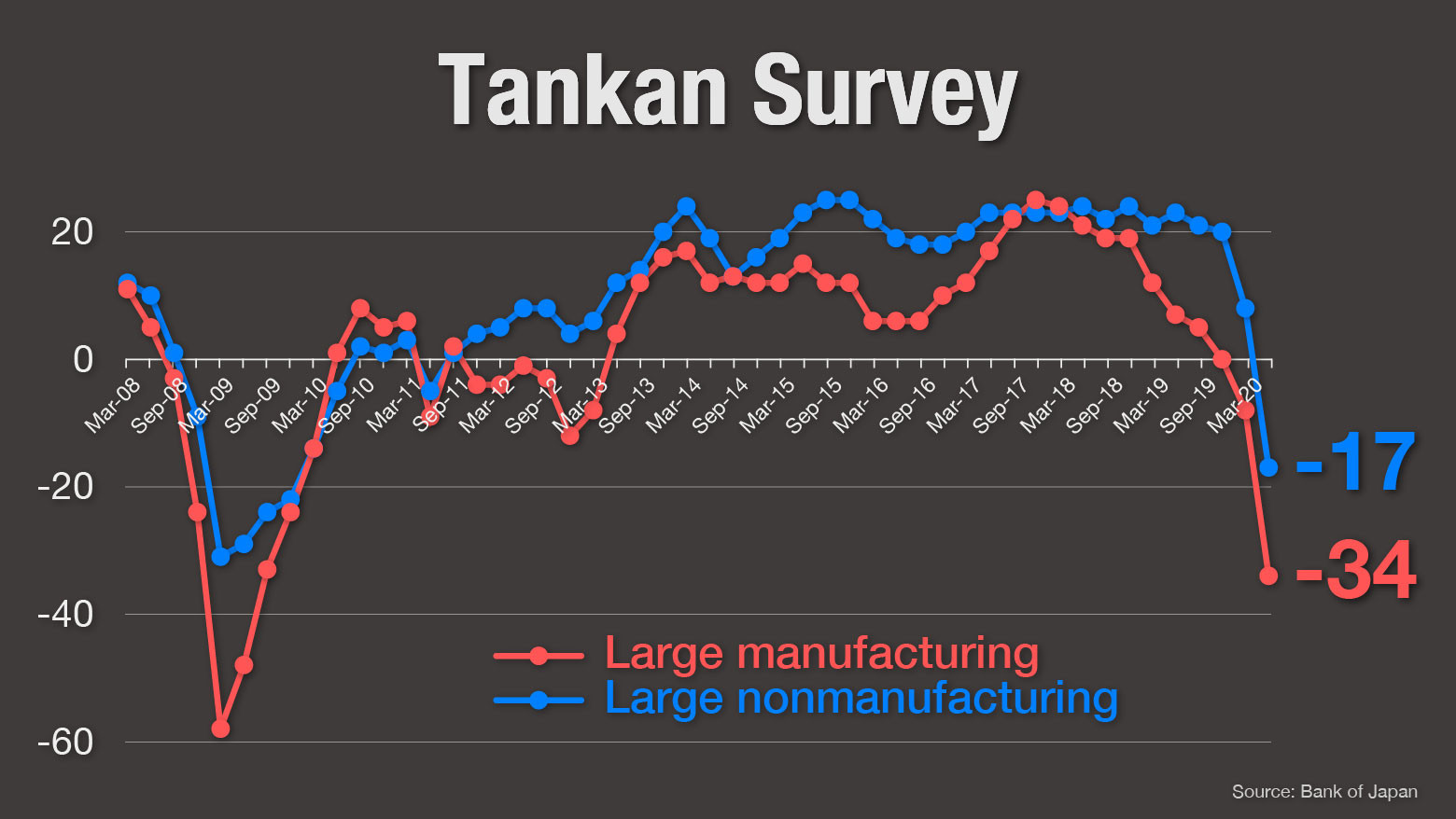

The Tankan is a quarterly poll that serves as a key economic indicator in Japan. For the current version, about 10,000 companies were surveyed in June, after a nationwide state of emergency had been lifted and business restrictions eased.

Large manufacturers' sentiment on the Tankan diffusion index worsened to minus 34 from minus 8 in March. That's the second-largest drop on record, behind a 34-point slump in March 2009 when the economy plummeted as a result of the global financial crisis.

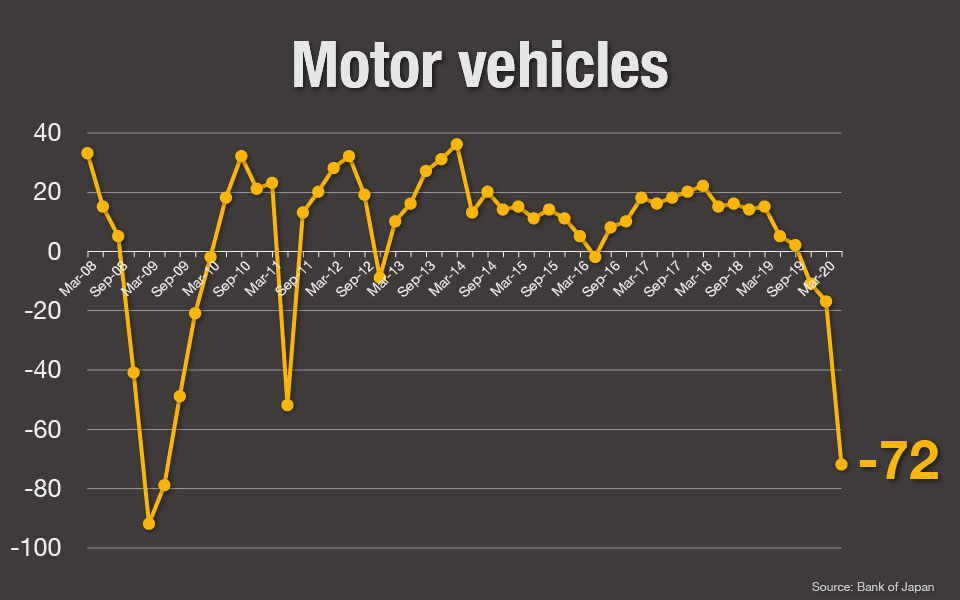

Conditions for the shipbuilding, heavy machinery, and motor vehicle industries are especially bleak. That's due to a sharp drop in exports and production in April and May when Japan was under a state of emergency.

The index for motor vehicles plunged to minus 72 from minus 17. Production at Japan's major automakers fell by 61 percent in May from a year earlier as the pandemic hit demand and kept factories closed.

Sentiment at large non-manufacturers is negative for the first time in nine years, down to minus 17 from plus 8 in March.

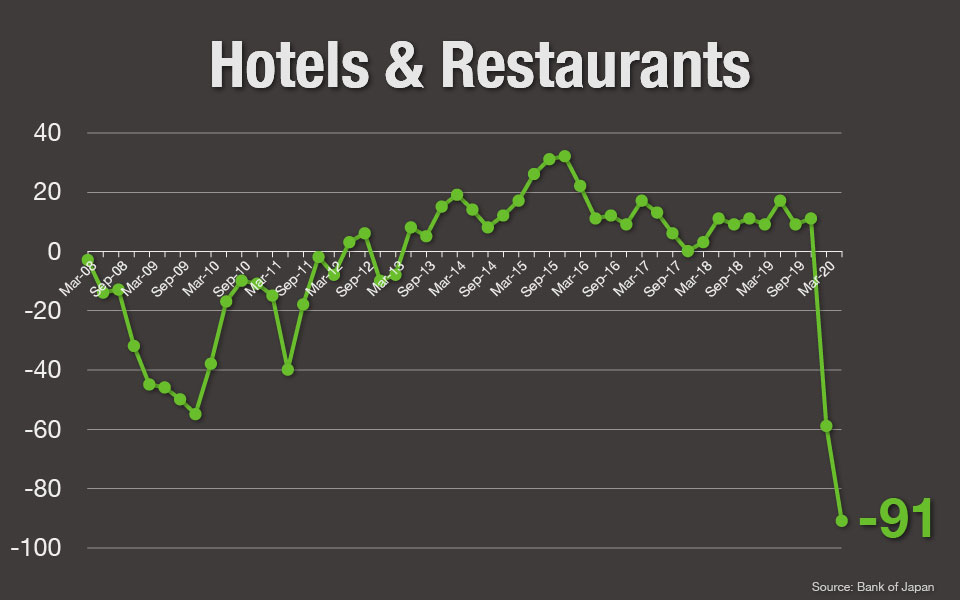

The coronavirus outbreak is dealing a crushing blow to the tourism industry. The index for the hotel and restaurant sector slumped to minus 91 from minus 59.

Though restrictions on travel to other prefectures have been lifted, Japan is still refusing entry to people from more than 100 countries and territories. Tourism officials say only 7.8 million people stayed at hotels or other types of accommodation in May. That represents an 84.8 percent drop from a year earlier.

Since Japan lifted the state of emergency for all prefectures on May 25, economic activity is clawing back. But managers, especially those in small and medium-sized enterprises, are pessimistic. Medium-sized manufacturers predict their confidence will fall further in the next Tankan survey in September to minus 41 from where it currently stands at minus 36. Small manufacturers see sentiment dipping slightly to minus 47 from minus 45. Large manufacturers predict a slight recovery.

Yamakawa Tetsufumi, Head of Research at Barclays Securities Japan, says the measures introduced by the BOJ and the government since March have been significant, but there is a fairly significant gap between the scale of those measures and the impact that SMEs are feeling at this stage.

Yamakawa says the latest survey shows that the labor market has deteriorated far more than predicted and shows a "fairly significant risk in terms of employment."