December meeting recap

The Fed reinforced its fight against inflation at its December 13-14 policy meeting, raising its key rate by half a percentage point, or 50 basis points. The federal funds target rate is now in a range of 4.25% to 4.5%, the highest in 15 years.

Change in easing pace

The move signaled a step down from the 0.75 percentage point pace seen over the previous four meetings. Fed Chair Jerome Powell said of the change, "The inflation data received so far for October and November show a welcome reduction in the monthly pace of price increases." He further explained, "In light of the cumulative tightening of monetary policy and the lags with which monetary policy affects economic activity and inflation, the Committee decided to raise interest rates by 50 basis points."

Policymakers forecast higher rates for a longer period

The Fed's half-point rate increase was largely in line with market expectations. What did come as a surprise for many investors was the central bank's rate outlook. Policymakers projected a median of 5.1% as the terminal rate of 2023. That means they see a target range of 5% to 5.25% at the end of next year. This forecast is higher than the previous one made in September, at 4.6%. Market participants had been placing their bets according to the last outlook: with hikes until the upper limit of the range hit 5%, then a change in course, with rate cuts toward the end of the year.

For 2024, policymakers see the terminal rate falling to 4.1%, also a higher level than previously indicated. The September projection was 3.9%.

Powell reinforced the strategy of maintaining high rates to tame surging prices. "The historical record cautions strongly against prematurely loosening policy. We will stay the course, until the job is done."

Implications for global economy

What does the outcome of the December meeting mean? Former Bank of Japan policymaker Kiuchi Takahide says it signals a "turning point" at the Fed. "As it takes time for monetary policy to affect the economy and prices, raising rates aggressively on the premise of a strong economy poses the risk of a downturn. The Fed is cautious about overkill."

Dollar to weaken

This "turning point" may affect currencies. In 2022, the dollar strengthened because the Fed's contractionary policy meant less supply of the greenback. Kiuchi thinks this trend might be reversed if the Fed is nearing the end of its tightening cycle.

He adds, "The dollar may drastically weaken if this coincides with a change in policy from the Biden administration." Kiuchi reasons Biden may start favoring a weaker greenback because it may have gotten too strong. "The dollar's value against major currencies has hit the same level as seen before the 1985 Plaza Accord, when countries agreed to intervene in the currency market in order to depreciate the dollar." Such a strong dollar, he says, would not be good for American export companies. "Biden will be up for reelection in two years, so he needs to expand his support base to beyond just liberals. In order to do so, he will want to strengthen the US economy. That means helping companies by pulling back the excessive dollar strength."

Asia to outperform

The December results may also indicate a decline of capital outflow from other countries. Money tends to go where investments yield higher returns, which typically means countries with higher rates. With the Fed making drastic increases in its key rate in 2022, other countries have been losing capital. Emerging countries have been particularly hard hit because investors tend to pull their money out of higher-risk assets first. Shirai Sayuri, another former BOJ policymaker, notes, "US rates are close to their peak. That, for emerging economies, means the large-scale capital outflows are unlikely to continue."

In addition, emerging economies in Asia may expand in 2023. Shirai says, "Asia will likely enjoy the strongest economic growth in the world next year. The region has relatively healthy fundamentals. In addition, Asian countries have had milder inflation compared to the rest of the world, so they haven't had to tighten monetary policy as much."

In fact, given the situation, Shirai thinks Asia may even see capital return to the region as the US and Euro-region economies slump.

However, she says one superpower poses a risk to this scenario of Asia outperforming. "China's economy is not doing well. There's a chance that may lead to a stagnation in trade, which will hit the whole of Asia."

Economic indicators unclear

The Fed's coming moves will have widespread impact on the global economy. However, the Fed's outlook may not be set in stone. Kiuchi warns, "The Federal Reserve doesn't have that strong a view on future monetary policy, as it will all be dependent on future economic data. There's still a lot of uncertainty."

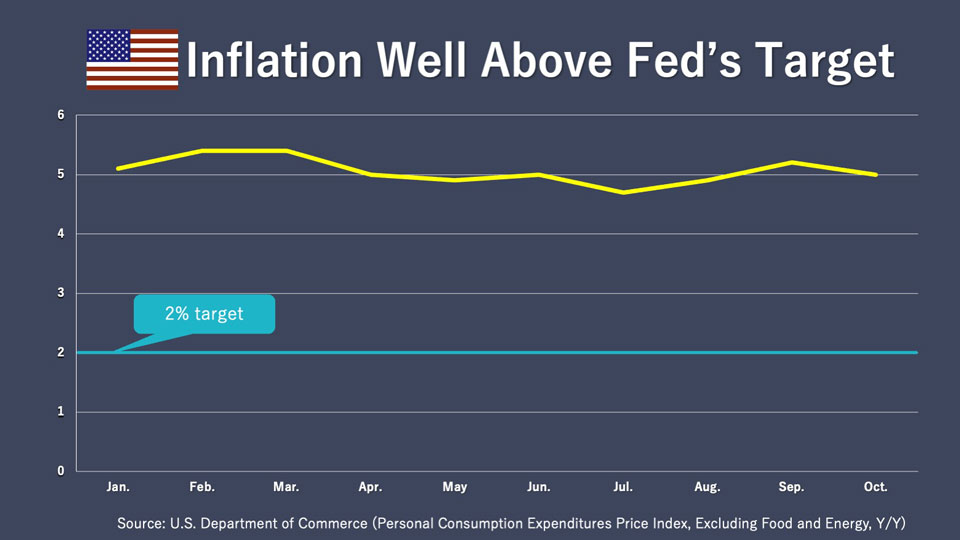

What data does the Fed look at when deciding policy? Obviously, there's inflation; the Fed's hikes are aimed at taming rampant prices. The core PCE (personal consumption expenditures price index excluding food and energy), which the central bank uses as an indicator of inflation, has come off its peak but is still far above the Fed's 2% target.

There are many more indicators to gauge the state of the US economy, and they paint a mixed picture. For example, the PMI (purchasing managers index), which surveys how businesses in the manufacturing and services sectors feel about the economy, has eased. In fact, it's now below the 50 threshold, signaling a contractionary mood. Employment data, on the other hand, is strong: the unemployment rate is near a 50-year low, while job gains and wage growth have been robust.

Fed should not focus on jobs data

If Powell's news conference after the December meeting is any indication, the Fed is focusing on jobs. The word "employment" came up 27 times!

However, Kiuchi thinks the central bank shouldn't base its decision too heavily on the strength of the jobs market. He notes, "The labor market is still impacted by the coronavirus pandemic and does not accurately portray the current state of the economy." Workers, he thinks, want to be hired in industries and by companies that come out as winners in the post-pandemic world, and are taking their time to assess the situation. That is restricting the labor supply and is leading to a jump in wages. Companies, seeing the worker shortage, are desperately trying to hire despite not clearly knowing the industrial structure of the economy after COVID, Kiuchi believes. This anomaly, he says, could skew a typically reliable indicator. "Even if the economy weakens, there could still be a labor shortage and strong jobs data. The Fed runs the risk of making the wrong decision by placing too much weight on employment figures."

Possible ramifications of Fed missteps

With the data perhaps not accurately portraying the state of the US economy, Fed policymakers will have difficulty knowing when to stop rate hikes.

Too much tightening risks recession

In fact, Kiuchi thinks the Fed may have already gone too far with rate increases, saying, "Except for the jobs market, the US economy overall is losing steam."

Shirai is more optimistic on the economy, noting, "The US is doing very well. Wages are rising and consumption is strong." However, she also fears the consequences of too many hikes. "If high interest rates are maintained, the US economy may see negative growth for a quarter or two. I put the chances of that happening at 30-40%."

Not enough quantitative tightening may destabilize financial markets

If the US falls into recession, Fed policymakers will likely lean toward putting a stop to tightening, or even easing. Those moves, too, could have negative repercussions. To learn how requires a review of quantitative tightening, or QT.

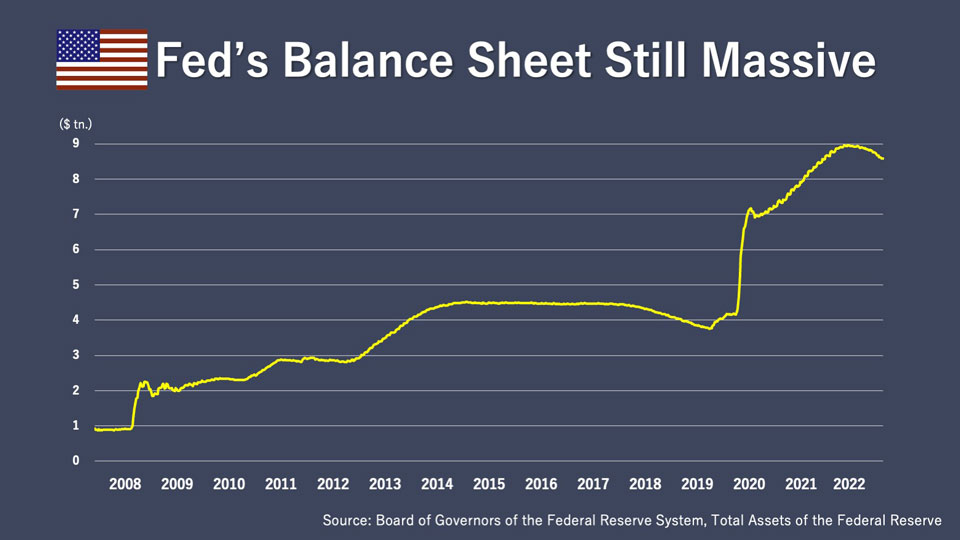

In addition to raising interest rates, the Fed has also been tightening policy by shrinking its massive balance sheet. The central bank's asset holdings had ballooned to nearly 9 trillion dollars during the pandemic as it purchased bonds and other assets in order to support the economy. The extra liquidity helped prop up asset prices, but now, in the era of too-high inflation, the Fed wants to do the opposite. That's why the central bank has been reducing its asset holdings.

However, Shirai points out that the Fed's balance sheet is still too big. "There's a possibility that the Fed will end its tightening process without asset prices correcting sufficiently. The Fed has expanded its balance sheet in such a way that the market still has too much liquidity." She adds, "There's no way of knowing how long the Fed can continue QT, or to what level it can shrink its balance sheet."

This may be a problem because the extra liquidity may have caused bubbles. Experts say numerous assets, such as real estate and low-credit bonds, are overpriced. Shirai is concerned that such bubbles will remain if QT is dialed back without a sufficient reduction in the Fed's assets, and will be a long-term risk going forward. Specifically, she believes the problem may be realized in under-regulated financial institutions. "Banks around the world were regulated in the aftermath of the global financial crisis, so they have sufficient resources. However, nonbank financial institutions did not go through the same rigorous process. As a result, such firms are invested in a wide variety of risky assets."

Rocky road ahead with hazy visibility

The Fed faces a rocky road ahead: on one side, there's the risk of too much tightening causing a recession, while on the other, not enough might lead to unstable financial conditions in the longer term. What's more, the way forward is hard to see: US economic data is mixed, and may inaccurately portray the state of the economy. If policymakers make one misstep, the repercussions for the global economy may be catastrophic.