City-wide lockdowns and international travel restrictions have decimated demand and dealt a crushing blow to the service sector and most other industries.

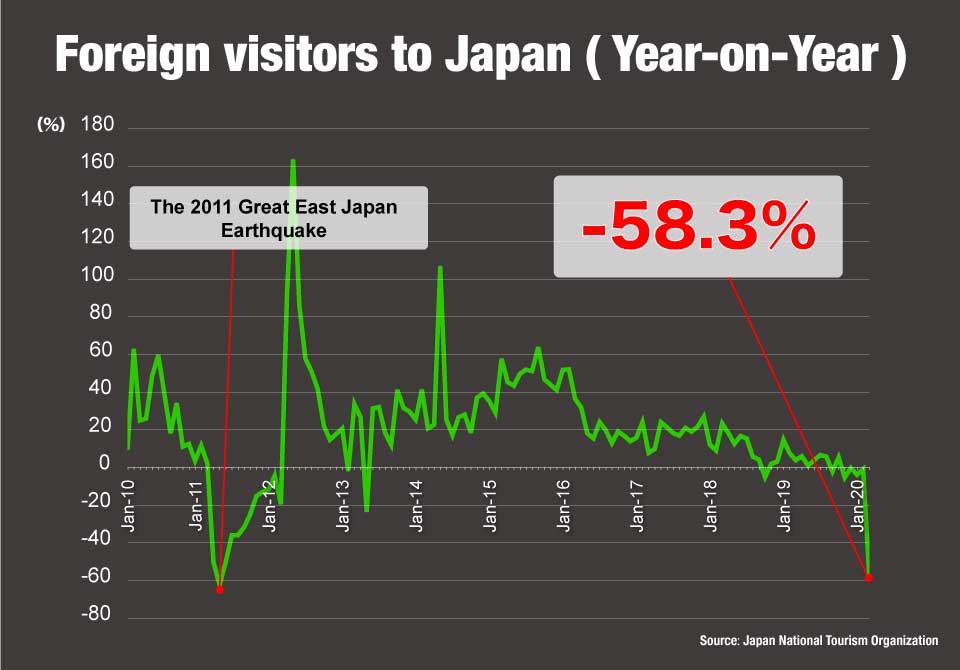

The shock has been particularly tough for Japan's tourism industry, which went from boom to bust virtually overnight. Visitor numbers for February were down from the same month last year by nearly 60 percent -- a record.

In March, sales at one department store plummeted more than 40 percent year-on-year. It was a similar story at many businesses.

For companies in Japan, the timing couldn't have been worse. Japan's fiscal year ends in March. So, too, does the business year for many firms. The impact of the pandemic on their end-of-year book-keeping has been profound.

So dire is the situation that from February to mid-March, private and government-affiliated financial institutions received more than 400,000 inquiries from companies about applying for loans.

In the weeks after the coronavirus emerged in China's Hubei Province, it was the manufacturing industry that suffered. Companies temporarily closed plants throughout China, causing major disruptions to the global supply chain. Soon, shock waves were sweeping through other industries, forcing financial institutions to put together massive stimulus packages to keep cash running through the real economy.

Toyama Kazuhiko, a managing partner of Industrial Growth Platform, has extensive experience in rehabilitating failed businesses. He warns that big companies could now face "a second wave" of damage as sales of durable products dry up.

The auto industry is one of many that could bear witness to Toyama's prediction in the months ahead. Automakers are expected to suspend work at factories in Japan and other parts of Asia and Europe as demand for vehicles plummets. Even Toyota Motor, one of the world's most successful car makers, is bracing for pain. The company has applied to Japanese banks for a new credit line totaling one trillion yen, or more than nine billion dollars.

Banks are also sailing into dangerous waters. Nomura Research Institute executive economist Kiuchi Takahide points out that after the global financial crisis in 2008, Japan's biggest banks started investing more heavily overseas, prompting small and mid-sized firms to turn to smaller regional banks for loans. Kiuchi says it's these banks that will suddenly find they have a mass of bad debts on their books.

In the US, Moody's Analytics chief economist Mark Zandi says one of the biggest problems concerns corporate leverage and debt. He says leverage will become a real issue if the economy continues to deteriorate, forcing corporates to cut their payrolls and investment in order to survive.

Financial accounts show US corporate debt is now 50 percent higher than it was at the onset of the global financial crisis in 2008.

Kiuchi, a former Bank of Japan policymaker, blames excessive monetary easing for causing money to flood the market and spill into high-risk, high-yielding corporate bonds.

Kiuchi says it's now up to central banks to act. He says they have no choice but to maintain market mechanisms. One idea, he says, is the plan by the US Federal Reserve Board to purchase corporate bonds and Commercial Paper.

A senior official at the International Monetary Fund recently pointed out that "pressure on the banking system is growing and higher defaults and debt are imminent."

The time has come for decisive and collective action. Fiscal and financial authorities around the world must confront this escalating crisis as one.