Emphasizing the significance

US president Donald Trump praised the deal, saying "We take a momentous step, one that has never been taken before with China. Together, we are righting the wrongs of the past and delivering a future of economic justice and security for American workers, farmers and families."

Chinese President Xi Jinping also emphasized the positive. He said, "phase one will be good for China, the US and the entire world."

Additional tariffs remain

Tariffs have been a hot-button issue. Following the phase-one agreement, the US plans to cut by half the 15 percent additional tariffs imposed on Chinese imports last September. However, Washington says for the time being it will maintain a 25 percent tariff on 250 billion dollars' worth of Chinese imports. This will be carried over to the next phase of negotiations.

Details of the deal

The "phase one" agreement document released by the US government is nearly 90 pages long and focuses on seven categories.

Expanding Trade

China is to import various US goods and services over the next two years in a total amount that exceeds, by no less than 200 billion dollars, its annual level of imports for those goods and services in 2017.

Agriculture and Seafood-related Provisions

China commits to purchase and import on average at least 40 billion dollars of US food, agricultural, and seafood products annually over the next two years.

Intellectual Property

China is to strengthen protection of corporate secrets and step up regulation of pirated goods. The US says these will help secure a level playing field for its companies and preserve American competitiveness.

Technology Transfer

China will end its long-standing practice of forcing or pressuring foreign companies to transfer their technology to Chinese companies as a condition for obtaining market access.

Currency

China is to refrain from competitive devaluations and targeting of exchange rates, while promoting transparency and providing mechanisms for accountability and enforcement.

Financial Services

China will remove barriers to US providers of a wide range of financial services, including banking, insurance, securities, and credit rating services, among others.

Dispute Resolution

Both countries set forth an arrangement to ensure the effective implementation of the agreement and to allow the parties to resolve disputes in a fair and expeditious manner.

Can it be realized?

Questions remain as to whether these goals can be met.

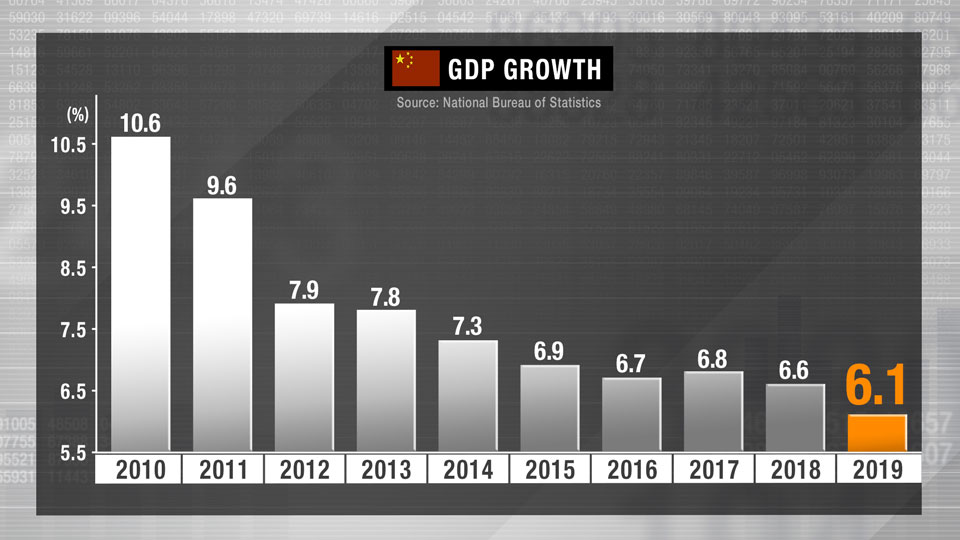

Most economists project China's growth rate, which has been slowing, will this year fall below the key 6% threshold for the first time in three decades. Under these circumstances, it is questionable whether China will be able to sharply increase US imports.

Moreover, purchasing 200 billion dollars more of imports means China must hit a target that's more than 1.5 times the amount in 2017. Some analysts say that's hardly realistic.

Worries between the US and China

If China fails to increase imports as agreed, President Trump may raise tariffs again. But more tariffs could have a negative impact on the US economy.

China faces even more difficult issues in the "phase-two" negotiations. They include a review of the preferential treatment for state-owned firms, which has been a major US concern and has drawn strong opposition from China.

Still a long way to go?

Chiwoong Lee, Chief Economist at Mitsubishi UFJ Morgan Stanley Securities, expects the negotiations to be prolonged.

"We have to imagine that the restrictions by US, not only for the tariffs, may go into other sectors. Because obviously 5G-related companies in China have been restricted in the States. And also the surveillance companies in China are being restricted in the United States as well."

He adds: "It reminds me of the past issue between Japan and US. Japan was being pressured first starting from the home appliances and it went to automobiles, then went on to semiconductors. That similar pattern could happen between the US and China. "

How will the world's two-largest economies move forward? Leaders in both countries are facing a difficult road ahead, and it is not yet clear what direction they will take.