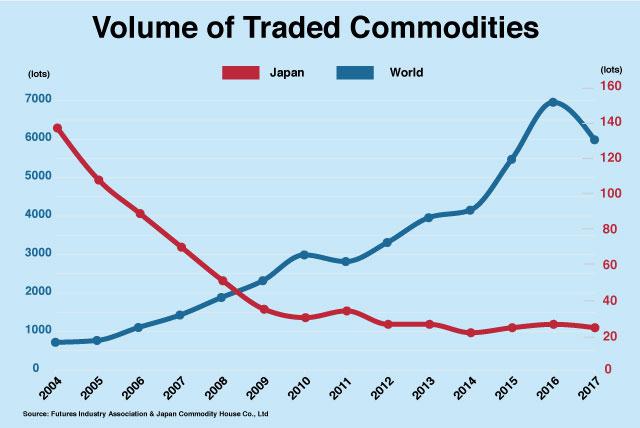

Commodity trading in Japan has shrunk to one-third of what it was a decade ago due to strengthened regulation and lack of effort to keep up with global trends. Meanwhile, operators around the world including CME (Chicago Mercantile Exchange), ICE (Intercontinental Exchange), and the HKEX (Hong Kong Exchange), have been growing. Global commodity trading has expanded more than 3 times in the same period.

The government’s Council for Promotion of Regulatory Reform has been pushing to create an all-in-one bourse. In fact, it was in 2007 that the government first attempted to make an integrated exchange with the aim of making it Asia’s leading financial hub. But back then, many were opposed to the idea, including TOCOM itself and the Ministry of Economy, Trade and Industry.

Recently, TOCOM has reported a third straight year of losses and experts warn it is unlikely the exchange will be able to survive global competition on its own. JPX CEO Akira Kiyota and TOCOM President Takamichi Hamada are currently hammering out the details to finalize the deal, but sources say they have not yet reached an agreement on the issue of who will handle crude oil futures.

Traders who used to work for TOCOM agree it was at one point a leader in commodity trading. Back in 2004, it enjoyed a 20 percent market share and traders would visit the exchange just to learn about commodity trading. Now, TOCOM handles only 1/240th of global commodity trading. It will require much effort for the exchange to make up for the "lost decade", when it lost its place at the top.

Officials at the Financial Services Agency say the integrated bourse has the potential to easily double current trading. JPX’s credibility will help increase both domestic and overseas market participants. Policymakers hope that Japanese trading houses currently using Chicago, Hong Kong, Singapore and Shanghai will return to the Osaka Exchange for derivative trading as it will be easier to operate under a single platform. But analysts say this may not be enough of an incentive. TOCOM offers limited derivative products and Japan lost commodity trading experts to other markets during the "lost decade".

The merge will happen thanks to a strong push from the government. But it will be up to the bourses themselves to make up for the lag and strengthen their capacity to make a comeback on the global arena.