Under the controls, exporters of items relating to gallium and germanium will be required to file an application with authorities, specifying the end-users and how the materials will be used. The application must be vetted and approved before the exporter can ship the products. Violators will face punishment.

The Chinese government says the move is meant to safeguard national security and interests. But the controls appear to be in response to the US and its allies ratcheting up pressure on China's high-tech industries.

Rare metals

Gallium is extracted as a byproduct from processing aluminum ore. The rare metal is a component in LEDs, mobile phones, LCD screens, and semiconductors.

Gallium nitride is among the restricted materials that are in high demand. It is used to make semiconductors that power electric vehicles.

According to the US Geological Survey, 550 tons of gallium was produced in the world last year, with China producing 540 tons. That is about 98%.

Germanium is used to make optical fiber, solar cells, and semiconductors.

The US institute says China accounts for 41% of the world's reserves as of 2016, ranking second after the US.

Japan keeping a close watch on the situation

Gallium and germanium are widely used in Japan as materials for semiconductors. The Ministry of Economy, Trade and Industry is closely monitoring the impact of restrictions, and is communicating with domestic manufacturers who produce them.

Gallium is used as a material for semiconductors and is leveraged in a wide range of applications, including mobile phones, LEDs and LCDs. According to data released by Japan Organization for Metals and Energy Security, Japan imported 94 tons of gallium, out of 165 tons supplied domestically in 2017.

China supplied the highest share of imports at 69%, followed by Russia with 6%, and then the US, Taiwan and Germany with 5% respectively.

Germanium is used as a material for semiconductor substrate wafers and optical fiber — almost all of it imported. Of this imported supply, 4.6 tons is used in wafers and other products, according to 2020 data. The highest share comes from China with 71%, followed by the US with 22%.

As Japan relies heavily on China, the industry ministry is keeping a close watch on Beijing's export controls. The ministry is also looking at ways to promote domestic recycling and helping to secure import sources outside of China.

Companies see no short-term impact, but concerns grow

Companies in Japan are waiting to see how Beijing will enforce the new measures.

Mitsubishi Chemical, a major chemical manufacturer, uses gallium in the production of semiconductor substrates. The company says it has secured a certain level of inventories in Japan and does not expect any impact in the short term. However, as the medium- to long-term outlook is unclear, Mitsubishi officials say China's export restrictions are a focus of attention.

A subsidiary of Dowa Holdings distributes high-purity gallium, half of it sourced from imports — mainly from China — and the other half from recycled materials. The company supplies gallium to domestic semiconductor manufacturers and others, and says it is collecting information on the impact of export controls.

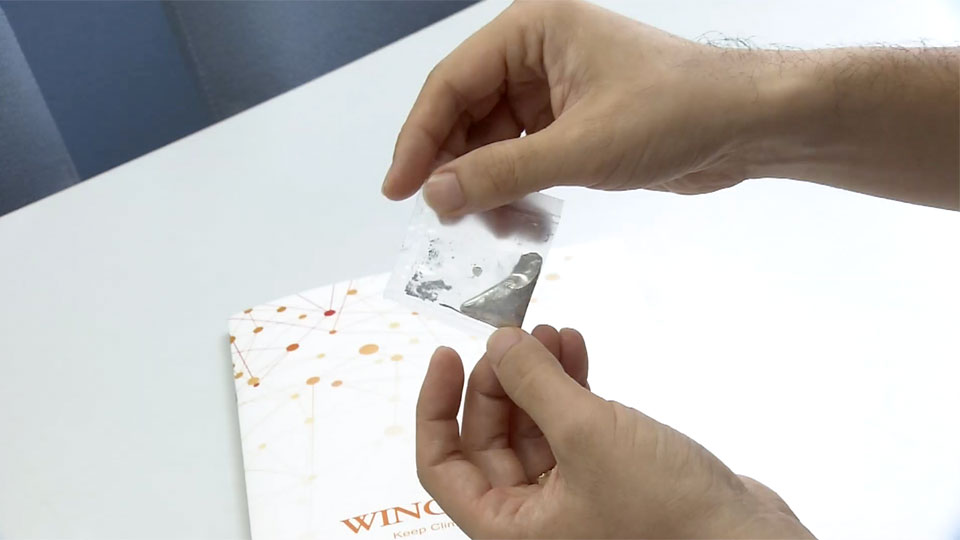

Trading company Wing says it is worried, describing gallium as their "lifeline." Gallium-related products account for 60-70% of the company's approximately one billion yen in annual sales.

"It is not at all clear how strictly the Chinese government will control it and how long it will take to get permission," says Wing official Uchi Wakaaki.

"From August, I think there will be a lot of confusion in various industries, but we can only hope that the regulations will be loosened," said Uchi, adding that controls on major raw materials would lead to major disruption in the global supply chain.

Japan's Chief Cabinet Secretary Matsuno Hirokazu spoke about China's measures at a regular news conference.

Matsuno said China's measures won't immediately affect Japan's supply chain, but could affect some areas in the future. He said Japan will monitor the situation in light of international rules such as the WTO. Matsuno made clear if unfair measures are taken against Japan, the country will respond appropriately based on the rules.

President Xi Jinping made no secret in recent years of his desire to make the international supply chain more dependent on China, indicating it would allow his country to both deter and counterattack against moves to block access to critical materials.

In 2020, the country enacted the Export Control Law, which strengthens export restrictions on products related to national security. It is believed that the move is aimed at using resources that foreign countries rely on China as "weapons" with the US in mind.

At a news conference on July 3, when Beijing announced the restriction on rare metals, Beijing's commerce ministry's spokesperson said, "The purpose is to better fulfill international obligations by protecting national security." He said the measure does not target any specific country.

However, Beijing has strongly protested Washington's ongoing trade pressure, including restrictions sales of advanced semiconductors to China. The spokesperson said US actions not only undermine the legitimate interests of Chinese companies but also damage the interests of many other countries, accusing the US for "artificially splitting the global semiconductor market."

The US tightened restrictions on semiconductor exports to China in October, 2022. Japan followed suit with stricter export controls on chip-making equipment on July 23rd.

Meanwhile, an English-language newspaper affiliated with the Chinese government quoted a former vice minister of commerce as saying that the export restrictions on rare metals are "just the beginning of a counterattack." The newspaper said that China will further strengthen its countermeasures if restrictions on high-tech fields targeting China are tightened.

Expert: China and US compete for supremacy

China's export curbs are "retaliation for loss of face", says Professor Suzuki Kazuto, an expert on international political economy and economic security at the University of Tokyo Graduate School of Public Policy.

Suzuki says China's latest action could have a negative impact on concerned companies but believes the impact will be short-term and will not change the global industrial structure. He says buyers will eventually find metal suppliers in other countries.

Suzuki said although China is at risk of losing market share in rare metals, Beijing wanted to show it would not yield to the United States and Europe.

On the other hand, he said political interests were also motivating US sanctions. Despite the risk of American companies losing access to China's huge market, he said the Biden administration is trying to appease hardliners in the country ahead of next year's presidential election.

Suzuki says people will misunderstand the situation if they look at it only in terms of economic rationality, adding "it is no longer possible to separate the economy and politics."