When the COVID-19 pandemic disrupted semiconductor supply chains and triggered shortages worldwide, it laid bare just how much Japan relies on imports and the risks it entails.

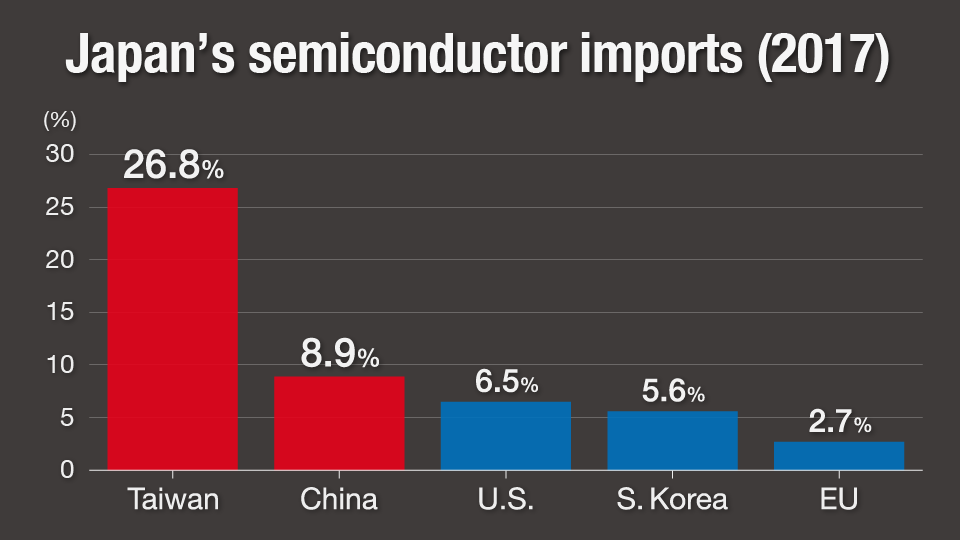

More than 25 percent of the country's chips come from Taiwan; around 10 percent come from China. Government officials and industry leaders have grown concerned about an over-reliance on these sources for parts that are critical to Japan's automotive and electronics industries.

Geopolitical risks expected to rise

The government released a report in June that focuses on the challenges involved in reviving domestic semiconductor production. The basic notion behind the plan is that the era of unlimited globalization is coming to an end and geopolitical risks are expected to grow in the coming decade.

For decades, the production process has been segmented by country. IT firms in the United States design the chips and Taiwan's manufacturing-only "foundries" make them. Japan is still the global leader when it comes to producing equipment to manufacture semiconductors. And this specialization resulted in cheaper products for companies and customers worldwide.

Biden seeks to counter China

Things changed when China expressed its ambition to be a semiconductor production giant. That spooked the US, and the Biden administration is now rushing to strengthen its own supply chain, earmarking $50 billion to persuade domestic and foreign companies to set up shop on American soil. Intel, TSMC (Taiwan Semiconductor Manufacturing Company), Samsung and Hitachi High-Tech are all either looking into it, or have already signed up.

The sight of even Japanese companies planning bases in the US has officials in Tokyo worried. They fear the US-China rivalry could see Japan slip even further behind.

Taiwan giant mulls Japan base

One way they hope to fight back is to entice TSMC, the world's top foundry, to set up a production base in Japan with offers of substantial financial and technical support. The Taiwan giant confirmed in mid-July that it is looking seriously at the idea, and is currently in the due diligence phase.

Japan's new strategy marks a clear departure from past industrial policy. After years of backing deregulation to spur private-sector-led growth, the country is now beginning to focus more on economic national security, supporting both domestic and foreign companies, to secure stable supply chains and keep its businesses running.