Uneven economic recoveries bring diverging monetary policies

Economies are recovering from the impact of the coronavirus pandemic at varying speeds. In Japan, much of the country remains in a state of emergency, under which economic activities are curtailed, at least until the end of September. Currently, people are asked to avoid nonessential outings and to refrain from traveling between prefectures. Businesses such as bars, restaurants and large commercial facilities are asked to close their doors at 8pm. On the other hand, in the United States, daily life is returning to normal as the economy reopens. This month, theater fans in New York saw the curtain rise again on Broadway following 18 months of shutdown.

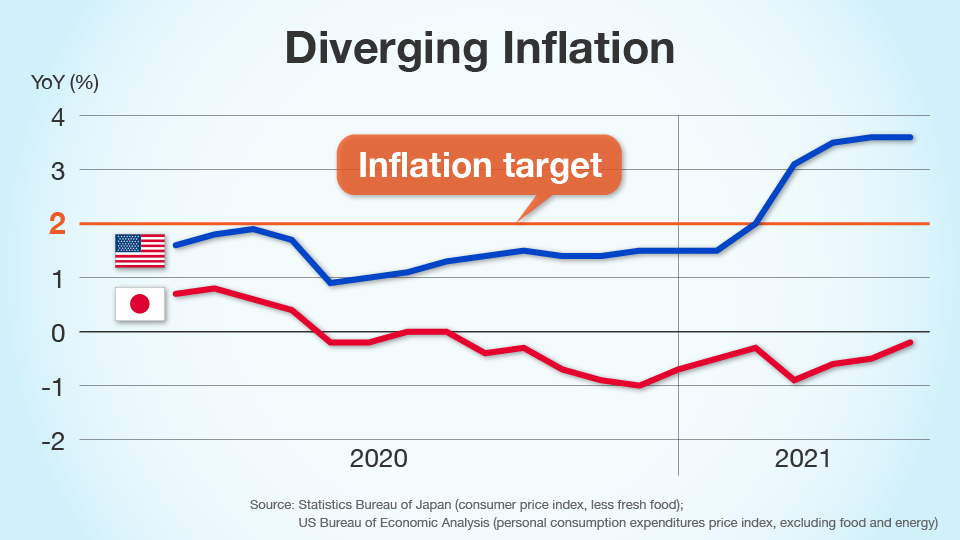

This divergence in economic activity is quite stark in numbers. The BOJ and the Fed both have inflation targets of 2% (the BOJ looks at consumer prices excluding fresh food, while the Fed uses personal consumption expenditures excluding food and energy). Japan’s inflation rate remains in negative territory. The US has seen its rate surge well above the 2% target in recent months.

Fujita Shumpei, an economist at Mitsubishi UFJ Research and Consulting, blames Japan’s lagging inflation rate on service prices. "The price of goods in Japan is moving in line with other countries, but service prices have barely risen, and that’s where Japan is being left behind." The situation highlights an underlying problem in the country. "Service prices tend to correlate with wages, and Japan has seen suppressed wage growth for a long time."

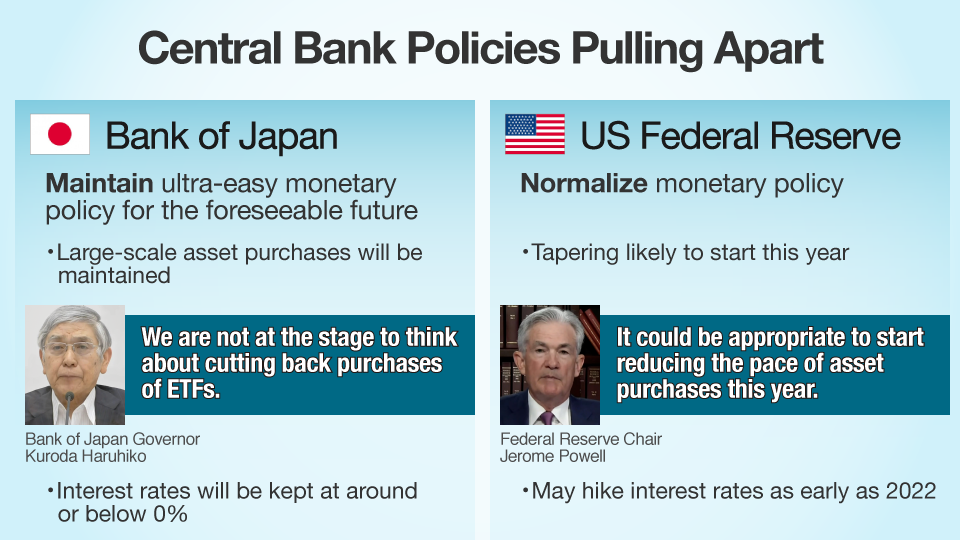

With economies in Japan and the US performing differently, central banks are diverging in their desire to stimulate the economy. The two countries held their central bank policy meetings on the same days, and they came out with contrasting results.

Bank of Japan Sticks to Easy Money Stance

The Bank of Japan maintained its ultra-easy monetary policy at its September meeting on the 22nd. Policymakers decided to keep short-term interest rates negative and continue guiding long-term rates at around 0% by buying Japanese government bonds. The bank gave no indication that it would cut back on its large-scale asset purchases, which include index-linked exchange traded funds (ETFs) and investment equities issued by real estate investment corporations (J-REITs), any time soon, and a rate hike is not on the horizon at all.

The BOJ makes large-scale purchases of assets so that rates hover near their intended target. This policy is called "yield curve control." The bank’s asset purchases have gone down from their peak amid the coronavirus pandemic. The move is widely seen as the BOJ calibrating its yield curve control, rather than an effort to cut back on asset purchases, known as tapering.

Federal Reserve Indicates Tightening Coming Soon

On the other hand, the US Federal Reserve signaled that it would head in the direction of tapering. On the same day the BOJ announced that it was keeping easy money flowing, the Fed proclaimed, "If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted." The statement followed what Chair Jerome Powell said in August: "It could be appropriate to start reducing the pace of asset purchases this year." Many market participants are now expecting the central bank to announce tapering at its November meeting. Additionally, the Fed indicated that it may target the middle of 2022 to end its tapering program, possibly setting the stage for near term rate hikes.

The Fed also updated projections on rate hikes in its so-called "dot plot," which shows where policymakers see interest rates in the future. It suggested that the central bank may raise interest rates in 2022, perhaps sooner than the markets had expected.

Differing monetary policies could drag on Japan’s economy

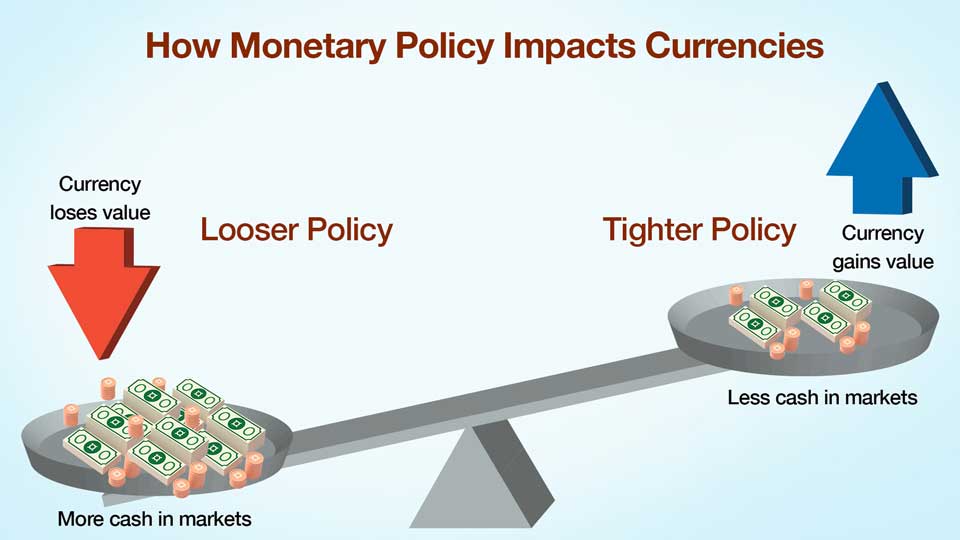

How might the monetary policy difference affect the Japanese economy? When one central bank has a looser policy than another, it pumps more cash into the markets. Once something is in excess, its value falls, so the country’s currency loses value. Since the BOJ’s policy will be easier than the Fed’s, the yen is expected to weaken against the dollar.

A weaker yen has long been considered as having positive impact on the Japanese economy. The country is a well-known exporter of manufactured goods such as cars and electronics, so a weaker Japanese currency means domestic companies earn more for items they sell overseas in foreign currencies. For example, when a Japanese automaker sells a vehicle for 50,000 dollars in the United States, the firm receives 4,000,000 yen when the dollar stands at 80 yen. If the dollar trades at 100 yen, the company gets 5,000,000 yen for the same car. In other words, the weaker the yen, the more likely that Japanese exporters can increase their revenue.

Japanese firms may no longer benefit from a weaker yen

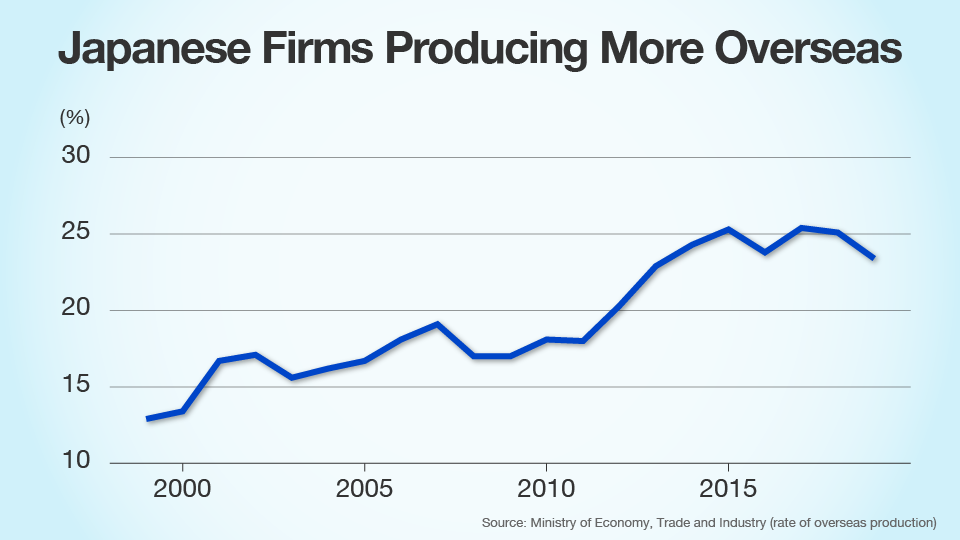

However, Fujita believes a weaker yen might not be so great for Japan anymore. "For years, manufacturers have been moving production overseas. The more they do this, the more they won’t enjoy the benefits of a weaker yen."

Fujita says the problem is exasperated by the fact that companies are importing more. "Japan is seeing more and more imports, so the downside of a weaker yen -higher import costs- has become more pronounced."

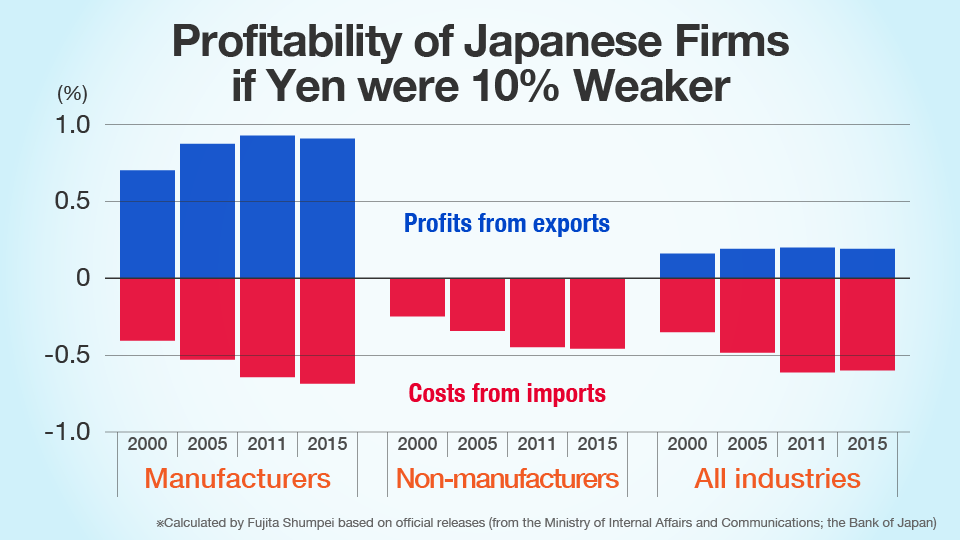

Fujita has run the numbers on how a weaker yen could impact the profitability of Japanese firms. He measured how different industries would have coped in 2000, 2005, 2011 and 2015 if the yen had fallen 10% in value at the time, and the results are given in the chart below. It shows that manufacturers would have seen more profits from exports over time, but their costs from higher import prices would have outpaced the savings. Non-manufacturers such as service companies generally do not export their products, so a cheaper yen wouldn’t have boosted their profits. However, it would have considerably raised their costs from imports over time. When the results for both industries are combined, according to their weights in the Japanese economy, it shows that profits from exports would have remained largely unchanged, while costs from imports would have grown substantially. Fujita says, "My calculations show that the economic structure of Japan has changed. Over the years, the country has seen its reliance on imports grow, and as a result, Japan’s industries combined would have lost 0.4% if the yen were 10% weaker in 2015. If the yen sees a devaluation going forward, there is not enough data to know how Japan would perform, but it can be surmised that the country would take an even bigger hit."

Fujita’s analysis shows that import costs could become quite a burden for Japanese companies were the yen to lose value. He says that firms would likely become less profitable due to the rise in costs. "Even when costs rise, Japanese firms avoid passing them on to consumers for fear of undercutting already weak demand. Instead, they cope by shearing profit margins."

Fujita warns that if the yen hurts the profitability of Japanese industries, it could have wider implications. "If companies see shrinking profits, that could impact wages, which may lead to a fall in consumption. There’s a risk that Japan’s economic recovery would be undermined."

Furthermore, if Japan’s lag in inflation were really due to stagnant wages as stated above, and a weaker yen hit workers’ pay, the country might never see inflation rise or monetary easing end. Japan may never get out of a vicious cycle in which neither wages nor prices grow.

Fujita is worried about the BOJ keeping policy easy for too long. "If Japan is late to the normalizing trend, the global economy might be struggling again by the time the central bank deems it time to normalize. Cycles in the economy could, in the future, make it difficult for the BOJ to normalize despite wanting to."

Fed’s tightening policy poses risks for the global economy

Japan is not the only country that could face challenges from tightening monetary policy at the Federal Reserve. Emerging economies will also likely see their currencies weaken against the dollar.

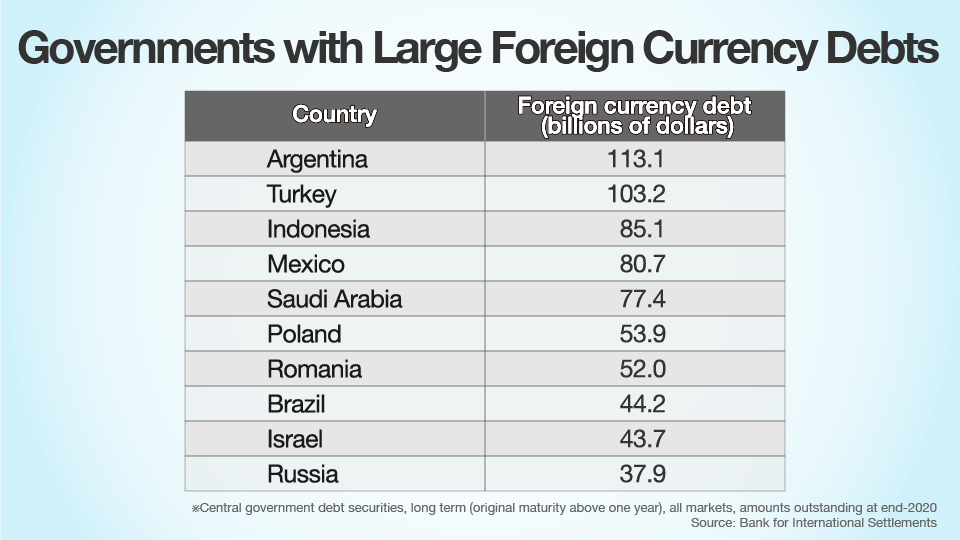

Fujita says, "Emerging economies tend to borrow through dollar-denominated government bonds. That means that if the dollar rises, their external debt grows, and the burden of repayment becomes heavier."

A heavier debt burden could have a significant impact on livelihoods in emerging economies. "Governments have been ramping up fiscal stimulus to help steer their economies through the coronavirus pandemic. If their debt burdens grow, it would limit budgets for fiscal stimulus. This would be a further blow to emerging economies."

The increased burden could even cause some governments to default. However, Fujita is not too pessimistic, saying, "The countries that are creditors, mainly developed nations, will probably allow emerging economies to postpone debt repayment should they face the risk of default. That’s because a default benefits neither creditor countries nor the global economy."

An uncertain future

The global economy during the pandemic has been supported by central bank easing. However, as different countries’ recovery speeds diverge, their monetary policies diverge as well. In the past, when the Federal Reserve has reined in easy money policies, it has often led to market selloffs. It remains to be seen how the world will handle US moves to normalize economic policy.