The consumption tax hike and ending deflation

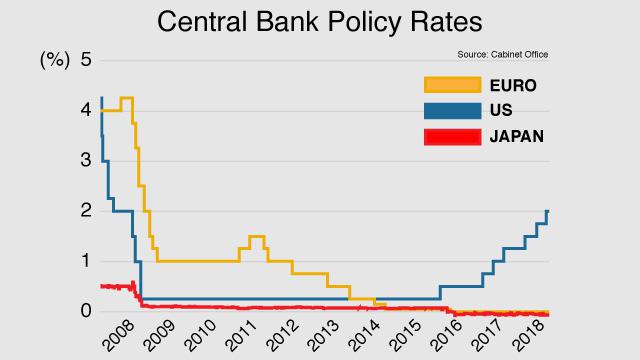

Abe reiterated on Monday that he will go on with his promised consumption tax hike, raising the rate from the current 8 percent to 10 percent in October of 2019. The increase had already been postponed twice. In order to raise the rate, he needs to be sure that the economy is resilient enough to handle a bigger tax burden. However, although the Bank of Japan has been continuing its aggressive monetary easing in order to support the economy, the BOJ is unlikely to reach its 2% inflation target anytime soon. In fact, this spring the central bank scrapped the inflation target date of fiscal 2019 on the back of sluggish price growth. The bank had already postponed its timeframe 6 times.

Abe has said that the BOJ’s easy money policy should not continue forever. But with a crucial national election coming in 2019, many experts doubt he is ready to approve an exit policy. So the question is when should the policy be ended? It remains to be seen if Abe will be able to declare an end to deflation before the consumption tax hike.

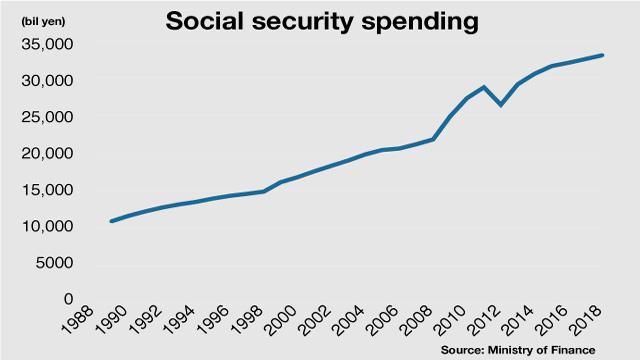

Tackling ballooning social security costs and restoring fiscal health

Japan’s social security costs are rising on the back of an aging population. The Abe government has pushed back its target date of achieving a primary balance surplus from 2020 to 2025. The country’s fiscal consolidation is stalled. Even if the consumption tax rates are increased next year, half of the revenue will go to providing free daycare for children and higher education.

What’s more, policymakers don’t want the tax hike to bring on another economic recession, so they are planning more tax incentives for people buying houses and cars.

The government is also considering giving out monetary points to consumers who purchase goods at small stores with credit cards. So it's unclear to what extent the country will be able to shrink its national debt.

Rebuilding the G20

Japan will host the Group of 20 Summit next year. It comes at a crucial time, with intensifying trade tensions threatening the global economy. There are growing concerns about a lack of international coordination when it's needed the most.

The G20 was reinvented during the global financial crisis a decade ago. Developing and emerging countries worked together to save the world economy. But now, a dispute between 2 crucial members -- the US and China -- could have a negative effect.

Japan faces the question of whether it should seek another form of international coordination, or make the G20 work. Some experts say that no international effort will be meaningful without the US and China. But others disagree. For example, the CPTPP, or TPP11, which excludes the US, may not be as effective as the original US-inclusive TPP. Still, the 11 member nations represent more than 13 percent of the global economy, and the pact slashes tariffs and protects intellectual property rights.

Amid the swirling economic issues, Abe seems to be more interested in cementing his legacy by revising the country’s constitution. But he has other work to do. After all, his signature policy, Abenomics, is what earned him the public's support. He may easily lose it if he fails to complete what he originally promised to achieve.