1.More Foreign Visitors

I was surprised to hear that a potato-producing town on the northern island of Hokkaido saw the biggest rise in both commercial and residential land prices. In Kutchan, a piece of land occupied by a small bookshop surged over 45%. A plot of land in a housing area surrounded by mountains and farms rose 33%.

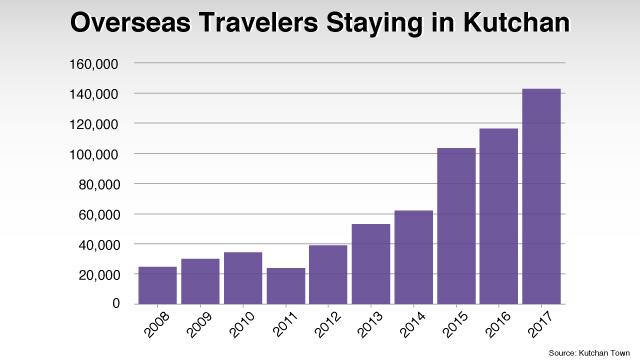

That's because the Niseko mountain range surrounding the town has become a popular destination for skiers and snowboarders from many countries. They've heard that ski slopes in the area have the world's finest powder snow. The number of overseas visitors that stayed in the town in 2017 has more than doubled in 5 years.

Kutchan is scheduled to host a meeting of G20 tourism ministers next year. Construction of shops and condos targeting foreign visitors is booming. There's also big demand for housing from workers at the ski resorts.

The price of a residential plot of land in Ichinomiya, a town about 100 kilometers east of Tokyo, rose 6% from last year. The town has a beach that will be a surfing venue in the 2020 Olympics. Word of the area's powerful waves has spread among surfers worldwide. They're now renting apartments in Ichinomiya.

A remote island in the Seto Inland Sea has seen residential land prices rise for the first time in 25 years. Getting to Naoshima from Tokyo means taking a plane, a bus, AND a ferry. Total travel time is at least 3 hours... not including transfer times. But Naoshima attracts many lovers of modern art. The island is scattered with works by world-famous artists and architects. It's also the site of an international contemporary art festival held every 3 years. The next one starts in April 2019.

2. Steady Economic Growth

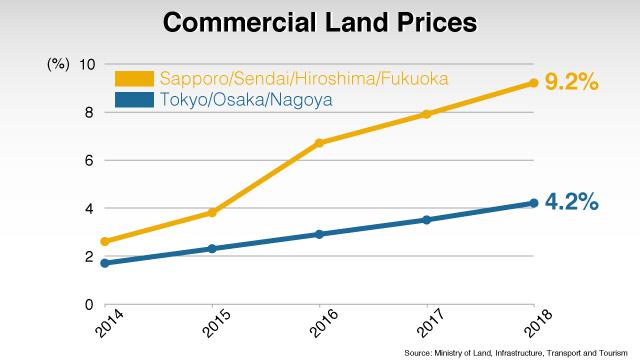

Another factor is brisk demand for office space. As Japan's economy continues to recover, companies are hiring more people ... and looking for bigger offices. Vacancy rates are lower, despite higher rents. That's driven up commercial land prices. The combined average in the three major cities of Tokyo, Osaka, and Nagoya has risen 4.2 percent. The four regional hub cities of Sapporo, Sendai, Hiroshima, and Fukuoka saw prices rise 9.2 percent.

3. Surge in Online Shopping

More people are shopping online, and that's led to increased demand for large distribution centers. Logistics companies are investing in facilities in rural areas with lots of industrial land. Areas with easy access to major highways and ports are seeing a rise in prices. One plot of land in Saga Prefecture rose 14%, for example. It's in Tosu, an area that's close to 3 major highways and known as a key logistics hub for the southwestern island of Kyushu.

Tomohiko Sawayanagi, head of the Hotels & Hospitality Group at JLL Japan, sees the rise in land prices as a relatively healthy trend. He says it's due to increasing demand for buildings, houses, and hotels... and isn't being pushed up by speculative investment like during the bubble era.

Sawayanagi expects that prices will continue to rise after the 2020 Olympics, because foreign tourists won't stop coming to Japan after the games. But he thinks that gaps will widen between areas where land prices are recovering and those where they continue to fall.