Looking back on September 22

September 22, the day of the government's currency intervention, started out with all eyes on the Bank of Japan. The US Federal Reserve had just raised its key interest rate by 0.75 percentage points, and released a projection on future hikes that was more aggressive than the version released three months earlier.

It was anticipated the Swiss National Bank would pull its key rate into the positive, while the BOJ would not change its ultra-loose policy and be left as the only country with negative interest rates.

Not only did both of those things happen, but BOJ Governor Kuroda Haruhiko reiterated his strong commitment to easing, saying at his news conference following the policy meeting, "The Bank of Japan will not raise rates for the foreseeable future. Rather, we will further loosen policy if needed."

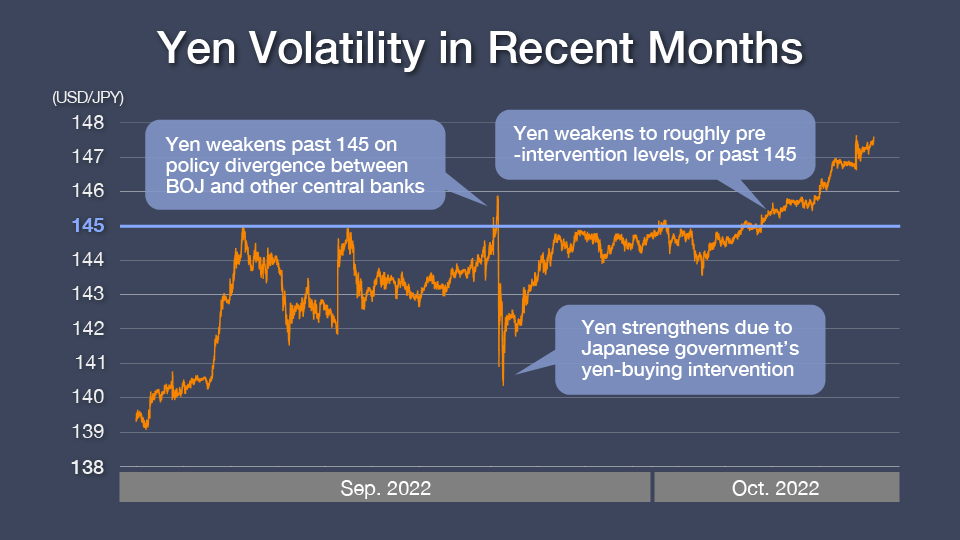

With the widening monetary policy divergence highlighted between Japan and other major central banks, the yen slid further; the Japanese currency had, up to that point, already lost about 20% of its value in 2022 against the dollar as many central banks had tightened policy earlier in the year. The yen lost ground against the dollar past 145, a threshold not crossed since 1998, as Kuroda continued his news conference.

Then, the dollar-yen pair suddenly reversed course: going from 145 to 140. Finance Ministry Vice Minster Kanda Masato revealed soon after that Japan had intervened by buying the yen for the first time since 1998, clarifying, "The government has just taken decisive action."

Japan spent approximately 2.84 trillion yen, or 19.6 billion dollars, intervening in the currency markets from August 30 to September 28. Information on the amount spent on each day within that period will be released in November, but if it had all been spent on September 22, that would make it Japan's largest currency intervention to date.

Motive for intervention

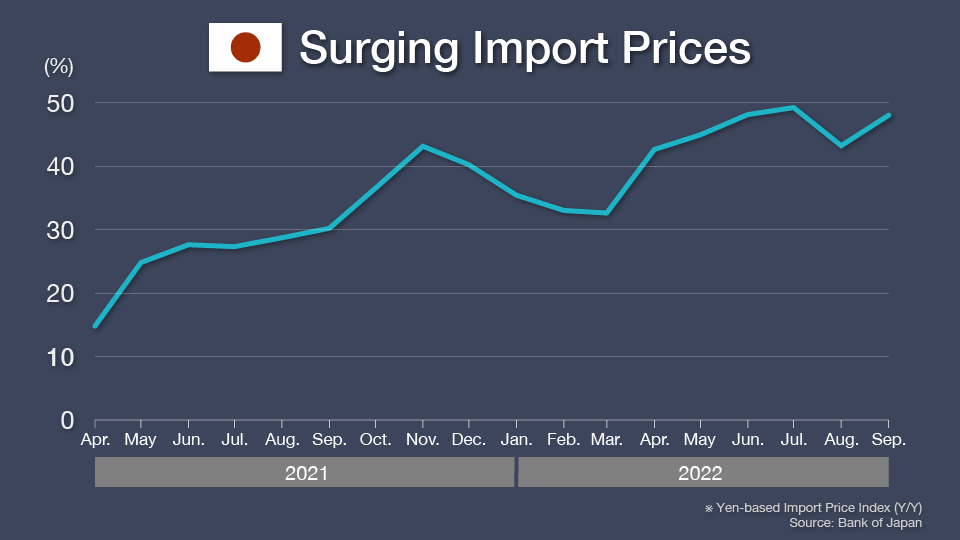

The intervention came as people in Japan were suffering from higher import prices due to the weaker yen. Yen-based import prices are, on average, 41.8% higher than last year.

Economist Kumano Hideo notes, "The yen started drastically weakening from March. If the currency exchange rate goes from 115 yen against the dollar to, say, 145 yen, that pushes up import prices by about 30%."

People across Japan are feeling the effects, with shoppers complaining about price hikes.

The Kishida administration must address the price increases, or face "a fall in its approval rating," says Kumano. "The government has gone to its last resort in terms of forex levels: intervention."

Kumano adds that intervention is "psychological" in nature. "An intervention right as the yen weakened past 145 against the dollar was meant to make market participants conscious of that level. Every time the yen weakens past a key threshold, the government will set a new line of defense. It's all meant to keep yen weakness at bay for a little while each time."

The yen's moves after the intervention

Sure enough, the September 22 intervention only briefly halted the yen's slide. The dollar-yen pair returned to roughly the same levels as before the government's move. What's more, the yen weakened further, with the greenback making it past 149, a 32-year low for the yen.

The government's intervention was aimed at strengthening its currency: yen-buying reduces the amount of yen in the market and raises its value. However, the BOJ's ultra-easy policy is having the opposite effect: monetary loosening increases the sum of money in the market, thereby lowering the value of the yen. The government buying the yen while the BOJ maintains its easy stance is like stepping on the gas and the brakes at the same time.

Kumano says officials are painfully aware that intervention can only accomplish so much. "The government knows that the effects of intervention are limited. That's why it launched a surprise attack, so to speak, at the most effective time: just after all the major monetary policy decisions. You deploy such a strategy when you know your battle strength is lacking, so to speak," he says.

How limited the government's ammunition is may depend on Japan's 'Foreign Exchange Fund Special Account.' This is basically where the government gets its funds to intervene in the currency market. Kumano notes, "There are about 1.3 trillion dollars in this special account, so if you evaluate just that figure, it seems like the government has an abundance of funds. However, much of that money has been invested into things like US government bonds, so the amount of liquidity the government has may actually not be that high. Given the situation, I would say the scale of currency intervention was daring." He adds that officials were able to be bold because they likely have no intention of continuing intervention for an extended period.

How long, then, might the yen-buying continue? Kumano believes the government will keep intervening for several more months because it thinks the yen only needs to be kept from weakening until the US economy takes a hit from its own hikes. "There will likely be concerns about the US economy in a few months, and the Fed may stop its rate hikes. If that happens, the currency market will see pressure in the opposite direction toward a stronger yen." He points out, "If you see the market eventually turning around, intervening right before the corner would be the most effective."

The other risk to fighting high prices

Currency intervention isn't the only tool the government is using to tame high prices. Prime Minister Kishida Fumio says his cabinet will compile an economic package to fight inflation.

However, Kumano cautions that policy support could weaken the yen further, and thus, worsen inflation, if it's seen as more than the country can finance. He cites the situation that recently took the UK by storm as an example of how worries about fiscal stability can lead to currency depreciation.

The Truss administration unveiled tax cut plans to help its people deal with soaring prices. That meant the government would have to borrow more, which prompted investors to sell the British pound. The sterling hit a record low against the dollar. The economic panic that ensued was so great that the British government had to backtrack on its tax cut plans.

Kumano says, "If the Kishida administration makes big moves to stimulate the economy, that means fiscal expansion without change to monetary policy. The yen might go into freefall as the pound did."

Kishida's trump card

If the Japanese government has an effective way to stop yen weakness, it may come down to Kuroda's successor as BOJ Governor. Kumano points out, "The Kishida administration has a trump card, so to speak. The yen is weakening because the Bank of Japan is saying it has no inclination to raise rates even as the US does so. But if the BOJ Governor changes to someone with a different stance, the dollar-yen pair may move in the opposite direction."

As for when the government might play that card, Kumano thinks, "as early as December." Kuroda's term as Governor ends in spring of 2023. Kumano explains, "Public attention tends to point to the government at the end of the year, when the budget for the next year comes into focus. By announcing Kuroda's successor at that time, the administration may hope to put the brakes on the yen's fall."

With the global currency market experiencing volatility, the Japanese government and the BOJ will have to tread carefully when it comes to the yen's value.