The BOJ announced that it plans to offer interest-free funds to financial institutions that offer climate-linked loans. The loans can be rolled over until 2030, the year Japan's leaders want to see gas emissions down by 46 percent from 2013 levels.

Until recently, the BOJ seemed almost reluctant to support green loans. The bank had taken the view that fighting climate change does not fall within its traditional mandate of achieving price stability and ensuring financial stability. But with the Suga administration endorsing measures to tackle climate change and reach net-zero carbon emissions by 2050, the BOJ has quickly changed tack.

However, there may be more to the shift in priorities.

The BOJ says it plans to maintain aggressive monetary easing by continuing to extend zero-interest loans to financial institutions, even after the country's economy starts to recover from the pandemic. And according to Governor Kuroda, this objective dovetails with climate action.

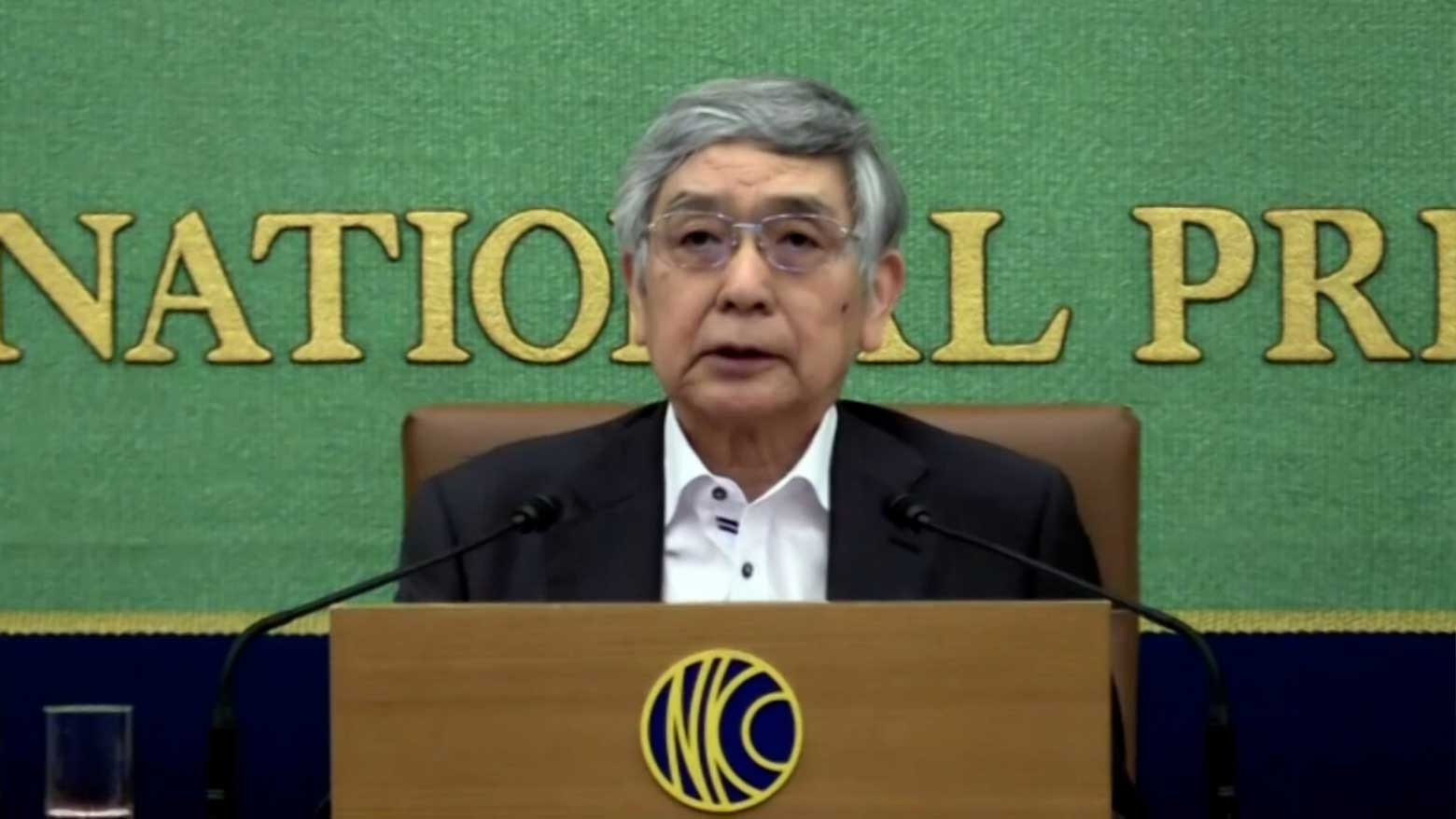

"From a medium- to long-term perspective, climate change could have an extremely large impact on developments in economic activity and prices as well as financial conditions," he said in a speech to the National Press Club, adding that "supporting the private sector's efforts on climate change will help stabilize the macroeconomy in the long run."

But many economists question whether the BOJ's plan goes far enough. Some expected the central bank to offer bigger incentives, such as 0.1 to 0.2 percent interest rates. However, the BOJ seems to feel that a zero percent rate would be enough for the business sector, where green investment and loans are popular. Kuroda explained that it is necessary for "central banks to devise ways to avoid involvement in specific allocations." In other words, he believes that providing indirect support through financial institutions is the way to go.

These comments have led to another concern: If the BOJ leaves financial institutions to judge whether an investment or loan actually addresses climate change, could this lead to the bank extending support to 'greenwashing' projects that do not actually meet its criteria? Although the bank has stressed that it will exercise discipline by asking financial institutions to disclose a certain level of information on such projects, many economists are calling for constant review and examination.

A recent report from the BOJ seemed to acknowledge this challenge. While some policymakers said that addressing environmental concerns is "appropriate", one warned against the risk of lavishly offering incentives with little evaluation.

Kuroda says the bank will take a "learning-by-doing approach", implementing crucial measures quickly, since the climate issue is so urgent, while also constantly reviewing and adjusting.

The bank plans to launch the new scheme by the end of this year.