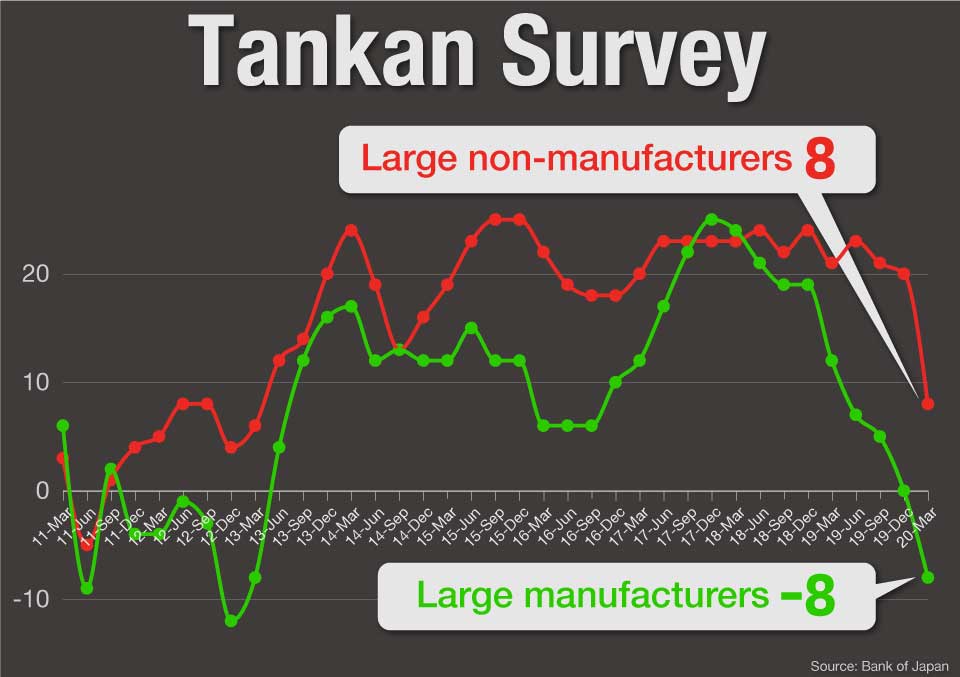

Sentiment among large manufacturers fell from zero to minus 8 in the October to December period. Japan's automakers were forced to halt some of their production lines, and they watched their global sales slow.

The sentiment among large non-manufacturers dropped by an even bigger margin, plunging from 20 to 8, as a tourism slump hit restaurants and hotels hard.

But the numbers might actually paint a rosier picture than the reality. Most of the companies are thought to have filled out their questionnaire by mid-March, before the death tolls surged in the US and Europe, and before the Tokyo Olympics and Paralympics were postponed.

We will need to wait another three months to see how those factors impact business sentiment.

The pessimism poses a threat to an already shaky job market. Japan's jobless rate has been at a historically low level of around 2 percent, but the number of new jobs added per month was slowing in sectors such as manufacturing, retail and food services even before the coronavirus began to spread.

The labor ministry says more than 1,000 workers were either laid off or faced non-renewal of their contracts in February and March.

Japan is now facing the possibility of falling back into deflation. Slow production and shrinking personal consumption, along with lower oil and commodity prices are pushing down prices.

And it's likely to be exacerbated by larger companies not raising wages this year.

The most urgent task facing the government and the central bank is to avert a sudden “economic death”. It’s not about stimulating the economy. It’s about keeping people and businesses afloat. They could support or endorse companies that retain employees, or give employers a reprieve on their utility fees.

Both large and small companies are now rushing to collect cash. The central bank and the government will need to figure out to what extent they will be supporting firms, and how quickly they can implement those measures.

Last Saturday, Japanese prime minister Abe Shinzo said an emergency economic stimulus package will be drawn up in the next 10 days. It will include cash benefits for households, implement tax reductions and exemptions from local taxes, as well as offer interest-free loans and a new benefit system for small businesses.

He said it would be larger than the one put together following the 2008 global financial crisis. But business leaders say we should prepare for the worst, on the assumption that we might be confronting a crisis bigger than the Great Depression.