Domestic whisky brands to be ceased

Late November, Kirin revealed plans to end sales of Fuji-sanroku Tarujuku 50 degrees, one of its 5 whisky brands accounting for more than 30 percent of the company's whisky sales. The shipment at the end of March 2019 is set to be the last batch. Suntory also announced in May it would end sales of the Hakushu 12 year old and Hibiki 17 year old whisky.

Impact of rising demand

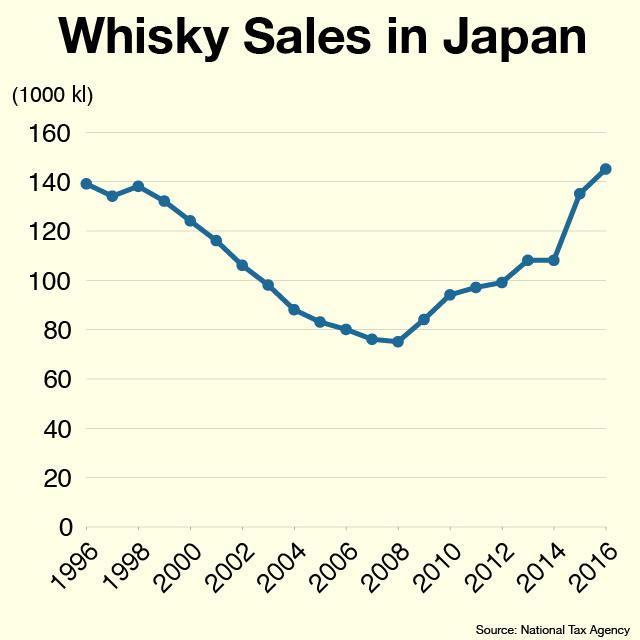

Makers say total shipments of domestic whiskies in Japan have more than doubled over the past decade. That's as Japanese whiskies won international awards. The sales campaign waged by Suntory and other large beverage makers to promote the whisky highball, a drink consisting of whisky and soda, has also boosted the spirit's popularity. The boom, however, has led to a shortage, making it difficult to provide a stable supply of the liquor.

A problem particular to whiskies

Makers say it is not easy to increase the production of whisky. In making whisky, barley or other grains are fermented and distilled. Then, the liquor is left to age in barrels. Depending on the type of barrel and the length of the aging period, a wide variety of aromas and tastes can be developed. Usually, several component whiskies that have undergone varying aging periods are blended to complete a whisky. If the component whisky is 10 years old, that means the process of making it started as many years ago. Even if whiskies are high in demand, makers cannot immediately boost the production of component whiskies.

Why were the makers unprepared?

But why couldn't the companies foresee whisky's popularity today? The whisky boom came after a 2-decade-long sales slump, which forced distillers to reduce production. This is why they are now short on component whiskies made over 10 years ago. Ironically, it was the whisky's major comeback that brought the problem to the fore.

To meet the surging demand, makers have taken measures like installing additional stills or building warehouses to store barrels, but their effects will not be felt for many years.

High prices attract foreign buyers

Meanwhile, prices of aged whiskies are soaring. They are often sold for more than 10 times their suggested retail price on online shopping sites. For example, at an auction in Hong Kong 3 years ago, a bottle of 52-year-old Japanese whisky fetched about US$100,000.

Japanese whiskies are highly acclaimed overseas and some foreign buyers are said to be buying and selling them abroad to make profits.

How can sales be resumed?

To resume the sale of the brands that have been discontinued, it is necessary to secure enough component whiskies to meet demand, but Suntory says it cannot say when it will be able to do so.

Beverage makers are taking measures such as lowering output of some brands or launching products which take less time to mature. But a recovery in supply will require patience.