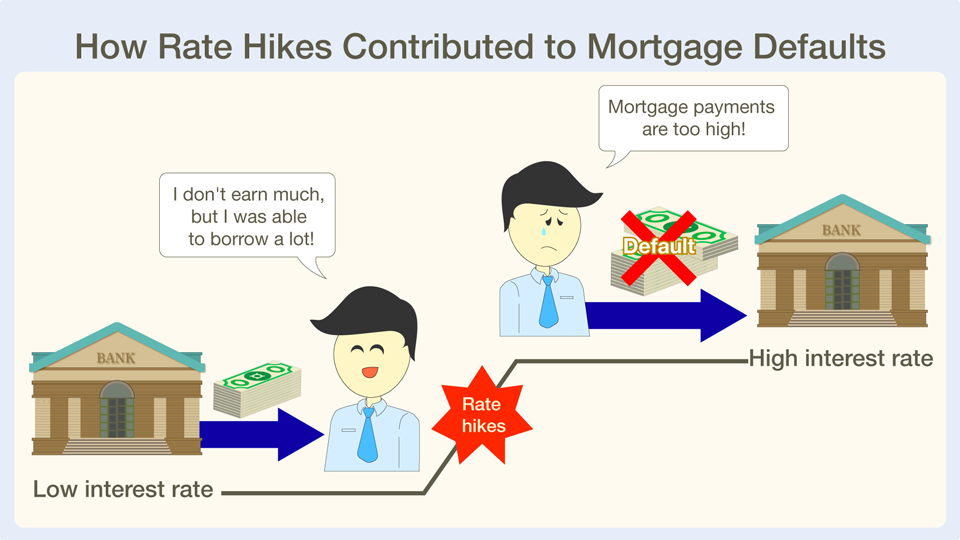

In the years leading up to the crisis, home prices in the US had appreciated amid favorable conditions. Stable economic growth and inflation, along with low unemployment and interest rates, had seen housing prices grow strongly. Expecting the trend to continue, people had taken out loans to build more homes. Many of the mortgages were imprudent, taken out by people with low wealth and income, some of whom had missed loan repayments in the past. These 'subprime loans' had ballooned before the Global Financial Crisis. At the same time, financial institutions seeking higher returns amid low rates had been investing heavily in financial assets associated with the subprime loans.

Then, from 2004 to 2006, the Fed hiked rates numerous times. The increases raised interest rates on mortgages, which meant higher monthly payments for many borrowers. This coincided with home prices peaking. Many people who had received subprime loans became unable to pay back their mortgages and defaulted. Financial institutions lost out on their investments and incurred large losses. Some went bankrupt, while others had to rely on government support. The effects of the crash were felt around the world.

Where the risks lie

The interlinked history of rate hikes and crises indicates that a shock may be on the horizon. Ito warns, "If you are a vulnerable country, industry or company, you have to watch out for US rate hikes." The following are some possible areas of trouble that analysts are keeping an eye on.

Risky corporate loans

Shirai believes risky corporate loans could be a source of financial chaos. Companies that are at higher risk of not being able to repay their debts must offer high returns in order to secure funds. "High-yield bonds are issued by very risky companies," says Shirai. "At this moment, in a low-rate environment, they can cheaply finance their economic activities. However, when interest rates start to face upward pressure, some companies are not going to be able to pay back their loans, so there might be some bankruptcies coming from the normalization of Fed policy."

Kiuchi agrees, adding, "During the coronavirus pandemic, the Federal Reserve eased policy more than its peers. Central banks in Japan and Europe also tried to support their economies, but there was only so much they could do because their policies had already been loose before COVID. During the pandemic, the Fed pumped more money into its market than other countries, and so now, market distortions are more prominent in the United States. The coming Fed hikes may trigger a financial crisis with the US as the epicenter. I am especially worried about the high-risk corporate debt there."

More on the corporate debt risk in this article:

Will 'fallen angels' cause the next financial crisis?

Emerging countries with debt

Meanwhile, Karakama believes that developing nations with big current account deficits and little foreign exchange reserves will face trouble after the Fed hikes. Turkey, Argentina and Brazil are often cited as examples of countries facing precarious financial situations.

Nonetheless, he believes that there is little threat to the rest of the world. "A bubble only turns into a global crisis when its damage cannot be contained within one country. The current economic challenges are not in that league." He says that because financial institutions were tightly regulated after the Global Financial Crisis, spillover effects to other nations will be minimal.

Ito is also worried about emerging economies with a lot of debt. If the Fed hikes trigger capital outflows like during the Asian Financial Crisis, he warns that "It will be difficult for the countries to roll over their debts."

Yet he also offers a ray of hope, saying it is not too late for countries, industries and companies with problems to avoid causing financial disruption even if the Fed hikes rates this year. "In the past, there was a correlation between Fed hikes and financial crises, but that's not destiny." Ito says the worst can be avoided if such entities "change their decisions, behaviors and policies."

The year to prepare

If there is any good news for countries and companies at risk, it may be that they will likely have time to change course and avoid causing a crisis. Experts say that if the Fed's hikes trigger problems, they would come in 2023 or later.

According to Kiuchi, the prospect of Fed policy tightening is sometimes enough to cause market shocks when rates are already sufficiently high. That may be why the Asian Financial Crisis hit after only one increase. However, he says that probably won't be the case this time because rates are close to zero. "When the Federal Funds Target Rate rises above 1%, which will likely be in 2023, the burden of borrowing costs may start to upset the markets."

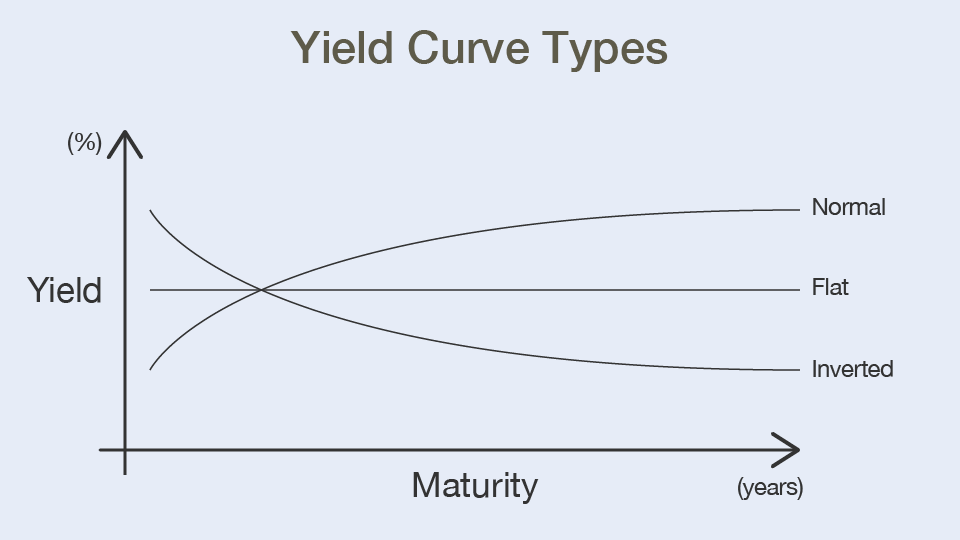

Shirai uses a slightly different metric for anticipating possible financial troubles. Her focus is the yield curve for US Treasuries.

The yield curve tracks different yields across maturities. Conventionally, the line slopes upward, in which case the yield on bonds with shorter-term maturities are lower than that of longer-term ones. This means that higher interest is paid on longer loans due to the risks associated with time. Such a yield curve is usually seen when the markets expect the economy to grow and interest rates to rise. A flattening curve can be an indicator that investors are not optimistic about economic expansion, and an inverted yield curve implies that they are concerned about the future.

Shirai says, "The yield curve flattened in 2021. If it should invert, financial institutions may take excess risk in order to book profits, which in the longer term could lead to disruptions in the markets. If this happens, the process will take years."

Whether the Federal Reserve rate hikes that are expected to begin this year will trigger a financial crisis remains to be seen. If another shock is coming, experts believe it is unlikely to happen this year. The outcome could well depend on the actions countries and companies take in 2022 to prepare for a new economic reality.