The job market

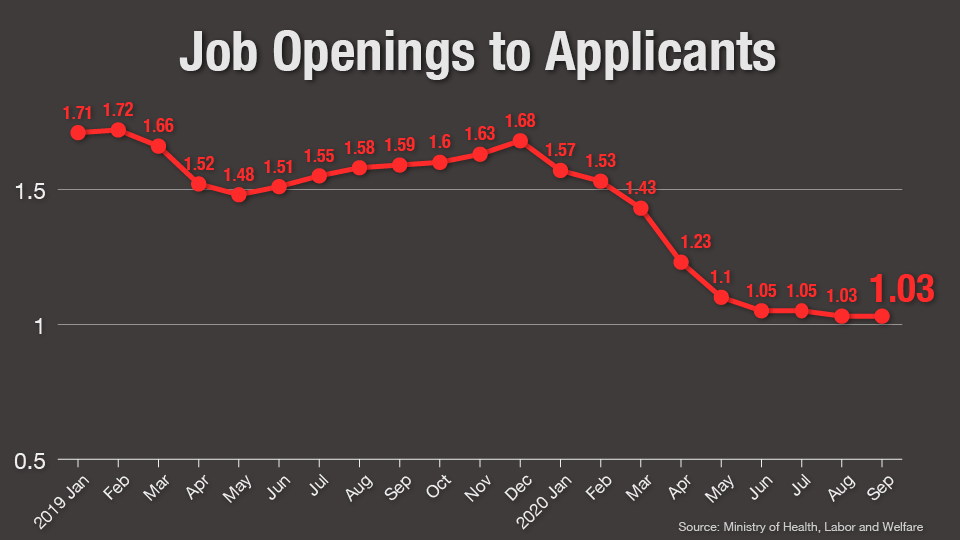

The job market has undergone a sudden change on the back of the coronavirus pandemic. The ratio of active job openings to applicants is treading lower, and may soon fall below 1.0. Japan has struggled with a severe labor shortage in recent times, but companies are now cutting non-regular employees and asking workers to take voluntary retirement.

Many Japanese companies, especially small and medium-size enterprises, have simply decided to call it a day. According to Tokyo Shoko Research, more than 40,000 firms had decided to go out of business as of October -- far outpacing the previous year. Experts believe the job market will continue to worsen slowly throughout next year.

Real Estate

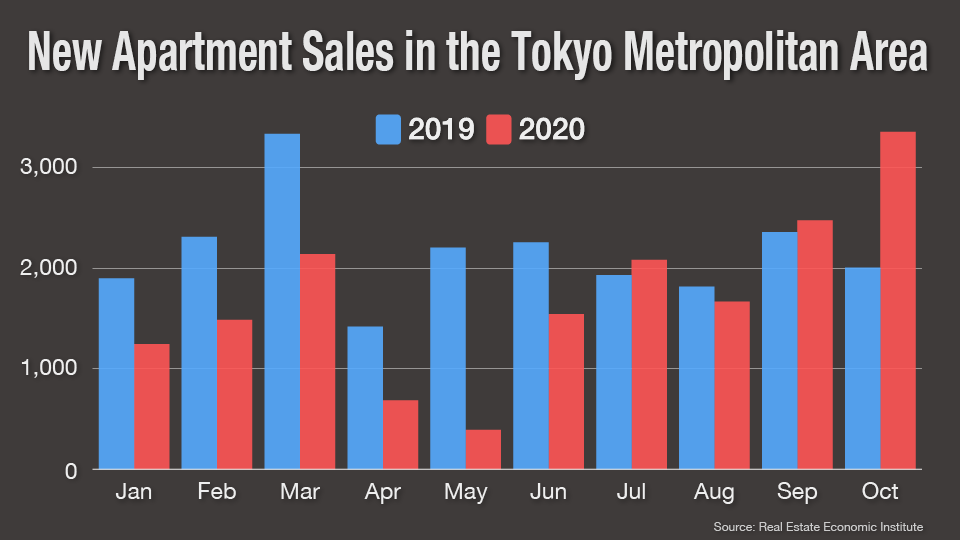

New condominium and apartment sales in the Tokyo Metropolitan area are recovering. A Real Estate Economic Institute survey shows an increase of 67.3 percent in October compared to the same month last year. Real estate agents say demand for new houses and condos is rising, because many people are settling in to the work-from-home lifestyle. The Bank of Japan's easy monetary policy, with ultra-low interest rates, is also helping investors hunting for bargain shopping.

Whether this trend continues next year is unclear. Most housing loan screenings are judged upon a borrower's salary and winter bonus in the previous year -- both of which are expected to broadly shrink this winter. In short, people may have a harder time getting a loan in 2021.

Gross Domestic Product growth

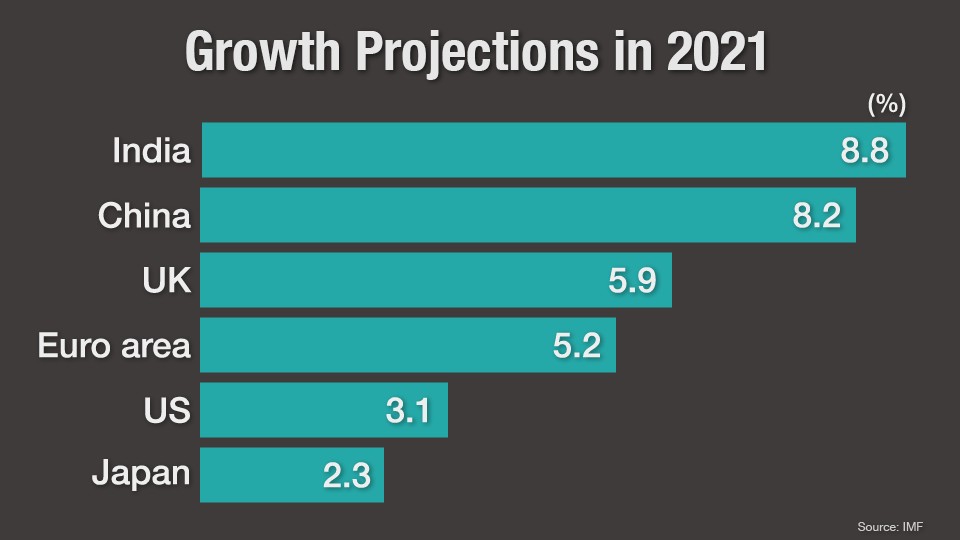

The International Monetary Fund predicts Japan will grow a meagre 2.3 percent next year -- the slowest among developed nations. In comparison, the United States is expected to grow 3.1 percent, and the European area comprising Germany, France, Italy and Spain, 5.2 percent. China is forecast to grow 8.2 percent, and India 8.8 percent.

The global pandemic means things can suddenly change for the worse or better, but Japan clearly needs a fresh growth strategy that not only provides a healthy dose of promise, but also bolsters the country's economic foundations.