Tokyo resident Takei Ryoko used to eat out three nights a week. But now, because of worries about the coronavirus, she rarely goes out for meals.

When she first started making her own dinners, pork was one of her go-to ingredients.

“Pork belly was cheap,” she says. “Tasty, and easy to use on a daily basis.”

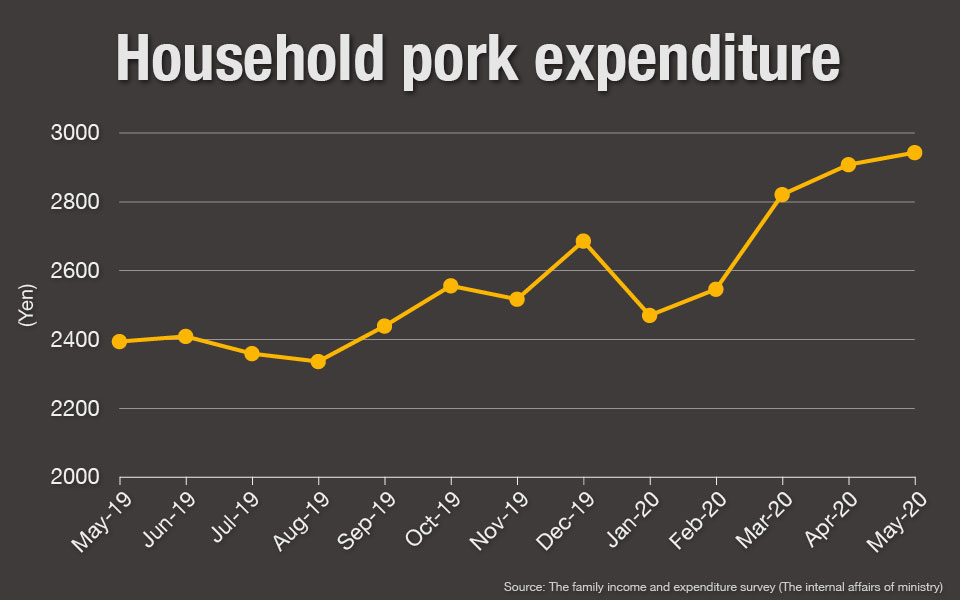

According to a survey on family income and expenditure conducted by the Ministry of Internal Affairs, Japanese households (excluding people living alone) spent 2,429 yen, or about $23, on pork in January. But starting in May, this figure rose to more than 2,942 yen, or about $27, an increase of about 19.1%.

The hike is partly attributable to the fact that families are eating at home more often during the pandemic: more meals at the dinner table means buying more pork at the grocery store. But it is also being driven by a surge in prices.

Akidai, a supermarket chain with locations across Tokyo, was forced to raise the prices of its pork products by 25% in just one month.

“Demand is high but right now we’re not able to get enough from North America,” says president Akiba Hiromichi.

Affordability has long been one of the reasons pork is so appealing to Japanese households, but that appears to be changing.

About half of the pork consumed in Japan is imported, and about half of that comes from the United States and Canada.

The US pork industry has been particularly hard-hit by the pandemic. According to The United Food and Commercial Workers International Union, at least 30 meatpacking plants have temporarily suspended operations at some point since March due to on-site coronavirus outbreaks. This has led to a 40% reduction in pork processing capacity, which has sent prices shooting up across the country.

The effects are being felt halfway across the world. HyLife Pork Table, a restaurant in central Tokyo, reopened last month after the nationwide state of emergency was lifted. Its speciality is a thick pork loin steak. But the price of the product it buys from Canada is up 15%. This increase, combined with a drop in customer traffic, is posing a big challenge to the restaurant.

“Pork prices in North America peaked in the April-through-May period,” says Funakoshi Naoyuki, Chief Development Officer of HyLife Pork Japan. “Pork that was purchased then is arriving in Japan now, and will continue coming in through August. That’s when prices will be highest. We have to find a way to make it through these months.”

The UN Food and Agriculture Organization said in its Food Outlook report last month that it expects pork production to decrease in 2020 to 101 million tons, or by 8% from the year before. That would be a second straight year of decline.

“I have no choice but to keep eating at home, now that infections are rising in Tokyo again,” Takei Ryoko says. “I’m going to have to switch to a cheaper brand of pork.”