Hot topic: Semiconductors

Economic security was on top of the agenda for world leaders at May's Group of Seven summit in Hiroshima.

A joint statement they released on the issue reads: "We will enhance resilient supply chains through partnerships around the world, especially for critical goods such as critical minerals, semiconductors and batteries."

Global supply chains have been tested by rivalry between the United States and China, as well as the COVID-19 pandemic, and Russia's war against Ukraine. Those factors have caused supply shortages that have harmed industry and consumers.

Japan's "Silicon Island"

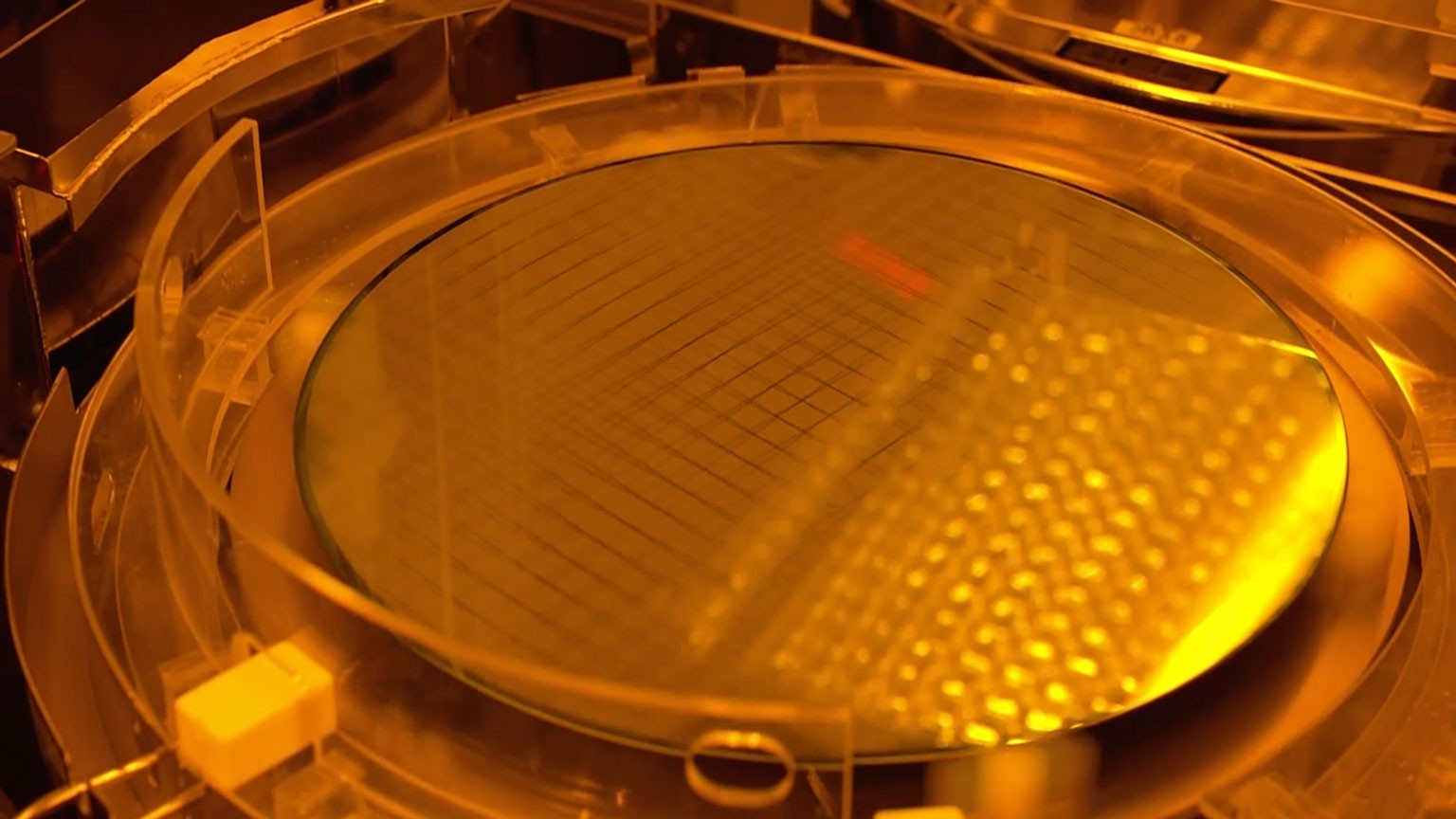

Kyushu is sometimes known as Japan's "Silicon Island." It is home to Kumamoto Prefecture where the foundations are being laid for the high-tech revival.

The world's largest contract chipmaker, Taiwan Semiconductor Manufacturing Company, is partnering with Sony Group and others to build a factory in Kumamoto. The Japanese government is providing a subsidy of almost $3.5 billion to cover half the construction costs.

Capital investment in the industry is picking up. Sony Group has announced a plan to build a second semiconductor plant in the prefecture, with the aim of starting output in 2025 or later.

Mitsubishi Electric is also constructing a power semiconductor plant in Kumamoto, with production scheduled to begin in April 2026. The firm has plans to expand at another plant, with a combined investment of approximately 100 billion yen, or about $710 million.

Another Japanese firm, Tokyo Electron, is constructing a new building for chipmaking equipment development at a cost of approximately 30 billion yen, or about $214 million. The facility is scheduled for completion in the fall of next year.

Kyushu is rich in water resources, which are essential for the production of semiconductors. Significant investments are being made not just in Kumamoto, but also in Fukuoka, Saga, and Nagasaki prefectures.

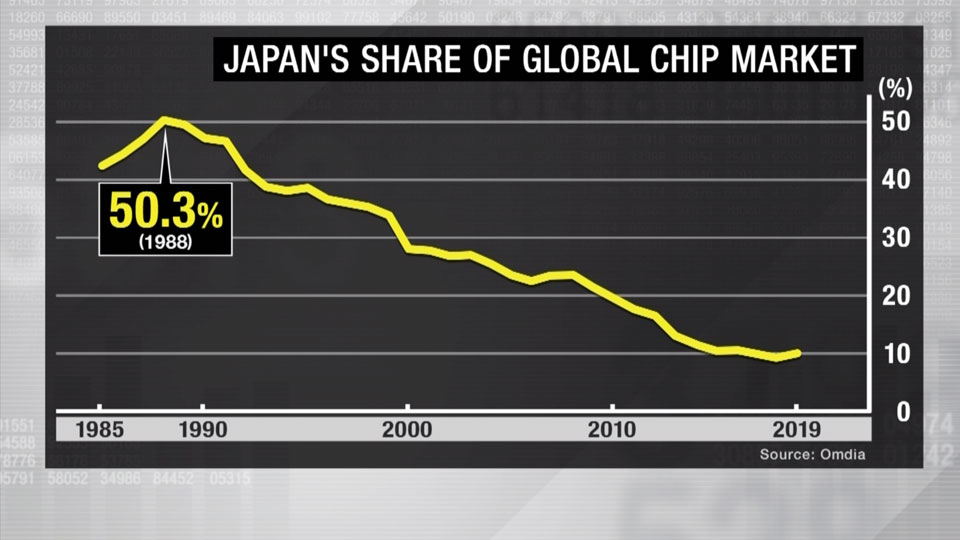

Japan's era of market domination

Japan once dominated the semiconductor industry with about half of the world market share in the 1980s. But it lost ground during the 1990s to South Korea and Taiwan.

A 1980s trade agreement on semiconductors between Japan and the US marked a turning point. Exports had become a source of trade friction between the two countries, and Japan was obliged to import semiconductors made overseas.

During this period, Korean and Taiwanese manufacturers gained strength, and the Japanese semiconductor industry became less competitive. Japanese firms were unable to keep up amid a shift in business models.

"Japan lost its game in semiconductor investment against Taiwan, South Korea and China," says Mitsubishi UFJ Research and Consulting senior manager Maitani Masato.

"If you learn from that experience, the industry definitely needs government support to build facilities and invest in technology and human resources."

The next generation

Another driver behind Japan's chip revival is a joint venture called Rapidus that is backed by the government to the tune of 330 billion yen, or about $2.3 billion. It involves some of Japan's best-known firms including Toyota Motor, SoftBank and NEC.

Rapidus plans to build a factory in Hokkaido with prototype line output by April 2025. It aims to mass-produce cutting-edge 2-nanometer semiconductors by 2027 — chips that are indispensable for next-generation fields such as artificial intelligence and self-driving vehicles, and which have yet to be put into practical use anywhere in the world.

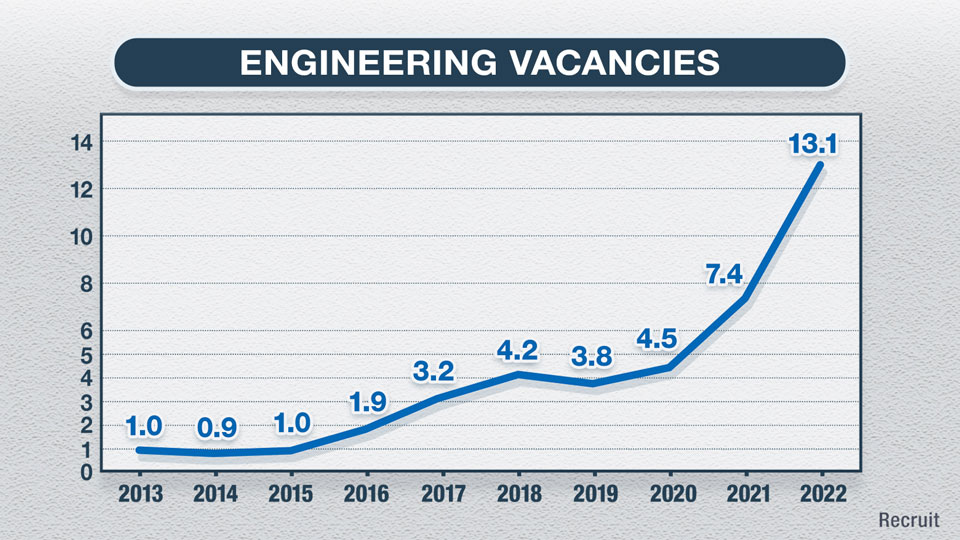

Growing demand for skilled workers

The rush to build semiconductor factories across Japan requires more skilled workers. An expert at employment services company Recruit says the number of jobs for engineers in the semiconductor field has increased 13-fold in a decade.

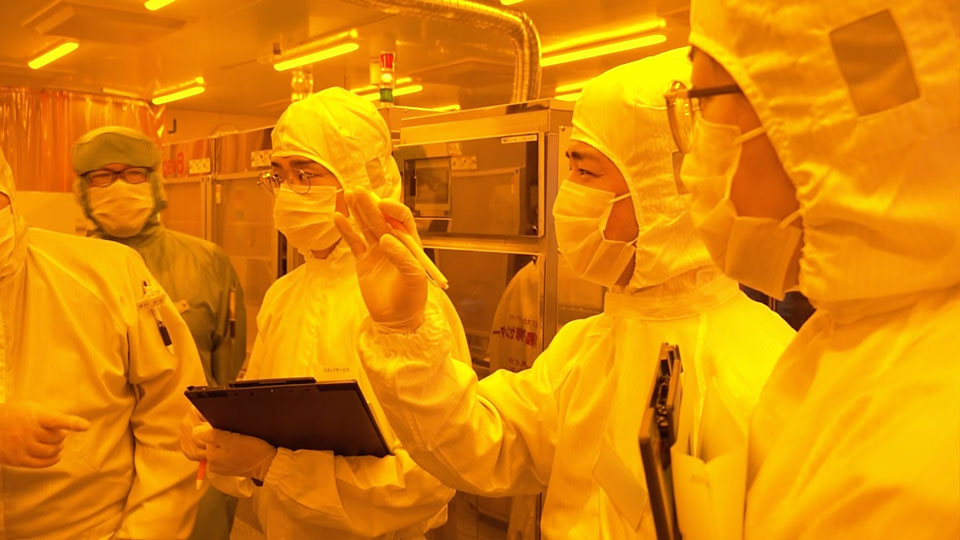

Training opportunities open up

Universities and technical colleges are teaching student engineers the specialized knowledge that's required. The private sector is also getting involved with hands-on training.

Tokyo-based company Ask Index has set up a learning center in Kumamoto Prefecture that has attracted strong interest from both employers and prospective students.

Staff at the facility teach basic semiconductor manufacturing techniques. As more people get involved in the industry revival, the center expects to revise its student target numbers from 100 to 1000 per year.

"We hope to nurture many people who can lead Japan's semiconductor industry into the future," says Ask Index president Tanaka Reisuke.

Despite the efforts to produce a ready workforce, industry associations are predicting personnel shortages of about a thousand workers — each year — for the next decade.

The high-tech comeback needs people to make it happen — to ensure Japan's prosperity and economic security.