For decades, Japan's auto industry has been characterized as a pyramid. At the top sat the manufacturer—Toyota, Honda, Nissan et al.—and underneath them, a vast base of parts makers and their subcontractors. But that pyramid is starting to crumble as the industry weans itself off gas and looks to an era of electric vehicles (EVs) and autonomous vehicles (AVs).

Companies like Koito Manufacturing, Japan's market leader in high-performance headlamps, know that their old business model won't work for much longer. Cars of the near future will be driving with cameras, radars and LiDAR (Light Detection and Ranging, which helps AVs analyze road surroundings in 3D); and there will be no call for bright lamps to light the way. Executives at Koito are exploring ways to adapt their products to the new era of automobiles and have dispatched an employee to one of the countries at the forefront of the auto-tech boom: Israel.

There is no domestic auto industry in Israel, but the country is home to more than 1,000 high-tech companies, including startups that have caught the attention of the world's leading automakers.

Koito's Mochizuki Takahiro is now based in Herzliya, a city known as one of Israel's biggest startup hubs. His task is to find ways to integrate high-tech sensors into his firm's lamps and signals. "We are focusing on LiDAR in particular, and have created a new organization to consider how to deploy it."

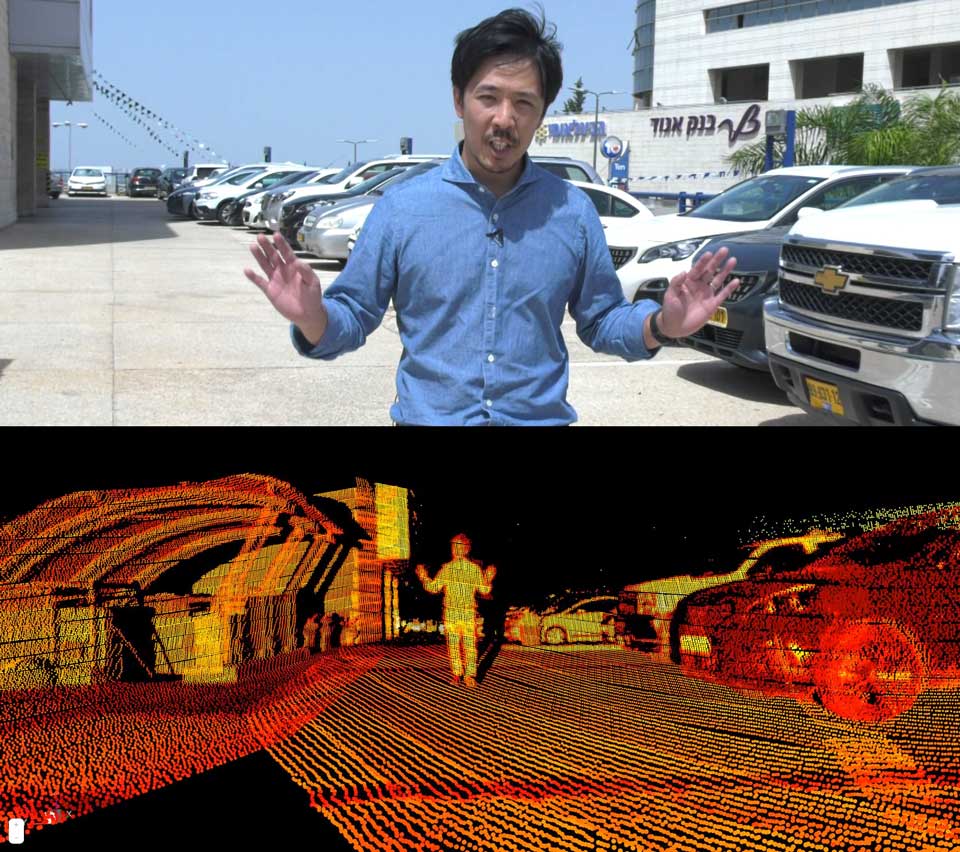

One of the hottest names in LiDAR is Israeli firm Innoviz Technologies. The company was founded in 2016 by former members of the Israeli military's intelligence unit, and debuted on the NASDAQ in April 2021 with a valuation of $1.4 billion.

"The most challenging problem and the biggest bottleneck in autonomous vehicles is LiDAR", says co-founder Omer Keilaf.

Until now, autonomous vehicles have used cameras and radars to understand their surroundings, but those technologies only measure the distance to cars or obstacles straight ahead and can be less accurate when it's dark or raining. LiDAR performs much better, but its high price has always been a problem.

Innoviz is preparing to launch a version it says will be 70 percent cheaper than its previous model with no loss of performance. Keilaf says affordable LiDAR will transform the industry.

German automaker BMW has already signed up. It plans to use the product in a Level 3 autonomous car—one capable not just of steering and accelerating, but of making driving decisions—slated for release in 2021.

Otsuka Hiroshi, CEO of Japanese automotive parts maker Musashi Seimitsu Industry, says the production pyramid is about to give way to a horizontal model, in which component makers with the best technology will be able to compete for business on a level playing field.

His firm recently invested in REE Automotive, an Israeli company that builds scalable, modular EV bases. They assemble a slim base that handles the steering, suspension, braking and other key functions. The only thing it needs is a body.

Musashi Seimitsu Industry is providing REE with gearboxes. CEO Otsuka says the investment and collaboration is a matter of survival for his company: "They can come up with bold ideas to create new drive components, and we can provide them with highly precise and durable gears. In the short term, the changes will be limited, but over 10 years the industry will change drastically. If we don't do anything now, we'll be dead in about 15 years."

REE recently reached an agreement with Hino Motors, Japan's leading truck-maker, on a partnership to develop a new business model suited for the era of electric vehicles.

"I am confident that this business alliance will become a driving force for Hino as we take on the challenge of generating new value in commercial mobility to harmonize with future society", said Hino's chair of board Shimo Yoshio.

Uri Gabay, CEO of Start-Up Nation Policy Institute, an organization that supports tech startups, says the collaborations with Japan's auto industry will strengthen the whole manufacturing industry. "The world is shifting. Smart manufacturing is becoming the standard because people see that it's not just about efficiency, it's also about resilience".

The traditional pyramid has been good for automakers as well as parts makers, providing stability and guaranteed contracts. The industry in Japan survived on a model known the world over as "kaizen"—the idea of making constant, gradual, but not industry-shaking improvements.

The EV and AV era means that thinking has to change, the players have to plant seeds for the future, and many see Israel as fertile ground for future success.