Foxconn, the world's largest contract manufacturing company, is better known for producing iPhones. Now, it wants to apply the process used to make smartphones to the development of next-generation vehicles.

MIH, a Foxconn-led consortium, unveiled its first prototype EV at Japan's Mobility Show, formerly known as Tokyo Motor Show, in October.

Foxconn-led alliance

The concept of this compact 3-seater is "BYOV" for "build your own vehicle." Its design allows flexible customization to meet the needs of different clients and business models; that means size, shape and parts can all be seamlessly changed. Corporate customers can even package their creations under their own brand.

The consortium has about 2,700 member companies from all over the world, contributing everything from autonomous driving technology, to data retrieving software and EV infrastructure. Many of these firms have no experience in the auto industry.

Experts say that is not surprising – EVs are simpler to make than conventional vehicles; fewer moving parts like radiators, fuel injectors, and gas tanks. And just like smartphones, they say the future of the industry will be defined by software, not hardware.

One alliance member is Tier 4, which develops platforms for autonomous driving. Company executive Miyoshi Ko says the key role played by software will reshape the industry.

"We believe EVs and software-defined vehicles will lead to a more open ecosystem and standardization in the industry," says Ko. "MIH is one of the leaders in trying to pursue this open ecosystem."

Open ecosystems

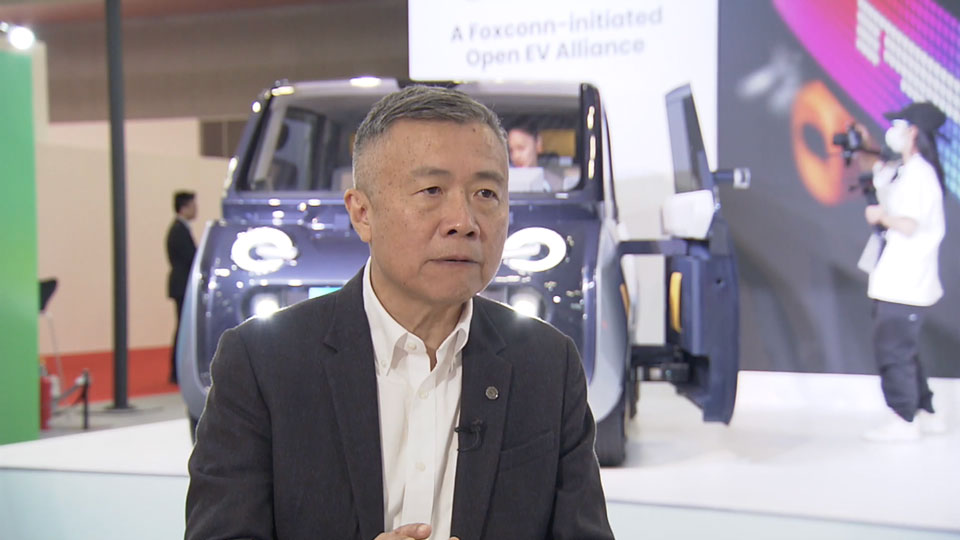

The CEO of MIH Consortium is Jack Cheng, co-founder of MIO, one of China's largest EV makers. He says the push to create an open ecosystem will lead to major disruption of the industry.

"Car companies are very closed ... they look to protect everything within their domain. We'll open it up and then we'll bring in more of the developers."

Cheng says just as smartphone software gets updated every 3 to 6 months, consumers will also be looking for the same upgrades in future cars.

Cheng says standardized components mean there will be less profit in making hardware ... cars. He says future revenues will come from selling apps that enhance the driving experience.

For that reason, the consortium is jockeying to be the platform of EV software, like iOS for iPhones or android for other smartphones.

MIH Consortium faces challenges

So, can they succeed? Fukao Sanshiro, Senior Fellow of Itochu Research Institute, says one of the biggest advantages for the consortium is the company leading it.

"Foxconn supplies devices for global companies such as Apple, so they have a good track record for procuring components, especially semiconductors."

Semiconductors are key components for EVs and self-driving cars. Next-generation vehicles will need a vast number of sensors – and secure connections to the Internet.

But Fukao also points to some challenges.

One is that, unlike smartphones, cars require high levels of safety technology. For that reason, he says the alliance will need to partner with an established automaker to help it clear government safety regulations.

Fukao says if this among other challenges can be overcome, the consortium is primed to shake up the auto industry.